3 Legal Ways to Charge for FMLA Paperwork

Employing someone includes the responsibility of managing various administrative tasks, one of which involves complying with the Family and Medical Leave Act (FMLA). This law provides eligible employees with job-protected leave for specific family and medical reasons. While the direct cost of offering FMLA leave falls on the employer, there are often indirect administrative costs associated with paperwork and documentation. Here, we explore three legal ways to charge for FMLA-related paperwork.

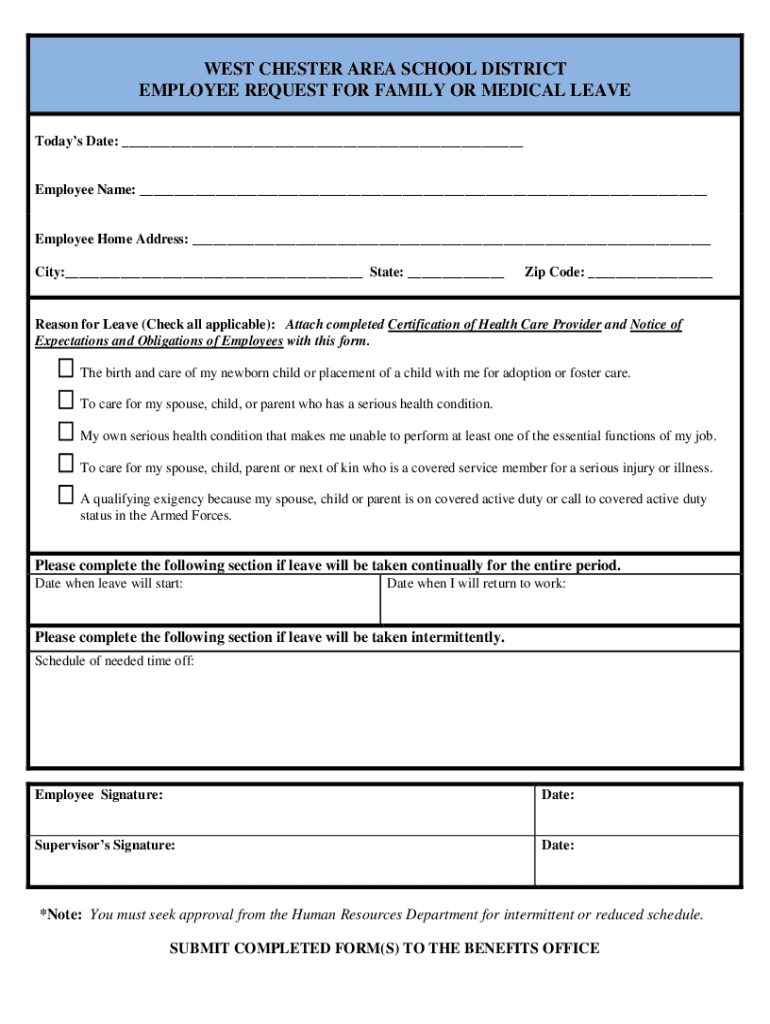

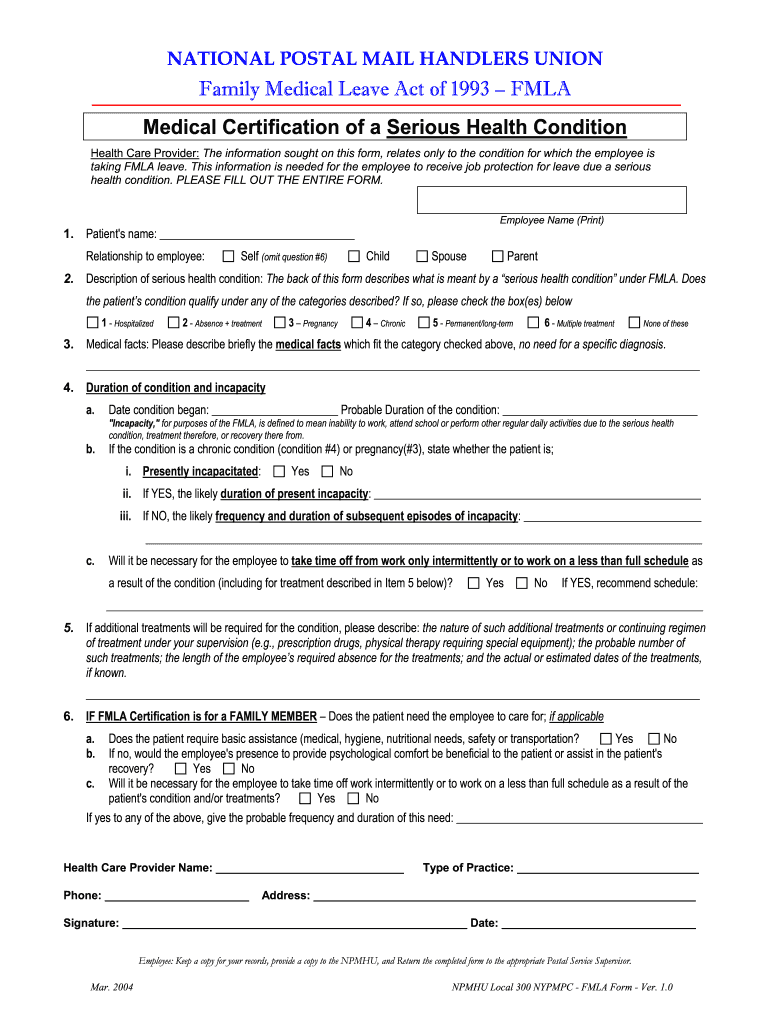

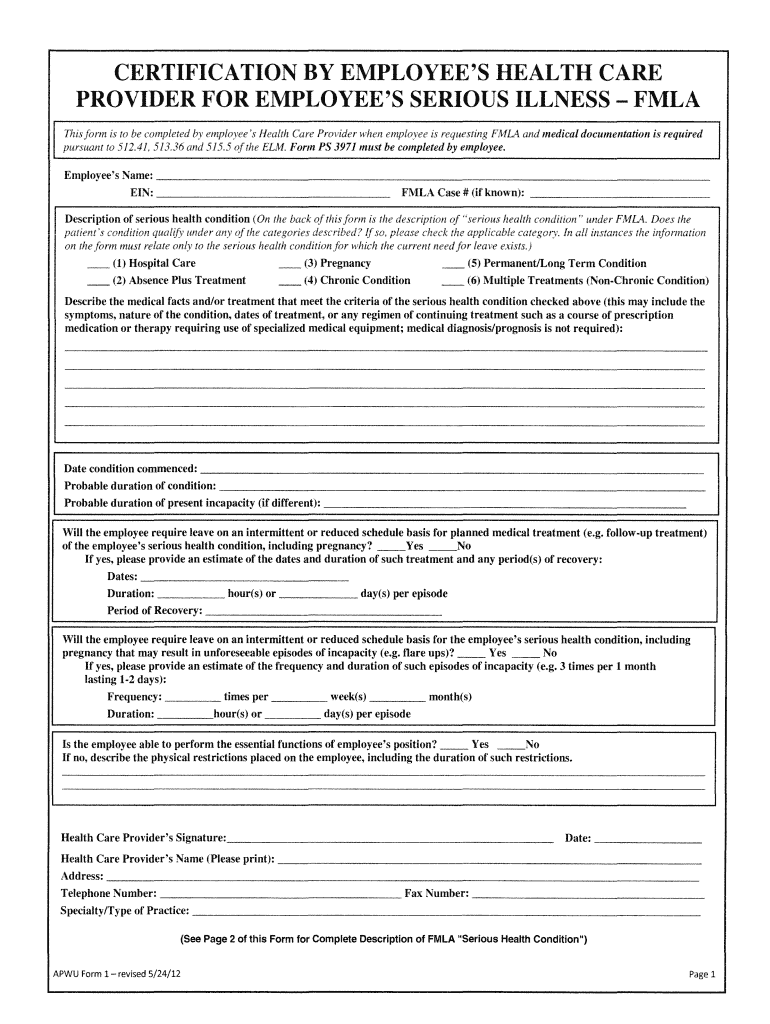

1. Fees for Medical Certification

When an employee requests leave under the FMLA, they might be required to provide medical certification to support their need for leave. Here’s how employers can address the related expenses:

- Reimbursement for Costs: Employers are allowed to charge employees for the actual costs of obtaining a second or third medical opinion if the original certification is found to be incomplete or insufficient. However, employers must follow these rules:

- Request for a second or third opinion must be made in writing.

- Employers cannot select a healthcare provider with whom they have a professional or familial relationship.

- Employees should not be charged more than what the employer has to pay for these certifications.

💡 Note: Charging for medical certification only applies to second and third opinions, not the initial certification provided by the employee's healthcare provider.

2. Fees for Reasonable Out-of-Pocket Expenses

While employers cannot charge employees for the preparation of FMLA paperwork, they can recover out-of-pocket expenses:

- Photocopying: Employers can charge for the cost of copying FMLA-related documents for employees, but this must be at a reasonable rate.

- Mailing or Shipping: Charges for the shipment or mailing of FMLA paperwork are permissible when the employee requests documents to be sent.

💡 Note: These fees should be minimal and only cover the actual expenses incurred by the employer, ensuring that they do not act as a barrier to the employee's ability to exercise their FMLA rights.

