Calculating UK Income Tax in Excel: Easy Guide

In the world of personal finance and business management, calculating your tax obligations correctly can be both crucial and complex. This is especially true in the United Kingdom, where the tax system involves several bands and allowances. Fortunately, Microsoft Excel provides a robust platform to handle such calculations with precision and ease. This guide will walk you through how to calculate UK income tax using Excel, ensuring you get a clear understanding of your tax liabilities.

Understanding UK Income Tax Bands

Before diving into the Excel formulas, it’s essential to grasp the basics of UK income tax bands:

- Personal Allowance: The tax-free income each year, currently up to £12,570.

- Basic Rate: Income between £12,571 and £50,270 taxed at 20%.

- Higher Rate: Income from £50,271 to £150,000 taxed at 40%.

- Additional Rate: Income over £150,000 is taxed at 45%.

Step-by-Step Guide to Calculate Income Tax in Excel

Here is how you can set up your Excel spreadsheet to calculate your UK income tax:

1. Set Up Your Data

- In cell A1, type “Income” and in B1, enter your annual income.

- In cell A2, type “Personal Allowance” and in B2, enter £12,570.

2. Determine Taxable Income

Calculate the amount of income after the personal allowance:

- In cell A3, type “Taxable Income.”

- In B3, input this formula:

=MAX(B1-B2, 0). This formula ensures that if your income is below the personal allowance, your taxable income remains zero.

3. Calculate Tax on Taxable Income

Use conditional logic to determine the tax rate for different bands:

- In cell A4, type “Basic Rate Tax.”

- In B4, enter:

=IF(B3>0, MIN(B3, 37700)*20%, 0)- this calculates the tax on income up to £37,700 (the taxable threshold for basic rate).

<li>In cell A5, type "Higher Rate Tax."</li>

<li>In B5, enter: <code>=IF(B3>37700, (MIN(B3, 125140)-37700)*40%, 0)</code> - for income over the basic rate threshold up to £125,140.</li>

<li>In cell A6, type "Additional Rate Tax."</li>

<li>In B6, enter: <code>=IF(B3>125140, (B3-125140)*45%, 0)</code> - for income above £125,140.</li>

4. Sum the Tax

- In cell A7, type “Total Tax.”

- In B7, add the tax calculated in each band:

=B4+B5+B6.

5. Optional: Calculate Net Income

- In cell A8, type “Net Income.”

- In B8, calculate the net income:

=B1-B7.

Notes on Calculations

🔍 Note: Remember to update figures annually as tax bands and allowances might change.

🔹 Note: This model assumes the standard Personal Allowance. If your allowance is reduced due to high income, adjust accordingly.

Using Excel in this way not only simplifies the process of tax calculation but also allows for easy what-if analysis. You can experiment with different income levels, additional allowances, or deductions to see how they impact your tax liability.

Excel's versatility with custom functions and conditional formatting can further enhance your tax planning. Here are some additional tips:

- Scenario Analysis: Use Data Tables or Scenario Manager to quickly analyze how changes in income or tax laws might affect your tax burden.

- Conditional Formatting: Highlight different tax bands with different colors to make the visual interpretation of your tax calculation clearer.

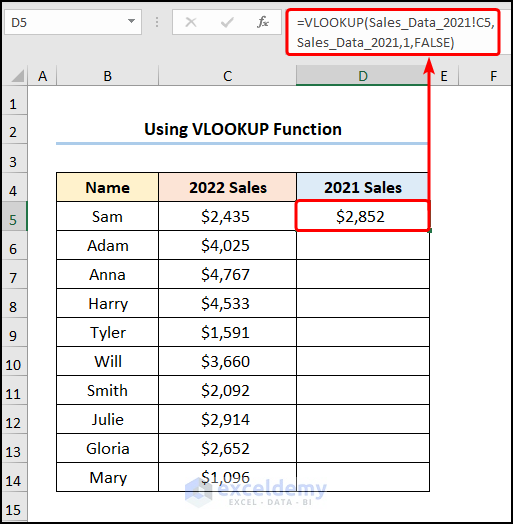

- Dynamic Lookup: If tax bands change, you can use lookup functions like VLOOKUP or INDEX MATCH to retrieve and apply the new rates.

By mastering these techniques, you'll not only gain control over your financial planning but also ensure that you're never caught off guard by unexpected tax liabilities. This approach also serves as an excellent tool for financial advisors or small business owners who need to manage multiple tax scenarios.

How often do UK tax bands change?

+

UK tax bands typically change annually as part of the Budget announcements, with major revisions occurring less frequently.

Can Excel handle regional tax rates?

+

Yes, Excel can be configured to account for different regional tax rates by using lookup functions or conditional logic.

What if my personal allowance is reduced?

+

If your personal allowance is reduced, you should adjust the formula in cell B3 to reflect your specific allowance.

Can this model calculate National Insurance Contributions?

+

Yes, you can extend this model to include National Insurance contributions, but it requires additional formulas and thresholds.

How accurate is Excel for tax calculations?

+

Excel can be very accurate provided the formulas and data inputs are correct. Always double-check your calculations.

By automating your tax calculations in Excel, you not only streamline your financial planning but also empower yourself with a tool that adapts to personal changes and policy updates. Understanding your tax situation through this approach provides peace of mind and can prevent costly mistakes or missed opportunities for tax savings.