How to Handle Total Loss Insurance Paperwork for Gentlemen

Handling total loss insurance paperwork might seem like an overwhelming task, especially in the wake of an accident or disaster. But for the well-prepared gentleman, mastering this process is an essential skill. This blog post will guide you through the maze of insurance claims, paperwork, and negotiations to ensure you come out with the best possible outcome.

Understanding Total Loss

First and foremost, understanding what constitutes a total loss is crucial. A vehicle or property is considered a total loss by insurance companies when the cost to repair it exceeds its pre-accident value or when it is damaged beyond economical repair. Here are key points to grasp:

- Actual Cash Value (ACV): The vehicle's value minus depreciation.

- Repair Estimate: An assessment of the repair costs.

- Policy Limits: Maximum payout according to your insurance policy.

Immediate Steps After a Total Loss

The following steps are your guidepost immediately after determining a total loss:

- Notify Your Insurance Company: Promptly inform your insurance provider about the loss. Most policies have a clause specifying the time frame within which you must file a claim.

- Provide Essential Information: Include details like the date of the accident, location, and circumstances leading to the loss. Photographs of the damage are invaluable here.

- Police Report: If it was an accident, file a police report. This serves as an official record of the event.

- Inventory: Make a detailed inventory of any personal items lost in the incident. Keep receipts or estimates of their value.

⚠️ Note: Ensure you review your insurance policy to understand what's covered, the deductible amount, and any policy exclusions before proceeding.

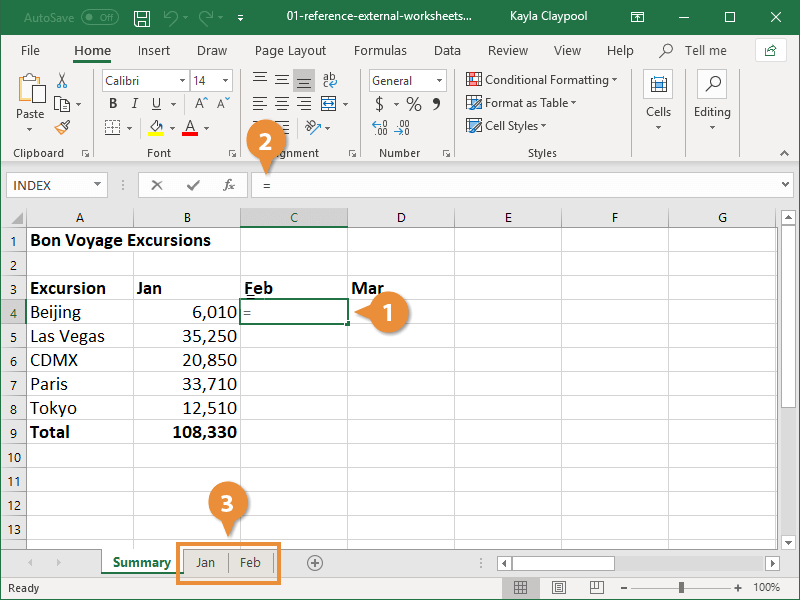

Documentation and Paperwork

The core of dealing with total loss insurance involves a lot of paperwork. Here’s a structured breakdown:

| Document | Description |

|---|---|

| Insurance Claim Form | The starting point of your claim; it includes your personal information, vehicle details, and incident information. |

| Vehicle Title | A valid, clear title establishes ownership and proves you are authorized to make a claim. |

| Accident or Incident Report | A report from law enforcement or incident documentation. |

| Proof of Ownership | Registration, bill of sale, or any document proving ownership. |

| Repair Estimates | Estimates from mechanics or repair shops showing the extent of damage and cost. |

| Photographic Evidence | Pictures of the damage, both internal and external. |

Submitting Your Claim

- Accuracy: Ensure all details in your claim form are accurate. Mistakes can lead to delays or denials.

- Timeline: Keep track of key dates, especially when deadlines apply for policy exclusions or time-bound claims.

