4 Simple Steps to Track Your 401k in Excel

Managing your 401k effectively requires keeping a close eye on its performance, contributions, and fees. While various financial tools and platforms exist, using Excel provides a customizable and familiar environment for tracking your retirement savings. This guide will walk you through four simple steps to track your 401k in Excel, ensuring you're always in the know about your financial health.

Step 1: Importing Your Data

The first step involves getting your 401k data into Excel. This can be done in several ways:

- Export Data: Most 401k providers allow you to download your account history. Look for options like “Download”, “Export” or “Save As” on their website.

- API or Web Scraping: If your provider supports it, you might use tools like Microsoft Power Query to pull data directly into Excel.

- Manual Entry: If the above methods aren’t available, you can manually enter your balance, contributions, and performance from your statements.

💡 Note: Be mindful of any terms of service when exporting or scraping data from your 401k provider.

Step 2: Organizing Your Spreadsheet

With your data in Excel, organizing it efficiently is key:

- Name Your Worksheet: Consider calling it something like “401k Tracker”.

- Columns: Create headers like Date, Contribution, Employer Match, Balance, Growth/Decline, Fees.

- Data Formatting: Use Excel’s formatting options to make date columns display as dates, currency columns as dollars, etc.

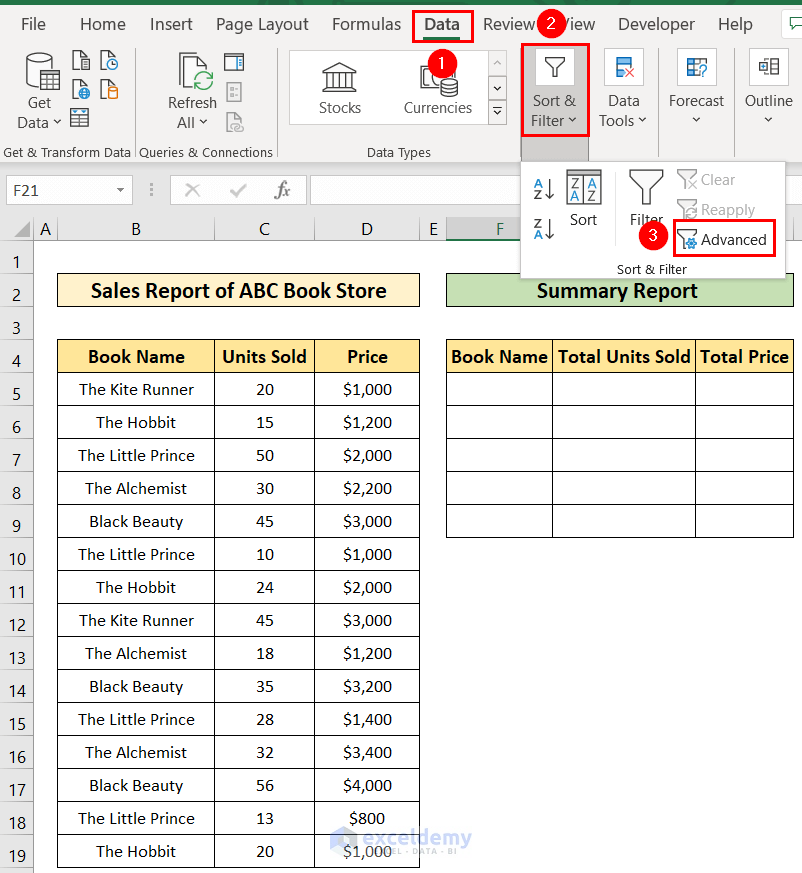

- Use Filters: Apply filters on headers for easy sorting and analysis.

Here's how you might structure your table:

| Date | Contribution | Employer Match | Balance | Growth/Decline | Fees |

|---|---|---|---|---|---|

| 01/01/2023 | $200.00 | $50.00 | $15,000.00 | -2% | $15.00 |

| 02/01/2023 | $200.00 | $50.00 | $14,785.00 | 0% | $15.00 |

📈 Note: Regularly update your spreadsheet to reflect the most recent changes in your 401k.

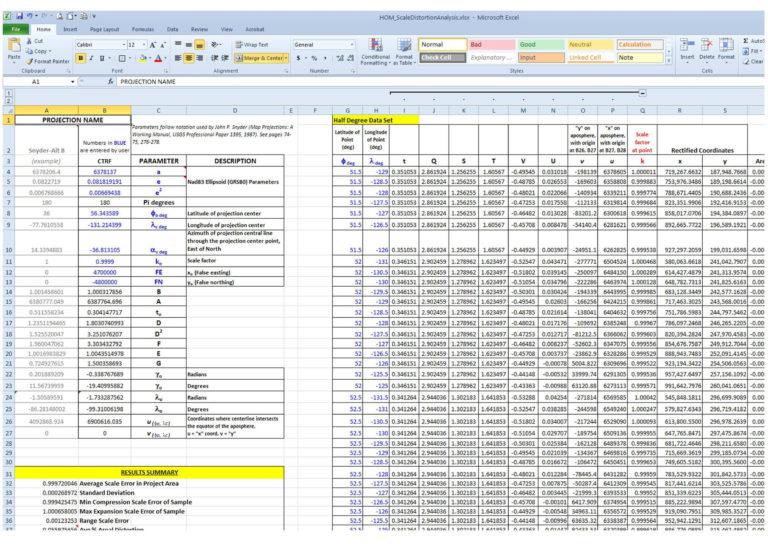

Step 3: Analyzing Your 401k Performance

With your data organized, you can analyze your 401k’s performance over time:

- Calculate Returns: Use Excel formulas to find the percentage increase or decrease in your balance over specified periods.

- Visualize Data: Utilize Excel’s charting tools to visualize trends in your balance, contributions, and performance.

- Track Fees: Keep a tab on the fees deducted from your 401k, as they impact your net returns.

Step 4: Automating Your Tracking

The final step involves setting up your spreadsheet for efficiency:

- Use Macros: Automate tasks like importing data or updating balance with Excel macros.

- Formulas: Create formulas for common calculations like ROI, remaining contributions to meet retirement goals, etc.

- Automated Alerts: Set up conditional formatting or alerts to notify when performance exceeds or falls below set benchmarks.

By implementing these steps, you've created a dynamic 401k tracking system in Excel. Now, you have a tool that not only records your contributions but also actively helps you manage your retirement funds efficiently. Regular monitoring and adjustments based on performance trends can significantly enhance your retirement strategy.

How often should I update my 401k data in Excel?

+

Updating your 401k data in Excel should be done at least monthly or when you receive new account statements to keep your tracking up-to-date.

Can I track multiple 401k accounts on the same Excel sheet?

+

Yes, you can track multiple 401k accounts in separate tabs or even within the same worksheet by using color coding or different sections.

Is it safe to import data from my 401k provider to Excel?

+

As long as you follow your 401k provider’s terms of service regarding data export and do not share sensitive information, importing data into Excel is generally safe.