Essential Guide: How Many Years to Keep Paperwork?

Managing paperwork effectively is a crucial aspect of both personal and professional organization. Whether you're dealing with financial records, legal documents, or personal mementos, knowing how long to keep certain documents can help you declutter your space, protect your rights, and ensure compliance with legal standards. This guide will explore the recommended retention periods for various types of documents, providing clarity on when it's safe to dispose of them, how to store them, and what to do when you need to shred them securely.

Why Keep Paperwork?

Before delving into specific timelines, it’s important to understand why we keep paperwork:

- Legal Compliance: Laws require you to keep certain documents for tax purposes or legal protections.

- Financial Records: To monitor financial health or substantiate tax returns during audits.

- Protection Against Claims: Keeping proof of transactions or agreements can protect against disputes.

- Sentimental Value: For personal records like birth certificates or family photos.

📚 Note: Always consider local laws or regulations, as they might vary from the general guidelines provided here.

Financial Documents

Tax Returns and Supporting Documentation

- General Rule: Keep tax returns and related documents for at least seven years.

- Why? The IRS has up to seven years to audit your returns if income was grossly underreported. Keeping documents for this period covers potential audits or refunds.

Bank Statements and Receipts

- Credit Card Statements: One year is usually sufficient unless you need them for tax purposes or disputes.

- Receipts: Keep receipts for big purchases (appliances, furniture) for the duration of the warranty or return period. For other receipts, retain them for the tax year they apply to.

Legal Documents

Contracts, Leases, and Mortgages

- Home Purchase/Sale: Indefinitely or until you sell the property. This includes deeds, mortgage statements, and any related legal documents.

- Leases: Until they expire plus an additional year to cover any disputes or late charges.

Birth and Death Certificates, Marriage Licenses

- These vital records should be kept indefinitely as they are irreplaceable and needed for various legal processes.

🔔 Note: While digitization is convenient, original documents might be required for legal matters. Consider keeping physical copies in a secure location.

Healthcare and Insurance

Medical Records and Bills

- Medical Bills: Keep for at least one year after payment or resolution of any disputes.

- Medical Records: Lifelong, especially for chronic conditions or legal issues that might arise.

Insurance Policies

- Life Insurance: Keep until the policy expires or benefits are received.

- Health Insurance: One year after the coverage ends, for any potential disputes.

Personal Documents

Wills, Trusts, and Power of Attorney Documents

- These should be kept indefinitely or until updated/replaced.

Property Records

- Documents like deeds, title documents, or home improvement records should be kept for as long as you own the property.