- Follow-Up: Contact your insurance agent or adjuster regularly to check on the status of your claim.

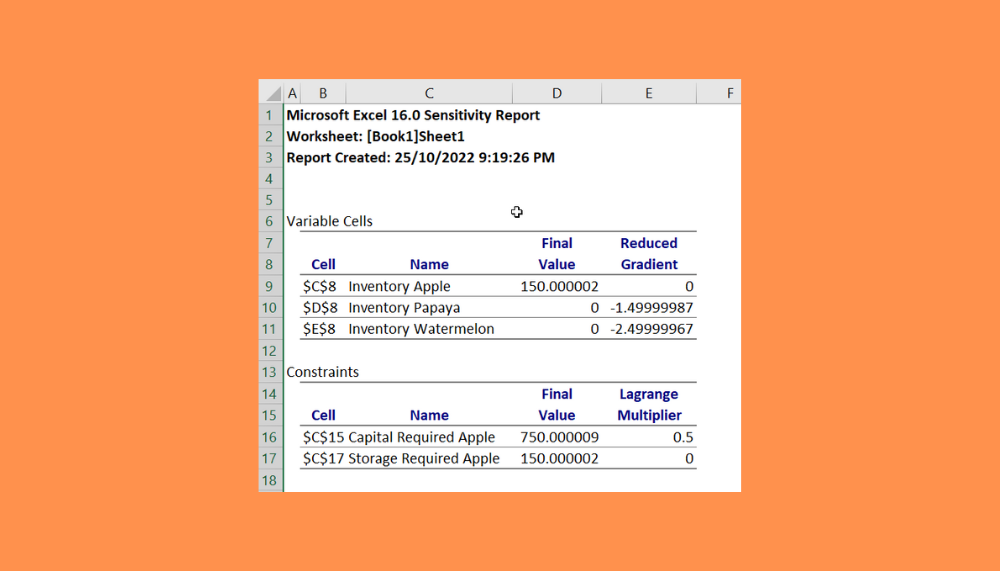

Negotiating the Settlement

Insurance companies aim to settle for the lowest amount possible. Here are tips to negotiate effectively:

- Be Prepared: Know your vehicle’s value. Use resources like Kelley Blue Book or NADA Guides for research.

- Documentation: Bring copies of repair estimates, comparable vehicle sales, and other evidence supporting your claim.

- Stay Composed: Keep your negotiation professional and assertive, not confrontational.

- Alternatives: Consider a replacement vehicle or cash settlement if the offered amount doesn’t meet your expectations.

What to Expect Post-Settlement

- Settlement Process: Once agreed, expect to receive your settlement payment or replacement vehicle promptly.

- Title Transfer: The insurance company might require the title for salvage or scrap value purposes.

- Release of Lien: If there’s a loan on the vehicle, the lienholder may be involved in the settlement process.

In the journey through a total loss insurance claim, your preparedness, diligence, and negotiation skills can greatly influence the outcome. You’ve learned to gather crucial documentation, file claims accurately, and negotiate assertively yet professionally. Remember, every detail matters; from the initial contact with your insurance provider to the final settlement. By mastering these steps, you not only protect your investment but also handle adversity with the grace and poise befitting a gentleman.

What happens if my car is declared a total loss?

+

Your insurance company will likely pay you the Actual Cash Value (ACV) or the policy limit for your vehicle, minus any deductible. They might retain the title for salvage or request you transfer the title to them.

Can I keep my totaled car?

+

In some cases, yes. This is known as a salvage title. You can retain the vehicle by paying the salvage value or negotiating with your insurance company, but you’ll need to handle repairs independently.

How long does the total loss process take?

+

Typically, the process can take anywhere from a few weeks to several months, depending on the complexity of the claim, cooperation from all parties, and the negotiation process.

What should I do if I disagree with the settlement offer?

+

First, gather more evidence supporting your claim, like repair estimates and comparable vehicle sales. Discuss this with your insurance agent or adjuster. If unresolved, consider mediation or legal advice.