401k Tax Documents: What You Need to Know

When managing your 401(k) retirement account, understanding the tax implications and the necessary documentation is crucial. Whether you're contributing, withdrawing, or rolling over funds, being well-informed ensures you avoid potential penalties and optimize your tax strategy. Here's an in-depth look at what you need to know about 401(k) tax documents and their importance.

Understanding the Basics of 401(k) Taxation

The allure of a 401(k) plan lies in its tax advantages. Contributions to these plans are made pre-tax, reducing your taxable income for the year of contribution. However, these contributions grow tax-deferred, meaning you’ll owe taxes when you withdraw the funds during retirement. Here are key points to consider:

- Pre-Tax Contributions: Your contributions reduce your current taxable income, but they’re taxed upon withdrawal.

- Tax-Deferred Growth: Investment earnings within the account grow without immediate taxation.

- Required Minimum Distributions (RMDs): Starting at age 72, you must begin withdrawing funds, which are then taxable.

- Roth 401(k): An alternative where contributions are made with after-tax dollars, and qualified withdrawals in retirement are tax-free.

Important Tax Documents for Your 401(k)

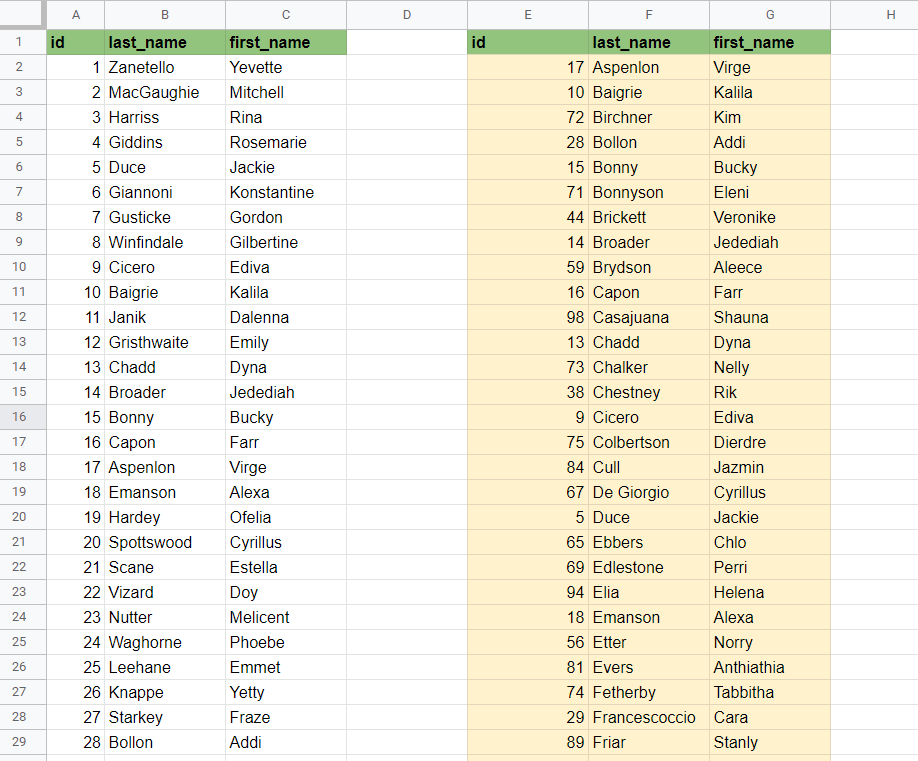

To manage your 401(k) effectively, you need to be familiar with several key tax forms:

| Document | Purpose |

|---|---|

| W-2 Form | Displays your contribution amount, which you deduct from your income for tax purposes. |

| 1099-R | Issued for distributions or rollovers, showing the amount withdrawn or transferred. |

| 5498 | Confirms your contributions and RMDs, though not necessary for tax filing. |

When to Expect These Documents

- W-2: Sent by January 31 for the previous tax year.

- 1099-R: You’ll receive this by January 31 if you had any distributions from your 401(k).

- 5498: Typically arrives by May 31, after the tax filing deadline.

Steps for Managing 401(k) Tax Documents

Here are the steps you should follow to manage your 401(k) tax documents effectively:

- Verify Your Contributions: Check your W-2 to ensure your contributions are reported accurately.

- Understand Distributions: Look at your 1099-R to know how withdrawals or rollovers are handled for tax purposes.

- Keep Records: Retain copies of your tax documents and statements to have a complete financial history.

- Plan for Taxes: Consider the tax implications when you plan to withdraw funds or convert to a Roth IRA.

- Seek Professional Help: If unsure, consult with a tax professional to ensure compliance and optimize your strategy.

💡 Note: Ensure your documents are securely stored, as they contain sensitive personal information.

Common Scenarios and Their Tax Implications

- Early Withdrawals: Typically, these come with a 10% penalty in addition to taxes on the withdrawn amount, unless an exception applies.

- Required Minimum Distributions: RMDs are taxable as ordinary income, and missing these can incur penalties.

- Conversions to Roth: Converting a traditional 401(k) to a Roth IRA involves immediate tax payment on the converted amount, but future qualified withdrawals are tax-free.

- Rollovers: Direct rollovers are generally tax-free, whereas indirect rollovers require careful handling to avoid penalties.

Proper tax planning can significantly impact your retirement savings. Keeping up-to-date with your tax documents and understanding their implications helps ensure you're making the most of your retirement strategy, avoiding pitfalls like penalties or missed deductions.

In managing your 401(k), attention to detail and proactive tax planning are indispensable. By staying informed about the various tax forms, understanding their implications, and seeking professional advice when necessary, you can navigate the complexities of retirement savings with confidence. Knowledge and preparation are your best tools to ensure that your retirement funds work efficiently for you, paving the way for a financially secure future.

What happens if I miss an RMD?

+

If you miss an RMD, you may face a 50% excise tax on the amount that should have been withdrawn.

Can I contribute to both a traditional 401(k) and a Roth 401(k)?

+

Yes, many employers offer both options, allowing you to split your contributions between the two, up to the annual IRS limit.

What if I find an error on my 1099-R?

+

Contact the plan administrator or IRA custodian to correct the error before filing your taxes to prevent discrepancies.

How do I know if I need to pay taxes on my 401(k) withdrawal?

+

Withdrawals from a traditional 401(k) are taxable. The IRS requires taxes to be withheld on these amounts unless you opt out or roll the funds over.