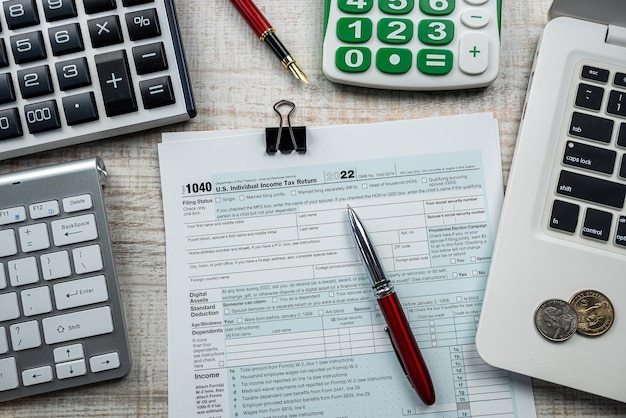

How Long to Keep Tax Paperwork: Your Essential Guide

Welcome to your essential guide on how long to keep tax paperwork. Managing your tax records can often feel overwhelming, with heaps of documents and the fear of losing something crucial during an audit. In this comprehensive guide, we'll explore the essential periods for retaining tax documents, the importance of these records, and how to organize them efficiently for easy access and peace of mind.

Understanding the Importance of Tax Records

Tax documents are more than just pieces of paper or digital files; they are your financial history and proof of your compliance with tax laws. Here are some reasons why keeping tax records is crucial:

- Proof of Income and Expenses: Records substantiate the income you've earned and the deductions you've claimed.

- Audit Protection: In case of an audit, having organized tax records can save time, reduce stress, and ensure you have evidence to support your tax filings.

- Legal Requirements: Certain tax records must be retained by law for a specific number of years.

- Future Financial Planning: Tax records provide insights into your financial patterns, aiding in better tax planning and investment decisions.

How Long Should You Keep Tax Paperwork?

The retention period for tax documents can vary based on several factors:

Income Tax Returns

You should keep records of your income tax returns for at least three years from the date you file your return or two years from the date you paid the tax, whichever is later. This period extends to six years if you underreport income by more than 25% of your gross income:

- Form W-2 (wage and tax statement)

- Form 1099 (income statements)

- Schedule C, E, or F (business income, rental properties, or farm income)

Supporting Documentation

Supporting documents like receipts, bank statements, and invoices need to be retained for:

- Three Years: Most supporting documents, unless they relate to property you own.

- Six Years: If you don't report income that you should have and it's more than 25% of the gross income shown on your return.

Property Records

Documentation related to property ownership, improvements, and sales:

- Indefinitely: Keep records of cost basis in the property, improvements, and depreciation until the period of limitations for the year of sale expires.

Retirement Accounts and Investments

Records related to retirement accounts, investments, and IRA contributions:

- Retirement Accounts: Keep records for as long as the funds are in the account and three years after distribution.

- Investment Records: Retain records for at least three years after you sell an investment.

Special Circumstances

Special circumstances can alter the standard retention periods:

- Fraud or Filing a Fraudulent Return: There is no statute of limitations if you file a fraudulent return or do not file a return.

- Bad Debt: If you claim a deduction for bad debt or worthless securities, keep records for seven years.

- Unreported Foreign Financial Assets: If you have unreported foreign financial assets and the income from them exceeds $5,000, the IRS has no time limit to assess tax and penalties.

🏠 Note: For rental properties, keep records for improvements, repairs, and depreciation as long as you own the property.

How to Organize and Store Your Tax Documents

Efficiently organizing your tax documents ensures that you can easily locate them during an audit or when needed. Here's a step-by-step guide to organizing your tax paperwork:

1. Categorize Your Documents

Create categories for your documents. Here are some common categories:

- Income: W-2s, 1099s, investment statements

- Expenses: Receipts, invoices, mileage logs

- Home Office Deductions: Proof of business use, square footage, utility bills

- Charitable Contributions: Donation receipts, bank statements

- Childcare Expenses: Childcare provider invoices, employment verification

2. Label Clearly

Use labels or folders to clearly mark each category. This ensures you or anyone assisting you can find the documents easily:

- Use durable file folders or boxes.

- Label with the year and category.

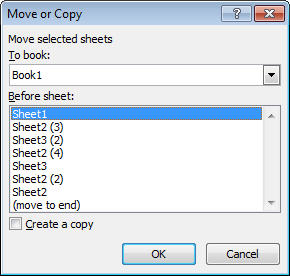

3. Digital Records

Utilize digital storage solutions for ease of access and reduced physical clutter:

- Scan documents and save them in folders on your computer or cloud storage.

- Use document scanning apps to turn physical receipts into digital copies.

4. Secure Storage

Keep your tax documents secure to protect your personal and financial information:

- Use a lockable file cabinet or safe for physical copies.

- Implement password protection for digital files and storage services.

5. Shred Unnecessary Documents

Once the retention period has passed for a particular document, shred it or dispose of it securely:

- Cross-cut shredders can be more effective than strip-cut shredders.

- Check local regulations on secure document disposal.

By following these steps, you can keep your tax paperwork organized, accessible, and secure, making tax season less daunting each year.

📁 Note: Ensure you have backups of all digital documents, ideally in a secure cloud-based storage solution to prevent data loss.

In summary, retaining your tax documents is not just about complying with legal requirements. It's about ensuring you have the necessary documentation to support your financial statements, protect yourself during audits, and plan for future financial health. We've discussed the various time frames for keeping different types of tax records, how to organize and store them effectively, and what to do with documents after the retention period expires. With this guide in hand, you can approach tax record management with confidence and ease.

How do I know if I need to keep a document longer than three years?

+You need to keep records longer than three years if you claim a loss from worthless securities or bad debt, if you do not report income that exceeds 25% of your gross income, or if you have unreported foreign financial assets.

What should I do with my tax documents after the retention period?

+After the retention period, shred physical documents to protect your personal information and securely delete digital files. Ensure you have backups and don’t delete records that need to be kept longer.

Can I scan and store my tax documents digitally?

+Yes, scanning your tax documents and storing them digitally is an effective way to organize and reduce clutter. However, ensure you have secure backups and follow best practices for digital security.