5 Steps to Build a Balance Sheet in Excel

Whether you are an accountant, a business owner, or someone interested in managing personal finances, understanding how to create a balance sheet is pivotal. Excel, with its powerful data analysis and financial modeling tools, provides an intuitive platform for constructing a balance sheet. Here are five detailed steps to help you craft a professional balance sheet in Excel, suitable for various reporting and analytical needs:

Step 1: Plan Your Structure

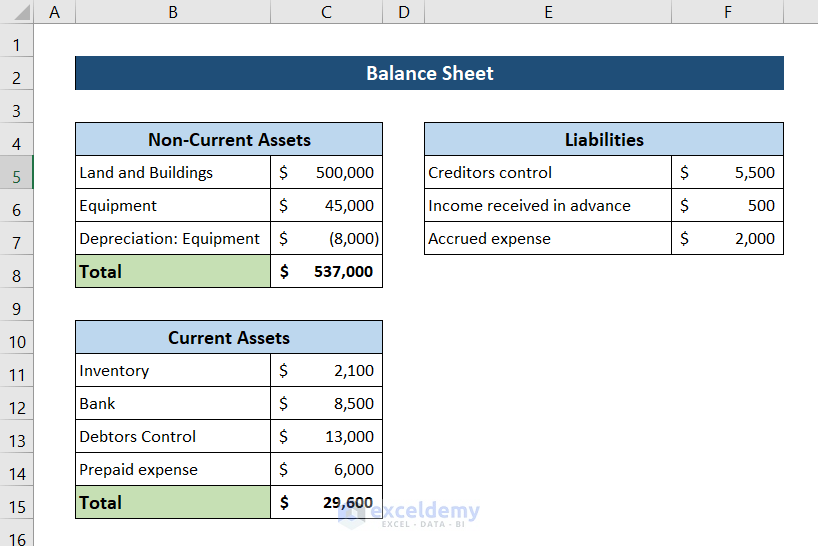

The first step in creating a balance sheet is to plan the structure. A balance sheet includes:

- Assets: What the company owns, both tangible and intangible

- Liabilities: What the company owes to creditors or lenders

- Equity: The net worth of the business, or the difference between assets and liabilities

Here’s how you can structure your Excel sheet:

| Asset Type | Section |

|---|---|

| Cash | Current Assets |

| Accounts Receivable | Current Assets |

| Inventory | Current Assets |

| Fixed Assets | Non-Current Assets |

| Intangible Assets | Non-Current Assets |

| Accounts Payable | Current Liabilities |

| Short-term Loans | Current Liabilities |

| Long-term Debt | Non-Current Liabilities |

To optimize the structure for SEO, use keywords like "balance sheet format," "Excel financial statement," and "accounting template" throughout your explanation.

📝 Note: When structuring your balance sheet, remember that all financial data should be entered with a consistent date to ensure accuracy.

Step 2: Set Up Your Excel Worksheet

Create three columns in your Excel worksheet:

- Description

- Amount

- Subtotal

Here's how you can set up your Excel sheet:

- In column A, list all items under the appropriate sections as planned in Step 1.

- In column B, enter the respective amounts for each item.

- Column C will be used for subtotals of assets, liabilities, and equity.

Ensure your headers are in bold and use different styles or colors to differentiate between sections for improved readability.

Step 3: Input Data and Calculate Totals

Now, let's input the financial data:

- Enter the asset values in column B under the 'Assets' section.

- Do the same for liabilities and equity.

- Use formulas to calculate the totals:

- For Assets:

=SUM(B2:B10)(assuming assets end at row 10) - For Liabilities:

=SUM(B12:B20) - For Equity:

=B22-B11(where B22 is the total assets and B11 is total liabilities)

- For Assets:

Remember to sum up current assets, fixed assets, current liabilities, and long-term liabilities separately to reflect financial health accurately.

Step 4: Formatting for Clarity and SEO

Here are some tips for formatting:

- Style Headers: Use

for major sections like "Assets," "Liabilities," and "Equity."

- Currency Formatting: Apply currency format to all financial amounts. Use Excel's formatting options to display values in the desired currency.

- Color Coding: Use different colors to highlight assets, liabilities, and equity sections. This helps in visually distinguishing each segment.

- Align Text: Center the data in columns for readability.

Applying these SEO-friendly practices will improve the visibility of your blog:

🔍 Note: Utilize keywords like "balance sheet Excel template," "financial analysis in Excel," or "how to make a balance sheet" within your formatting description for better SEO placement.

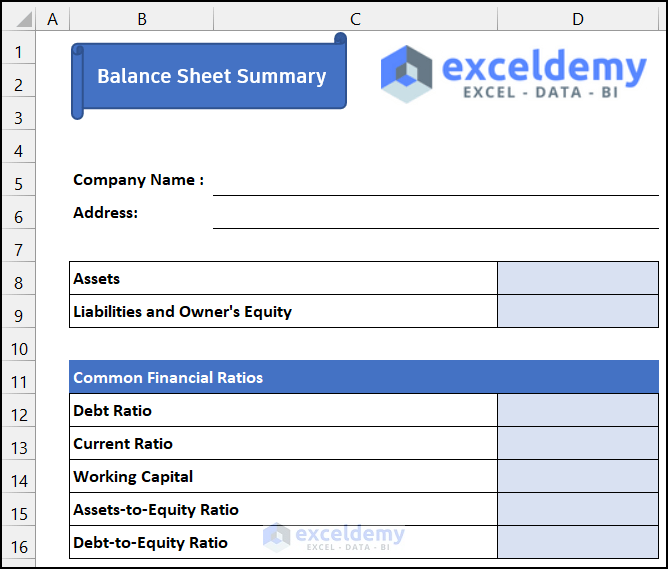

Step 5: Analyzing and Verifying the Balance Sheet

After inputting your data:

- Check if total assets equal total liabilities plus equity, verifying the accounting equation.

- Use conditional formatting to highlight any discrepancies or key figures.

- Review for any errors or missing data which might require further input or adjustment.

Now, let's wrap up our journey through the creation of a balance sheet in Excel.

In summary, building a balance sheet in Excel involves careful planning, structured data entry, precise calculations, and smart formatting. This five-step process provides you with a comprehensive understanding of how to organize financial information into a balance sheet that accurately reflects the financial position of your entity. By following these steps, you can create a tool that not only aids in internal management but also in presenting financial health to stakeholders or for compliance purposes. This exercise not only sharpens your Excel skills but also enhances your understanding of financial reporting and analysis.

Can Excel formulas automatically update the balance sheet?

+

Yes, Excel formulas will automatically update the totals and other calculations when the underlying data is modified, ensuring real-time accuracy of your balance sheet.

What if my balance sheet does not balance?

+

If your balance sheet does not balance, you should check for input errors, missing data, or incorrect classification of assets and liabilities. Using Excel’s formula auditing tools can help identify discrepancies.

How often should a balance sheet be prepared?

+

Typically, a balance sheet is prepared at the end of each accounting period, which could be monthly, quarterly, or annually, depending on the business needs and reporting requirements.