5 Tips for Paperwork-Free E-Checks

As the digital age continues to evolve, traditional methods of handling checks and paperwork are becoming increasingly outdated. Businesses and individuals alike are seeking more streamlined, efficient ways to manage financial transactions. Electronic checks, or e-checks, offer a seamless solution for conducting transactions without the hassle of physical paper. Here are five essential tips to effectively manage paperwork-free e-checks.

1. Understand the Basics of E-Checks

E-checks, short for electronic checks, allow for the transfer of funds from one bank account to another electronically. Here's what you need to know:

- How it Works: E-checks operate similarly to traditional checks but without the physical paper. Instead of writing and mailing a check, the process is digitized.

- Security: They require the same or even higher levels of security since transactions occur over digital networks. Encryption and secure protocols ensure the safety of the transaction.

- Speed: E-checks are processed much faster than paper checks, often clearing within one business day.

2. Choose a Reliable E-Check Service Provider

The choice of service provider is crucial for the success of your e-check transactions:

- Reputation: Look for providers with a solid track record in security, customer service, and efficiency.

- Features: Consider the functionality, integration capabilities, and user experience the provider offers.

- Compliance: Ensure the provider complies with financial regulations like PCI DSS for handling payments securely.

🔒 Note: Always verify that the service provider adheres to the relevant financial security standards.

3. Implement Automation for Efficiency

Automation can significantly reduce the workload associated with managing financial transactions:

- Recurring Payments: Set up automatic payments for recurring bills or subscriptions.

- Electronic Statements: Receive and review electronic bank statements to keep track of your e-check activities.

- Batch Processing: If you process many transactions, batch processing can save time and reduce errors.

4. Ensure Accurate and Secure Data Entry

Accuracy and security are paramount in electronic transactions:

- Data Validation: Implement checks to ensure all entered data is accurate before transaction initiation.

- Two-Factor Authentication (2FA): Use 2FA for transactions to add an extra layer of security.

- Employee Training: Educate staff on the importance of data security and how to handle e-checks safely.