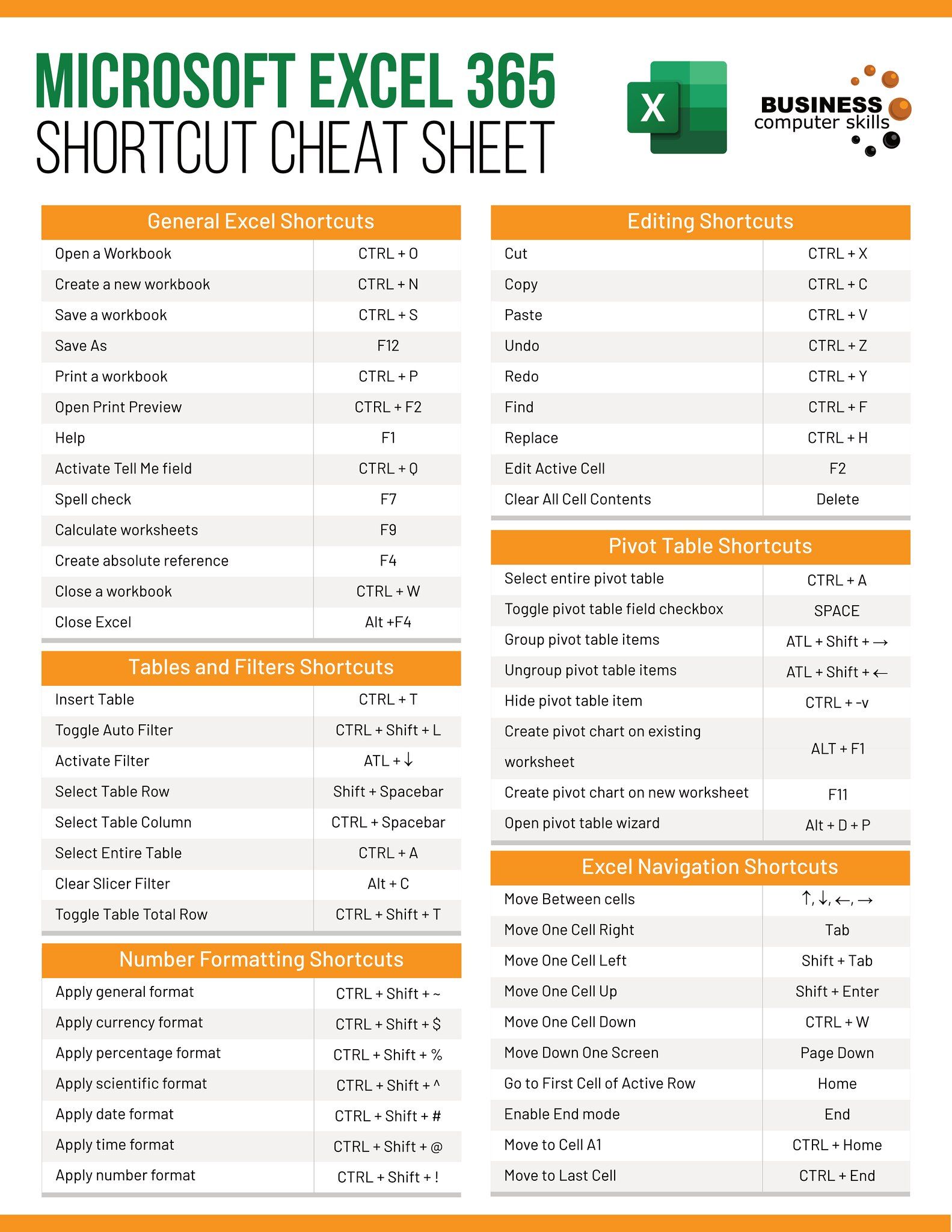

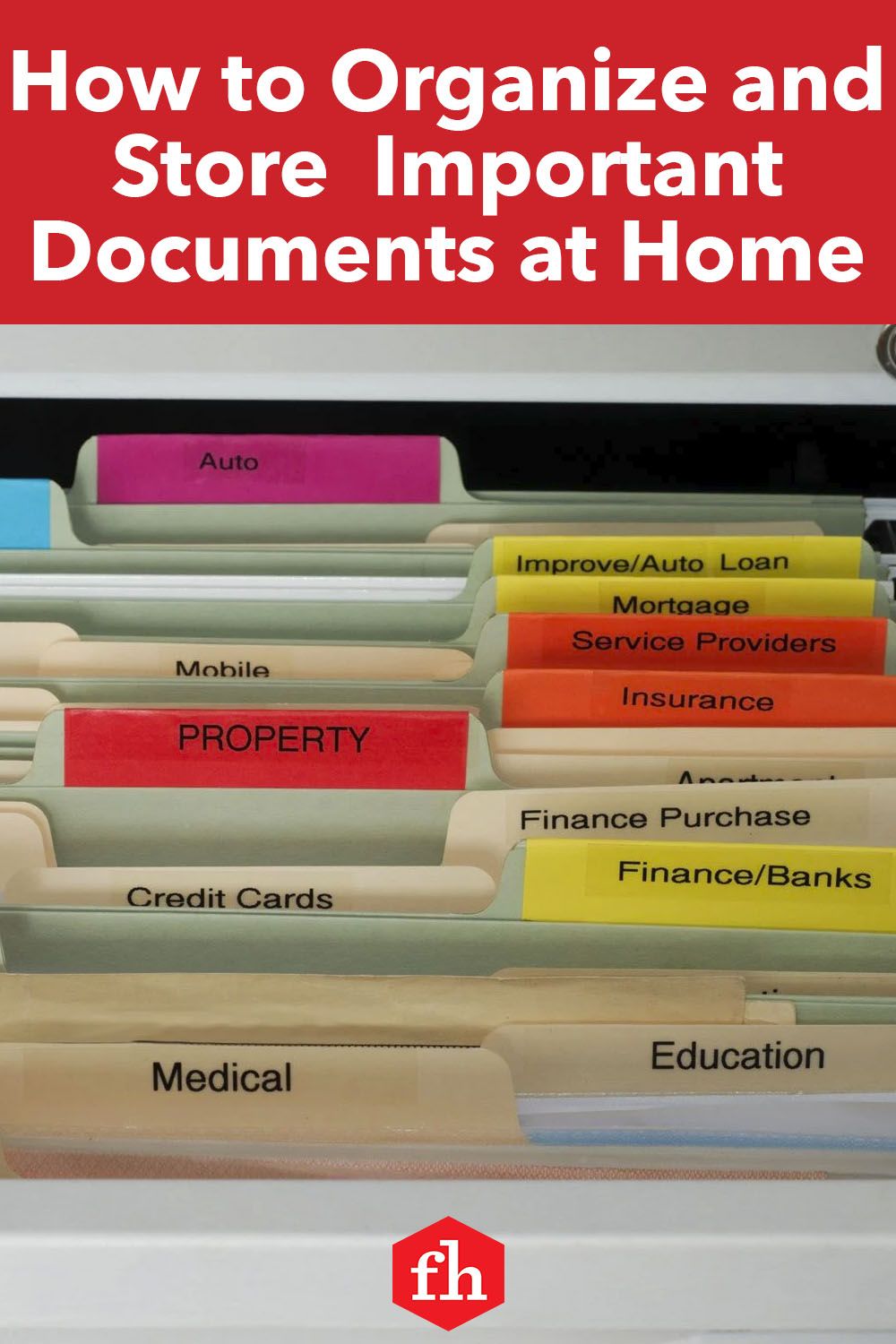

How to Store and Organize Your Documents

Organizing your documents effectively not only helps in retrieval but also in safeguarding them:

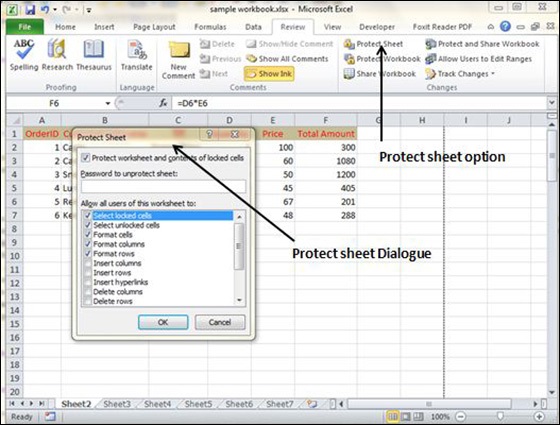

- Physical Storage: Use fireproof and waterproof safes or filing cabinets for important documents.

- Digital Storage: Scan documents and back them up on cloud services or encrypted external hard drives.

| Type of Document | Physical Storage | Digital Storage |

|---|---|---|

| Tax Returns | Safe or file cabinet | Cloud storage with secure backup |

| Medical Records | Home safe | Encrypted cloud service or personal computer |

| Legal Documents | Fireproof safe | Digital copies, backed up in multiple locations |

Shredding and Disposal

When it’s time to get rid of documents:

- Shred: Use a cross-cut shredder to prevent identity theft.

- Recycle: Shredded paper can be recycled; ensure it’s done securely.

To sum it up, managing paperwork involves understanding the necessity of each document's retention period. By adhering to these guidelines, you can effectively protect your interests, comply with legal standards, and keep your personal and business records organized. Remember, while these are general recommendations, always check with local laws or an expert for specific cases or if in doubt. Keeping documents secure, both physically and digitally, ensures that you can retrieve them when needed without compromising privacy or security.

How long should I keep utility bills?

+

Utility bills can generally be kept for one year unless needed for tax deductions or disputes with service providers.

Is there a legal requirement for keeping documents after a divorce?

+

It’s wise to keep all related legal and financial documents indefinitely due to potential future claims or legal issues.

What about keeping employment records?

+

Documents like pay stubs should be kept for a year, while job offers, performance reviews, or employee handbooks might be retained for several years or as per company policy.