Accessing Paperwork from Closed Accounts: A Guide

In today's digital era, managing accounts, particularly bank accounts and investment portfolios, can become quite a hassle once they are closed or dormant. This guide will delve into the steps and considerations for accessing paperwork or important documents from these accounts, ensuring you can effectively manage your financial history.

Why Accessing Closed Account Paperwork is Important

Closed or dormant accounts might seem irrelevant, but their records are valuable for various reasons:

- To verify past financial transactions for credit or loan applications.

- When filling out forms for benefits or insurance, where past account information might be required.

- For estate planning or in the case of audits where proving income sources is essential.

Steps to Access Paperwork from Closed Accounts

1. Contact the Financial Institution

The first step in retrieving documents from a closed account is to contact the financial institution that held the account. Here’s how:

- Reach out through customer service. This can often be done through phone calls, emails, or live chat.

- Have your personal information and any account details ready to verify your identity.

💡 Note: Some banks might have a special protocol or department for handling closed account requests.

2. Verify Your Identity

Financial institutions are bound by strict privacy laws. You’ll need to:

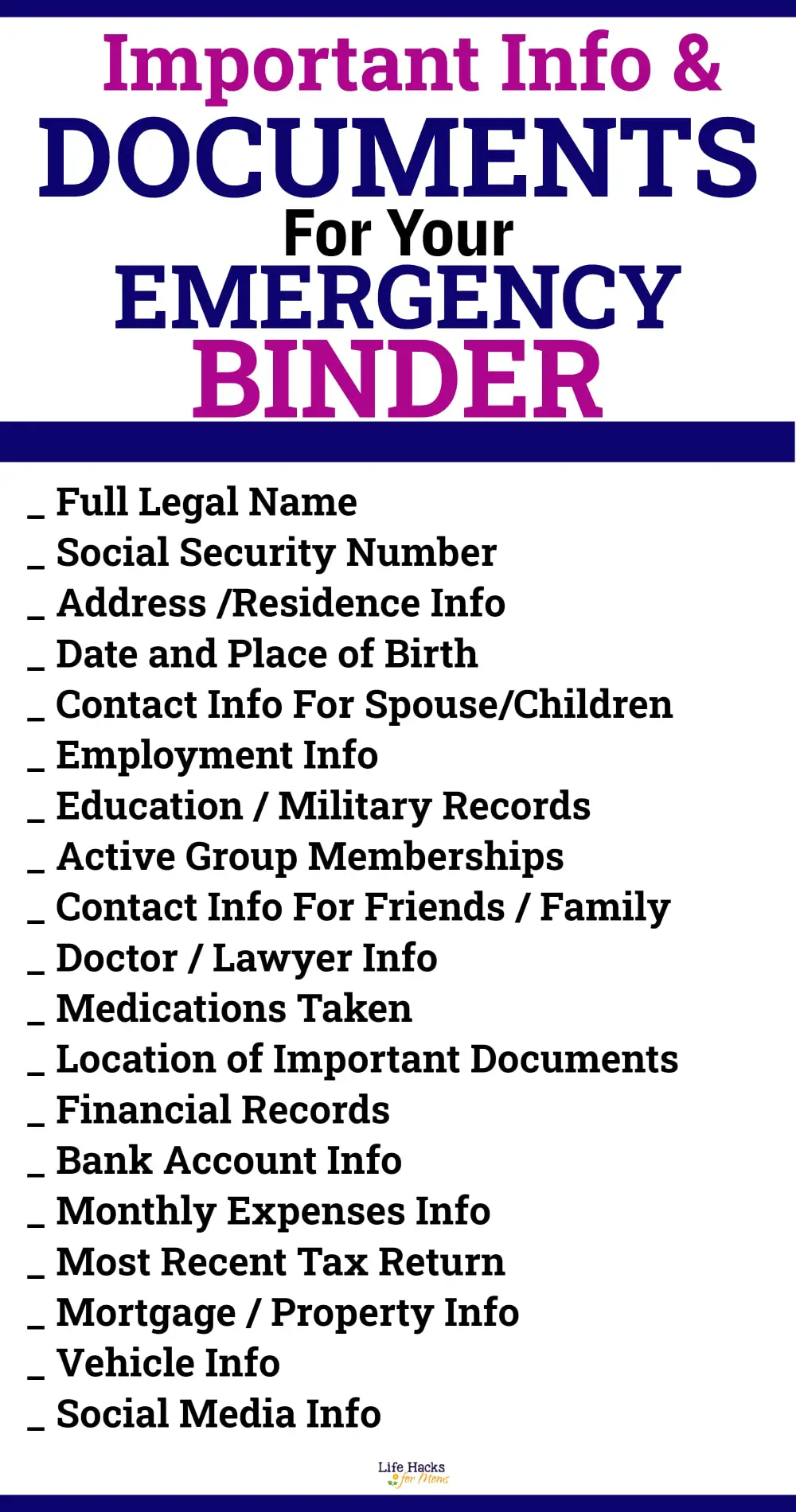

- Provide your full name, social security number, or any other official identification.

- Prepare to answer security questions which might include details from the time the account was active.

- In some cases, mailing a notarized request might be necessary.

3. Understand the Document Retention Policy

Each institution has its policy on how long they retain records:

- Typically, banks hold onto records for 5 to 7 years after account closure.

- Investment firms might have different retention periods for different types of documents.

4. Retrieve the Documents

Once identity is verified, the next steps include:

- If the documents are still available, the institution might:

- Send the documents electronically via secure email or portals.

- Mail paper copies to your address on file or one you provide.

- In case the records are no longer available:

- Ask if they can retrieve information from backups or archives.

- Check if an official statement or letter can be issued instead, summarizing your account details.

- Be Patient: The process might take time, especially if the account has been closed for several years.

- Legal Representation: If you face difficulties, consider hiring legal help to expedite the process.

- Document Everything: Keep records of all communications and requests made to the institution.

📌 Note: Retrieval fees might be charged by some financial institutions.

Considerations and Tips

When dealing with closed accounts, keep these in mind:

Accessing documents from closed or dormant accounts requires diligence and understanding of how financial institutions operate. While the process might seem bureaucratic, having access to these documents can be crucial for financial management, estate planning, or in legal matters.

What if I can’t remember my account number?

+

Even without an account number, financial institutions can often locate your account using other personal details like your name, address, or SSN.

Can I access documents from a closed account if I wasn’t the account holder?

+

If you’re the executor or have legal authority over the account, institutions might release the information upon verification of your rights.

Are there alternatives if the bank no longer has my documents?

+

Banks might provide alternative documentation or you might need to consider legal alternatives to prove the existence of your account.