5 Essential Tips for Post-Probate Paperwork Retention

The process of probate can be complex and emotionally taxing, especially during a period of grieving or family upheaval. Once this legal process is complete, knowing how to manage and retain the resulting paperwork is crucial. Proper handling of probate documents can aid in future legal proceedings, provide clarity in financial dealings, and help preserve the decedent's estate documentation for the beneficiaries. Here are five essential tips to ensure you are effectively managing your post-probate paperwork:

1. Organize Documents Immediately

As soon as probate proceedings are finalized:

- Create a Filing System: Use clearly labeled folders for different categories like tax documents, estate inventory, asset distribution, and legal correspondence.

- Digital Archiving: Scan all documents and save them in secure, cloud-based storage. This not only saves physical space but also makes retrieval easier.

- Backup Regularly: Ensure that digital copies of all documents are backed up frequently to avoid loss due to technical failures.

Organizing your documents right after probate will save time and effort in the future, reducing the stress of having to sort through piles of paper when issues arise.

2. Understand Retention Requirements

Different documents have different retention periods:

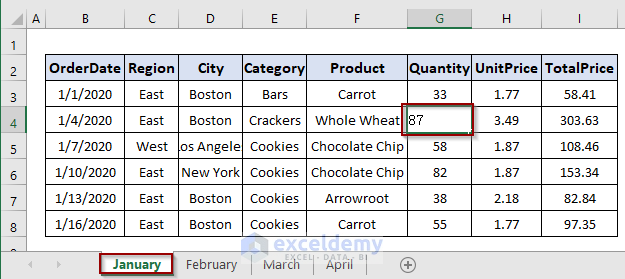

| Document Type | Retention Period |

|---|---|

| Death Certificate | Permanently |

| Last Will & Testament | Permanently |

| Tax Returns | 7 Years |

| Property Titles | Until Sold or Transferred |

| Correspondence with Legal Advisors | Until Probate Closes + 5 Years |

💡 Note: Legal or financial advisors might suggest longer retention periods based on specific case complexities.

3. Safeguard Sensitive Information

Protecting personal information is paramount:

- Secure Storage: Use safes or lockboxes for physical documents, and password-protected, encrypted files for digital documents.

- Shredding: Dispose of unnecessary documents by shredding to prevent identity theft or misuse.

- Limit Access: Only give access to documents on a need-to-know basis to minimize the risk of information leakage.

By securing sensitive information, you ensure that the privacy and financial security of the estate and its beneficiaries are maintained.

4. Keep Beneficiaries Informed

Transparency helps in maintaining trust among beneficiaries:

- Provide Access: Allow beneficiaries access to non-sensitive documents or summaries that pertain to their interests.

- Regular Updates: Keep them updated on estate progress, especially when significant decisions or transactions occur.

- Understand their Rights: Inform beneficiaries about their legal rights and how to access probate records.

5. Regular Review and Update

Probate documents might require periodic review:

- Check for Changes: Review documents annually or when changes occur in estate laws or family circumstances.

- Update Beneficiaries: Update beneficiary information if there are changes in their status or if new heirs arise.

- Archive or Shred: Determine which documents can be archived permanently and which can be safely disposed of.

By keeping a close eye on probate documents, you can manage any issues proactively, ensuring that the estate remains well-protected and efficiently administrated.

The key to handling post-probate paperwork is organization, understanding retention requirements, safeguarding sensitive data, keeping beneficiaries informed, and regularly reviewing and updating records. Through these practices, executors and heirs can manage the estate with confidence, knowing that all paperwork is in order. The journey through probate is arduous, but with these tips, the aftermath can be streamlined, reducing future complications and ensuring that the decedent's wishes are honored with respect.

What should I do with probate documents if I am moving?

+If you are relocating, it’s essential to take important probate documents with you. Use a secure moving box or service, and inform your legal or financial advisor about the move to update any relevant records or contacts.

Can I dispose of all probate documents once the estate is settled?

+No, not all documents can be disposed of. Essential documents like the death certificate, the last will, and any deeds or titles should be kept permanently or until they are no longer relevant (e.g., property is sold).

How do I handle disputes over probate documents?

+Disputes should be handled with the help of legal counsel. Keep all documentation that relates to the dispute, and seek professional guidance on how to proceed, keeping in mind the estate’s interest.