3. Fees for Third-Party FMLA Management Services

Some organizations opt for third-party services to handle FMLA administration, reducing the workload on HR staff. Here’s how employers can approach the costs:

- Shared Costs: If the employer uses a third-party service to manage FMLA leave, they might share the cost with the employee. However:

- Sharing must be permissible by law and company policy.

- The employee's contribution should be reasonable and not discourage the use of FMLA.

| Method | Description |

|---|---|

| Medical Certification | Charging for second or third opinion certifications |

| Out-of-Pocket Expenses | Charging for document photocopying, mailing, or shipping |

| Third-Party Services | Sharing costs of FMLA management service |

💡 Note: While sharing third-party service costs is legal, it must not be structured in a way that could be interpreted as retaliatory or obstructive to FMLA usage.

In conclusion, employers can charge for certain aspects of FMLA paperwork, but these charges must be strictly aligned with legal requirements. They are designed to cover only legitimate expenses without creating financial barriers for employees seeking to use their FMLA rights. As with any employment law, staying informed of changes and consulting legal counsel for specific situations can help navigate these complexities effectively.

Can Employers Charge for the Initial Medical Certification?

+

No, employers cannot charge employees for the initial medical certification required for FMLA leave. This cost is borne by the employee or their health insurance provider.

How Should Out-of-Pocket Expenses be Calculated?

+

Out-of-pocket expenses should reflect the actual cost incurred by the employer. For example, if the employer prints documents for the employee, the fee can cover the cost of paper and ink, but should not be inflated to include profit.

What if an Employee Can’t Afford Third-Party Service Fees?

+

If the employee finds the fee for third-party FMLA management services to be financially prohibitive, the employer should consider alternative solutions or absorb the cost to ensure employees can exercise their FMLA rights without financial barriers.