7 Essential Years to Keep Tax Paperwork

Managing your tax documentation can often seem like a daunting task, especially if you aren’t sure how long you need to keep the records. Understanding the duration you should retain tax-related paperwork is crucial not only for complying with legal requirements but also for ensuring you have the necessary records for any future audits or financial references. Let’s dive into the essentials of managing tax records, highlighting key periods and types of documents you should keep.

Why Keep Tax Documents?

There are several compelling reasons to keep tax documents:

- Tax Audits: The IRS has the authority to audit tax returns for a certain number of years, so retaining your documents can be crucial if you are audited.

- Refund Claims: If you need to file an amended return or claim a refund for missed deductions, having access to your tax records is essential.

- Financial History: Tax documents can serve as records for your financial transactions, loans, or mortgage applications.

7 Years Rule

As a general rule, keep most tax records for at least seven years. This period accounts for the following reasons:

- The IRS has three years from the date you file your return or two years from the date you paid the tax, whichever is later, to audit your return if they find an error.

- If you significantly underreport your income (more than 25%), the statute of limitations increases to six years.

- If you do not file a return or file a fraudulent one, there is no statute of limitations.

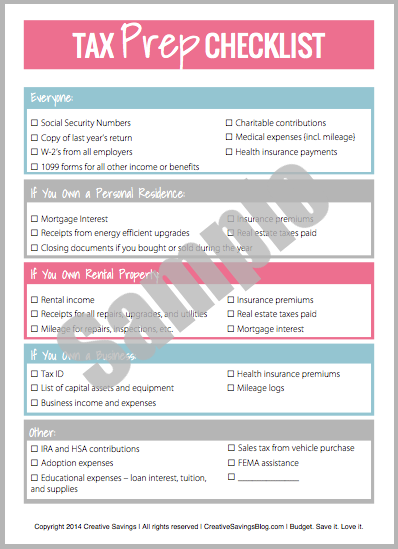

Documents to Keep

Here’s a breakdown of the documents you should keep for seven years:

| Document | Purpose |

|---|---|

| W-2s, 1099s | To show income reported to the IRS. |

| Receipts for Deductions | To support deductions or credits claimed. |

| Business Expense Records | To justify business deductions for self-employed or business owners. |

| Charitable Donation Records | To back up claimed deductions for charitable contributions. |

| Investment Records | For reporting capital gains or losses. |

| Mortgage Statements | To prove interest deductions. |

| Medical Expenses | When itemizing deductions. |

Longer Retention for Certain Documents

Some documents should be kept longer than seven years:

- Property Records: Hold onto records of purchase, sale, or improvement of property until you sell the property. This could be indefinite if you still own the property.

- Retirement Accounts: Keep records of contributions to IRAs, 401(k)s, etc., permanently, especially if you made after-tax contributions which could be non-taxable upon withdrawal.

- Loan Documents: Retain records related to home equity loans, mortgages, or auto loans, including payoff statements, until the loan is paid off or potentially longer if there are future tax implications.

📝 Note: IRS regulations can change, and individual circumstances might warrant keeping records for longer than the general rule. Always consult with a tax professional to understand your specific requirements.

Best Practices for Document Management

Here are some tips to keep your tax documentation in order:

- Use a well-organized filing system or software to categorize documents by year and type.

- Go digital where possible. Scan documents and store them securely online, but also keep hard copies if preferred.

- Label clearly and consistently, whether it’s physical folders or digital files.

- Back up electronic records to prevent data loss.

The Conclusion

Keeping tax records for the appropriate duration not only aids in compliance with legal mandates but also provides a comprehensive financial history. Whether it’s for an audit, financial planning, or proving your eligibility for credits and deductions, having access to your tax documents is invaluable. Remember, while seven years is a common rule, some records might require you to keep them for longer or even indefinitely. By understanding these retention periods and following best practices for document management, you can navigate tax season with ease and confidence.

What happens if I can’t find my tax documents during an audit?

+

If you’re unable to provide documentation during an audit, the IRS may disallow deductions or credits, leading to additional tax liabilities, penalties, or fines. It’s important to keep your records accessible and up-to-date.

Can I shred documents after seven years?

+

After the seven-year period, for most documents, shredding is safe as long as no open legal issues or potential liabilities are involved. Always check that no other state-specific regulations or circumstances require longer retention.

How should I store my tax documents?

+

Use fireproof safes for hard copies or secure cloud storage for digital files. Ensure physical documents are kept in a dry, secure place, and digital files are backed up regularly.