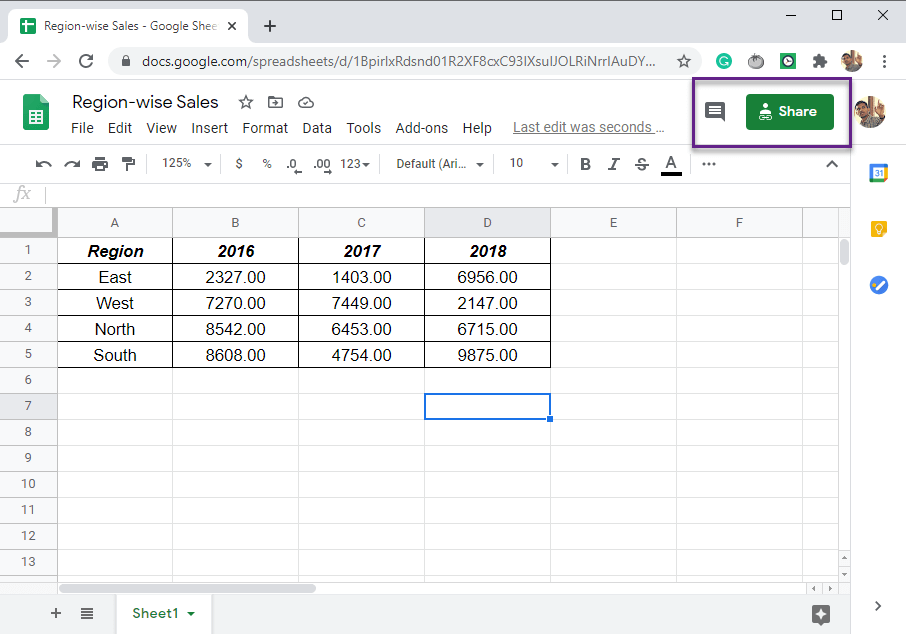

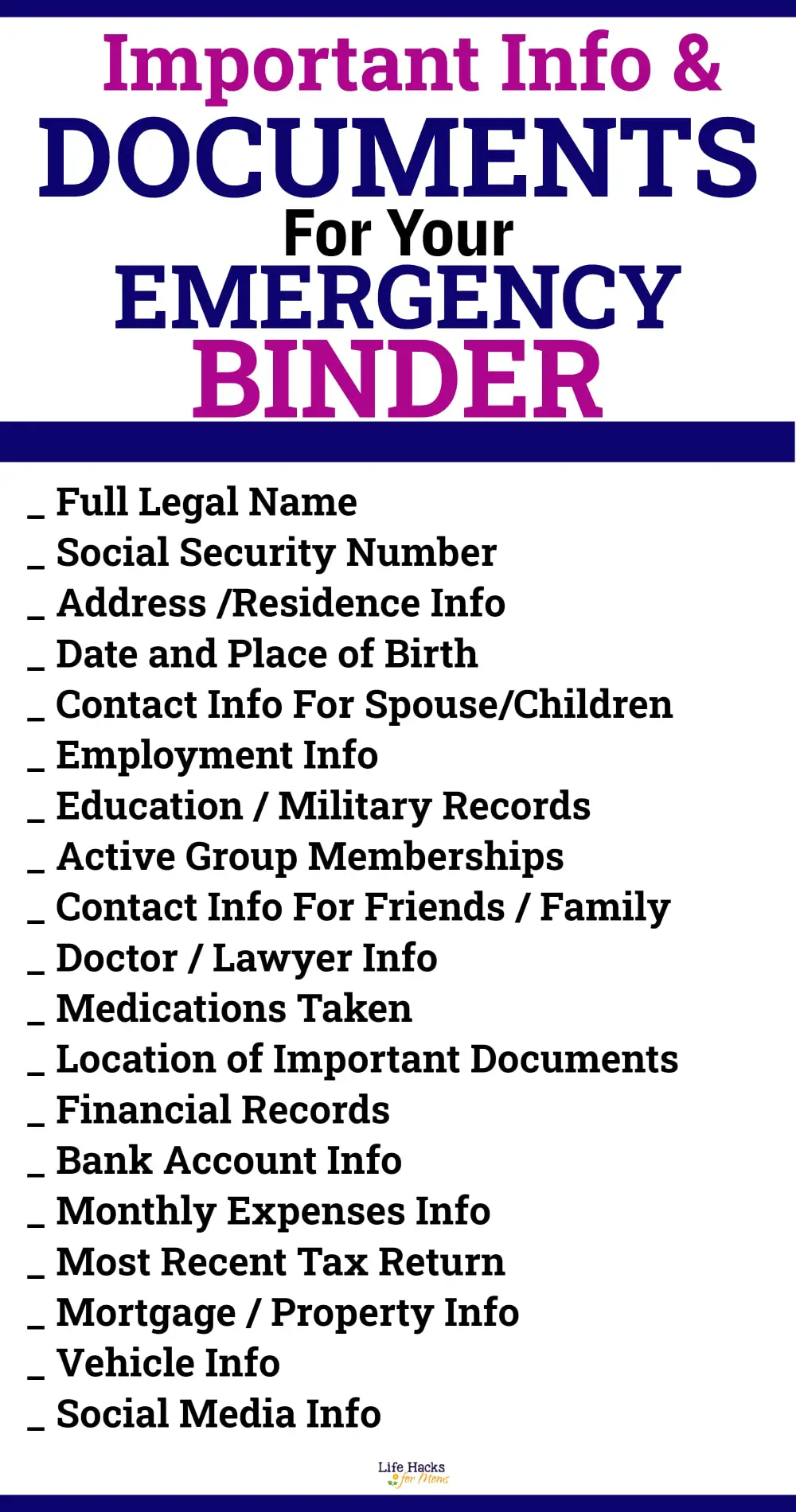

5. Keep Documentation and Records

Even though e-checks eliminate paper, maintaining electronic records is essential:

- Digital Archive: Store copies of e-check transactions securely.

- Regular Audits: Conduct internal audits to verify the accuracy of your records and to detect discrepancies early.

- Legal Compliance: Ensure that your record-keeping practices meet all legal requirements for financial transactions.

Embracing e-checks not only reduces the physical clutter of paperwork but also improves transaction efficiency, security, and record-keeping. By understanding the basics, choosing the right provider, automating processes, ensuring data accuracy, and maintaining digital records, you can seamlessly integrate e-checks into your financial management system. This approach not only streamlines financial operations but also aligns with modern digital practices, making it easier to manage finances in an increasingly paperless world.

What are the benefits of using e-checks over paper checks?

+

E-checks offer several advantages including reduced processing time, lower costs due to less paper usage, improved security through encryption, and ease of integration with accounting software.

How secure are e-check transactions?

+

E-check transactions are typically very secure when using reputable service providers who employ SSL encryption, tokenization, and other advanced security measures to protect transaction data.

Can e-checks be used for international transactions?

+

Yes, e-checks can be used for international transactions, but be aware of different banking regulations, currency conversion fees, and potential delays in processing times.

What should I do if an e-check transaction fails?

+

In case of a transaction failure, verify the details entered, ensure sufficient funds are available, and contact your bank or the e-check service provider for further assistance.

How do I set up recurring payments with e-checks?

+

To set up recurring payments, go to your e-check service provider’s platform, enter the recipient’s details, schedule the frequency, and authorize the recurring transaction.