7 Essential Tips for Managing Deceased Parents' Paperwork

Dealing with the loss of a parent is an emotionally challenging time, compounded by the overwhelming responsibility of managing their affairs. Amidst grief, the task of organizing and managing deceased parents' paperwork can seem daunting. Here, we provide essential tips to guide you through this process with clarity and care, ensuring that you honor your parents' legacy while navigating the legal and financial intricacies that follow their passing.

1. Organize All Documents in One Place

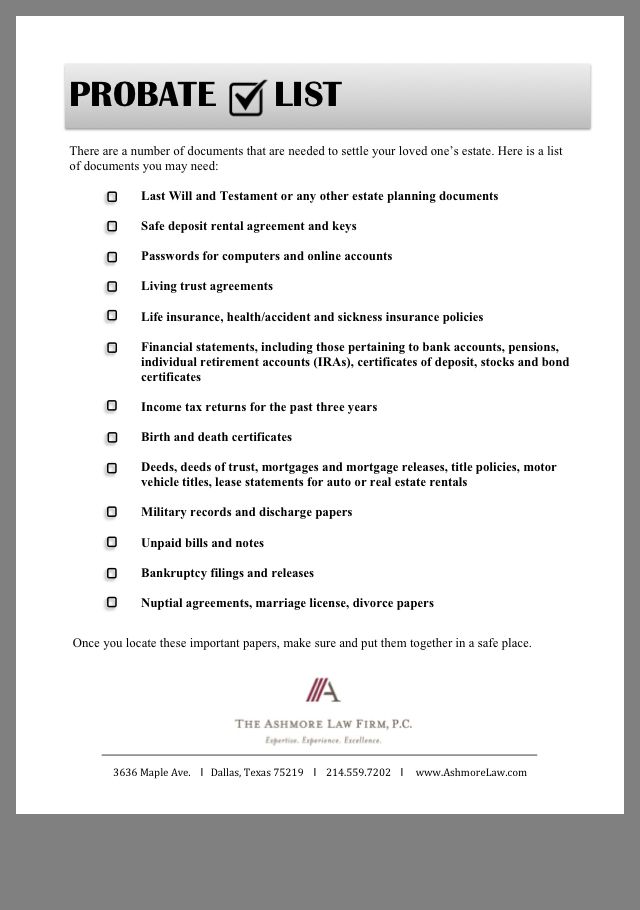

The first step in managing your parents' paperwork after their passing is to gather all documents in one centralized location. This could be their home office, your residence, or even a secure digital folder if electronic versions exist:

- Collect birth certificates, marriage certificates, wills, trusts, and any other legal documents.

- Find financial records including bank statements, investment portfolios, insurance policies, and pension information.

- Look for medical records, especially those related to the cause of death or final illnesses.

- Gather property deeds, vehicle titles, and any other proof of ownership.

📌 Note: Be thorough, as documents often hide in unexpected places like old briefcases or between pages of books.

2. Understand and Execute the Will or Estate Plan

If your parents had a will or trust, this is your roadmap:

- Review the document with a legal professional to understand its provisions, beneficiaries, and any potential challenges.

- Identify the executor or trustee and discuss the estate administration process.

- Notify beneficiaries and any named guardians if applicable.

- Begin the probate process if required by the estate's assets.

Having this understanding will help you manage your expectations about the timeline and what needs to be done legally.

3. Notify Necessary Parties

The notification process involves:

- Informing social security, banks, credit card companies, insurance providers, and utility services about your parent's death.

- Securing bank accounts by notifying financial institutions, preventing fraudulent activities.

- Contacting any pension funds, life insurance companies, and other benefit providers.

| Party to Notify | Action |

|---|---|

| Social Security Administration | Notify and potentially apply for survivor benefits. |

| Financial Institutions | Close accounts or transition to joint owners. |

| Insurance Companies | File claims or transfer policies. |

4. Keep Records of Debts and Liabilities

You'll need to:

- Make an inventory of all outstanding debts, including mortgages, loans, credit card balances, and any tax liabilities.

- Consult with an attorney or financial advisor on how to handle these debts post-mortem.

- Ensure payments are paused or handled correctly during estate administration.

Remember, your parents' estate is responsible for settling these debts, not their heirs directly.

5. Manage Assets and Investments

Asset management includes:

- Identifying all assets such as real estate, vehicles, bank accounts, and investments.

- Determining the value of these assets for tax purposes and to comply with the will.

- Deciding whether to sell, distribute, or maintain assets in line with the estate plan.

Getting professional appraisals can be useful in establishing current asset values.

6. File Taxes for the Estate

After a parent's death, tax considerations are essential:

- File a final income tax return for the deceased.

- Potentially file estate or inheritance taxes if the estate value exceeds certain thresholds.

- Retain all relevant tax documents, including a copy of the death certificate.

7. Keep Emotions in Check

Managing deceased parents' paperwork can be emotionally taxing:

- Take breaks when needed, and seek support from friends or professionals.

- Consider outsourcing some tasks if they become overwhelming.

Navigating this administrative journey doesn't mean you have to put your grief on hold. Finding a balance between your emotional well-being and the responsibilities at hand is key.

By following these steps, you'll streamline the process of managing your deceased parents' paperwork, making a challenging time slightly easier. While it's a journey filled with legal formalities and paperwork, it's also an opportunity to honor their memory and legacy.

Remember, the end of their physical presence doesn't mean the end of their influence. They live on through you, your siblings, and the way you choose to handle their affairs with dignity and respect. Approach this task with patience, seek professional advice when necessary, and always keep in mind that this too shall pass, leaving behind cherished memories rather than administrative burdens.

How soon should I start organizing my deceased parents’ paperwork?

+

Begin as soon as you’re emotionally ready, but keep in mind that some financial institutions and authorities require timely notification to prevent issues like penalties or fraudulent activities.

Can I handle all my parents’ paperwork by myself?

+

While it’s possible, consulting with professionals like attorneys, financial advisors, or estate planners can provide guidance on complex issues and ensure you’re not missing any legal or tax obligations.

What happens if my parents didn’t have a will?

+

If there’s no will, the estate will pass through intestacy laws, which vary by jurisdiction. This means the court will decide asset distribution, often leading to delays, legal fees, and not necessarily in line with your parents’ wishes.