Personal Allowance Sheet: Essential Payroll Paperwork Explained

Understanding Personal Allowance Sheet

The Personal Allowance Sheet is a fundamental document in payroll management, essential for ensuring employees receive the correct salary while adhering to taxation laws. This piece of paperwork outlines an employee's tax-free personal allowance, helping employers manage deductions efficiently. Let's delve into the specifics of what a Personal Allowance Sheet entails, its importance, and how it integrates with payroll systems.

What is a Personal Allowance Sheet?

A Personal Allowance Sheet is an official document that lists the amount of income an employee can earn tax-free during the tax year. Here's what you need to know:

- Personal Allowance: Every individual has a standard amount they can earn without paying income tax.

- Annual Review: This allowance is reviewed and potentially adjusted each tax year to reflect inflation and economic changes.

- Tax Thresholds: The sheet details different tax bands and corresponding rates, which determine how much tax is payable after the personal allowance is exhausted.

The Role in Payroll Management

Incorporating the Personal Allowance Sheet into payroll systems is critical for:

- Accuracy: Ensuring that the correct amount of tax is withheld from each paycheck, reducing the likelihood of overpayment or underpayment of taxes.

- Compliance: Meeting legal obligations regarding tax deductions, thus avoiding penalties for the employer.

- Employee Satisfaction: Providing transparency in how much net pay employees will receive, which is essential for budgeting and financial planning.

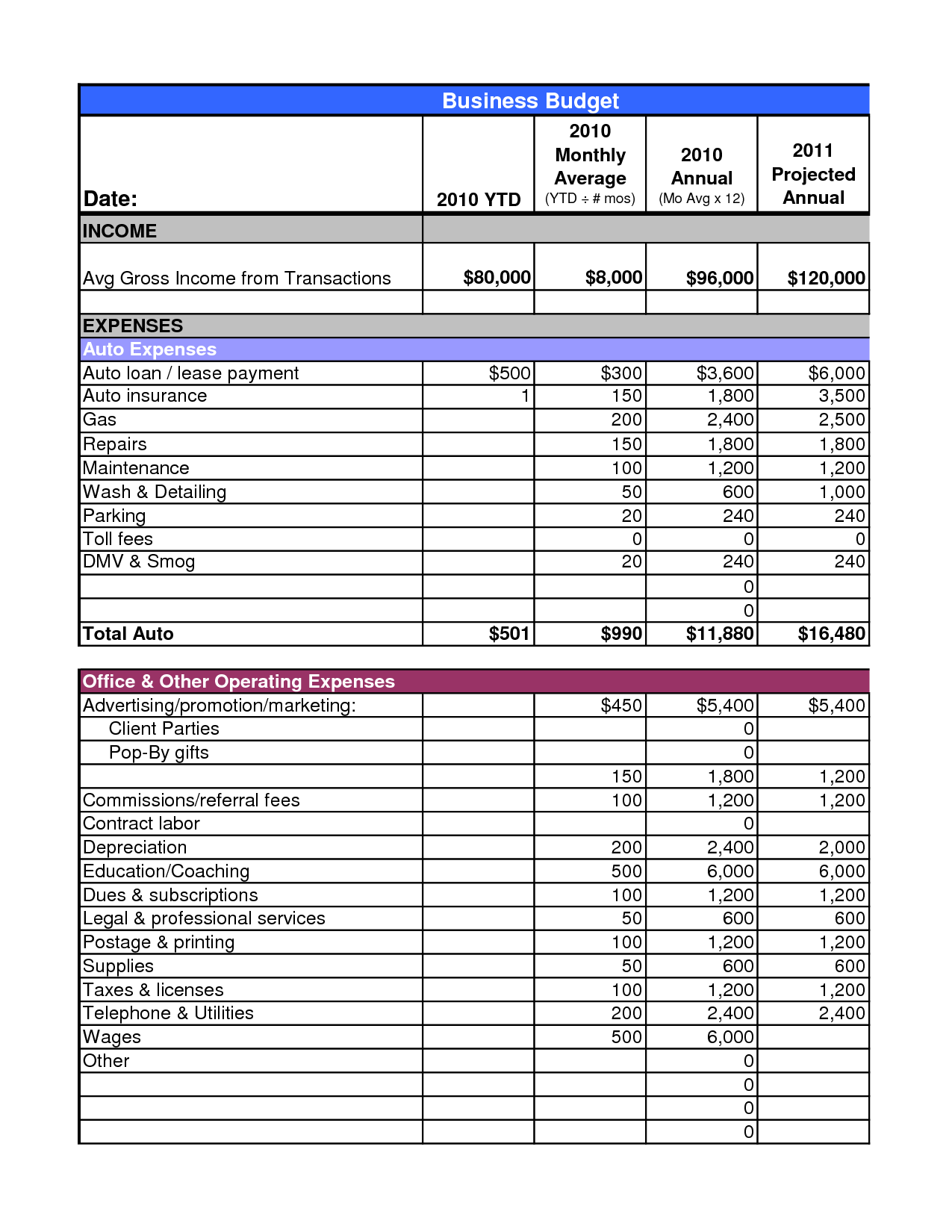

Creating and Using a Personal Allowance Sheet

Here's a basic breakdown of how to create and utilize a Personal Allowance Sheet:

| Step | Description |

|---|---|

| 1. Gather Information | Collect employee details, personal allowance, and tax band information. |

| 2. Calculate Tax | Determine the taxable income by subtracting the personal allowance from the annual salary. |

| 3. Update Employee Records | