5 Simple Steps to Craft an Excel Income-Expense Sheet

Keeping track of your finances is crucial, yet can often seem overwhelming. An income-expense sheet is a fantastic way to gain insight into your financial health. Let's explore how to craft an effective Excel income-expense sheet that ensures you manage your money wisely.

Step 1: Set Up Your Workbook

Start by opening Microsoft Excel and creating a new workbook. Here’s what you need to do:

- Rename the first sheet as “Summary” for an overview of your financial status.

- Create additional sheets for different time frames or purposes (e.g., “Monthly Income”, “Monthly Expenses”, “Annual Summary”).

Step 2: Design Your Income Sheet

Income tracking is pivotal. Here’s how to set up your income sheet:

- Label columns with headers like “Date”, “Source”, “Amount”, and “Notes”.

- Under each source, list regular income like salary, freelance payments, or investment returns.

💡 Note: Use the SUM function to total income across various sources for accuracy.

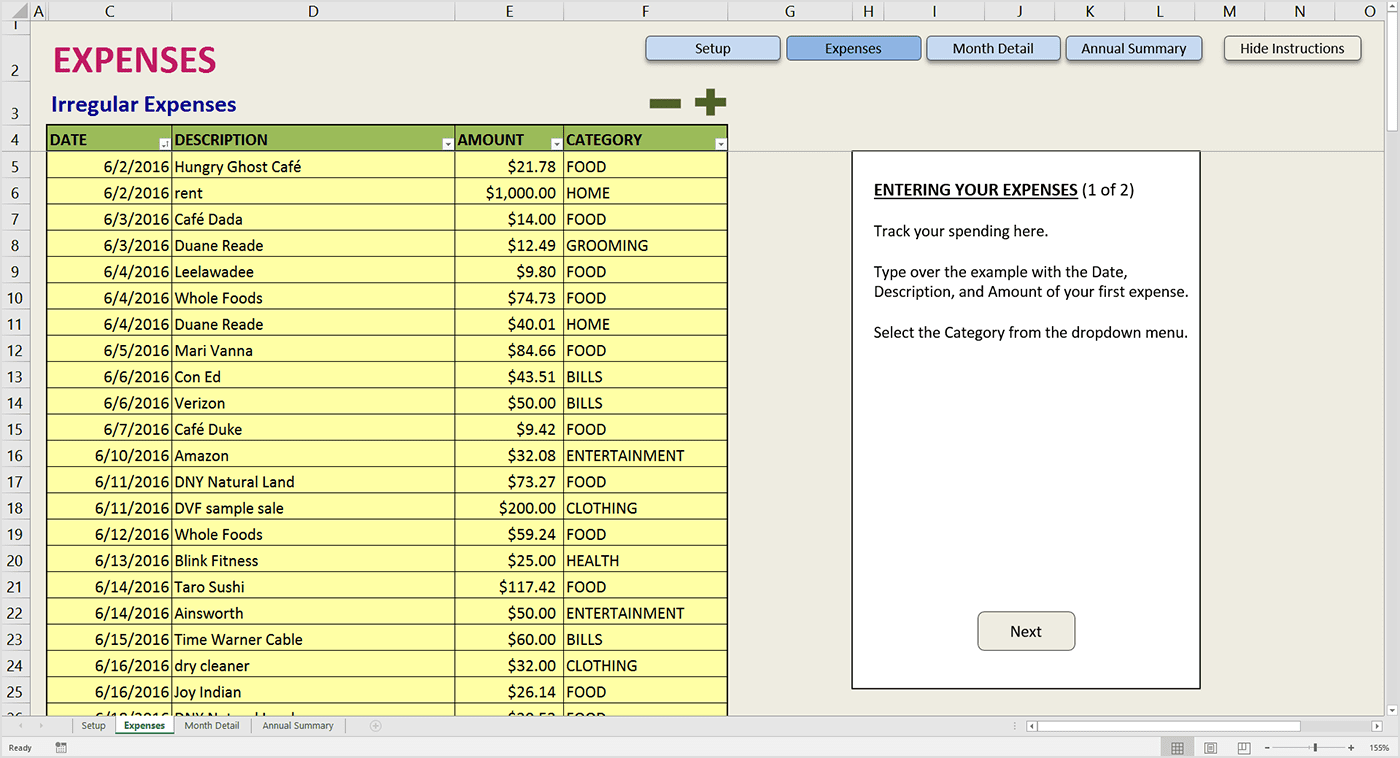

Step 3: Establish Your Expense Sheet

Now, let’s create a sheet for your expenses:

- Include headers like “Date”, “Category”, “Amount”, “Payment Method”, and “Details”.

- Categorize expenses into sections like Housing, Utilities, Groceries, Entertainment, etc.

- Utilize filters for each column to easily sort and analyze your expenses.

| Date | Category | Amount | Payment Method | Details |

|---|---|---|---|---|

| 01 Jan 2023 | Groceries | 150</td> <td>Debit Card</td> <td>Weekly shopping</td> </tr> <tr> <td>03 Jan 2023</td> <td>Utilities</td> <td>100 | Auto Pay | Electricity bill |

Step 4: Create a Summary Sheet

Your summary sheet will consolidate data from the income and expense sheets:

- Create headers for each month’s income, expenses, and net balance.

- Link cells to pull data from your income and expense sheets using formulas like =SUM(Sheet1!A1:A10).

- Use conditional formatting to highlight when you’re in the red or in the green.

Step 5: Review and Optimize

Once your sheets are set up, here’s how to optimize your tracking:

- Regularly update your income and expenses to keep the data accurate.

- Analyze trends to see where you might save money or need to adjust your financial strategy.

- Use pivot tables for deeper analysis if you’re feeling ambitious.

To create an effective income-expense sheet in Excel, you've now gone through the five essential steps. This methodical approach ensures you have a robust tool to monitor your finances, helping you make informed decisions for your financial wellbeing.

In summary, setting up an Excel income-expense sheet doesn't require being a finance guru. It's about organizing your financial data in a way that makes it manageable. By understanding your income and expenses, you can plan for savings, investments, or debt reduction, fostering financial independence and security.

What should I do if I have multiple sources of income?

+

If you have multiple income sources, list each source in your income sheet. Use separate rows for different incomes or create sub-categories under a main “Income” column. Summarize all sources at the bottom using the SUM function.

How often should I update my Excel sheet?

+

Updating your income-expense sheet daily or weekly keeps the data current. However, even monthly updates can provide valuable insights if done consistently.

Can I use this sheet for business purposes?

+

Absolutely. You can customize the sheet to fit your business’s needs, like tracking client payments, business expenses, and profit margins.

What if my expenses exceed my income?

+

If your expenses consistently exceed your income, you’ll want to review your spending habits. Look for areas where you can cut back, increase your income through additional work, or possibly use the data to negotiate debt relief or financial advice.