5 Essential Paperwork Tips for Your Engagement

Embarking on the journey of engagement is a thrilling chapter in life, filled with promises of love, companionship, and shared dreams. However, amidst the excitement, there are practical aspects that couples often overlook - the paperwork. From ensuring you're legally ready to marry, to planning for the future, the right paperwork can make your engagement and eventual marriage smoother. In this post, we'll explore five essential paperwork tips that every engaged couple should consider.

Prenuptial Agreement

Discussing a prenup might seem unromantic, but it’s a practical step in any serious relationship:

- Asset Protection: Protects individual assets in case of divorce or death.

- Debt Considerations: Addresses how debts will be handled.

- Inheritance and Estate Planning: Ensures that your assets are distributed according to your wishes.

💡 Note: Consulting with a family lawyer can provide tailored advice suited to your unique situation.

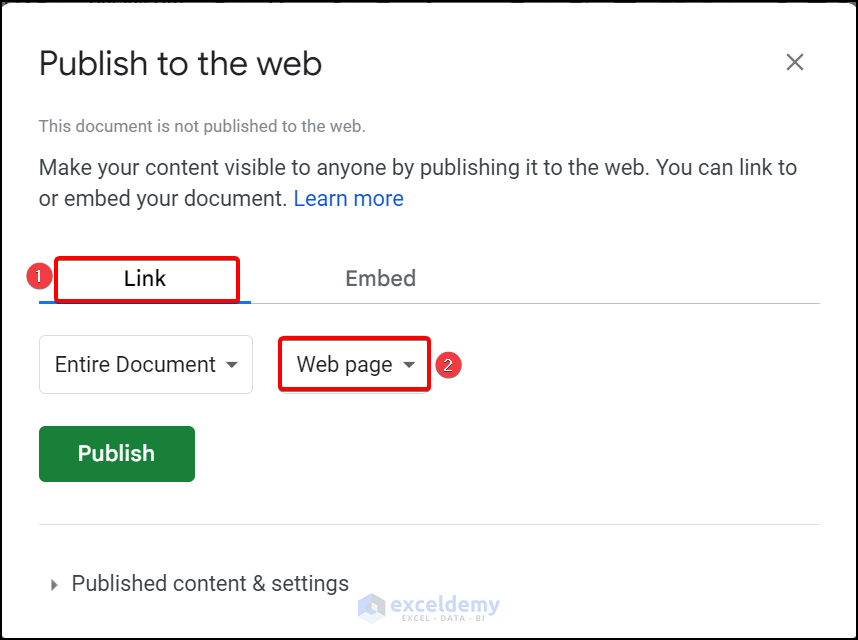

Joint Accounts or Financial Management

Before you tie the knot, discussing finances can prevent future disputes:

- Joint Savings Account: Great for shared savings goals like honeymoon, home down payment, or emergency funds.

- Credit Cards: Decide if you’ll open joint credit accounts or maintain separate ones.

- Setting Financial Goals: Talk about your financial aspirations and how to reach them together.

Life Insurance

Life insurance isn’t just for the elderly. Here’s why it’s crucial:

- Security for Dependents: Provides financial support if something happens to you.

- Peace of Mind: Knowing your partner will be financially okay.

- Types of Insurance: Term life, whole life, or universal life - choose what fits your needs.

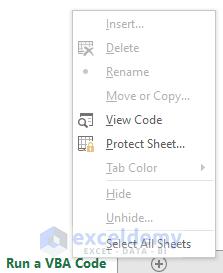

Updating Legal Documents

Make sure your legal documents reflect your new life status:

- Change Beneficiaries: Update life insurance policies, retirement accounts, etc.

- Will and Estate Planning: Ensure your will reflects your current wishes.

- Power of Attorney: Assign someone to make decisions for you if you’re unable to.

Understanding and Preparing for Name Changes

If you or your partner plan to change your last name, here are some tips:

- Documents Needed: Marriage certificate, passport, driver’s license, etc.

- Process and Timeline: Understand the steps and time it might take to complete.

- Legal Considerations: There might be legal repercussions like credit and bank account changes.

As you take these steps towards organizing your engagement paperwork, remember that this process is not just about legality or formality. It's about creating a foundation of transparency, mutual understanding, and planning for a shared future. Each piece of paperwork you handle together can become a testament to your commitment and foresight, setting the stage for a life filled with support and love.

Why is it important to have a prenup?

+

A prenuptial agreement clarifies financial expectations, protecting individual assets, addressing debts, and ensuring that your wishes regarding inheritance and estate planning are respected.

How can a joint account benefit an engaged couple?

+

A joint account can foster trust, simplify financial management, and help in saving for shared goals like a honeymoon or home purchase.

What are the key considerations when choosing life insurance?

+

The type of policy, coverage amount, premiums, and the duration of the need for insurance should be carefully considered. Term life insurance might suit young couples, while whole or universal life might be better for long-term planning.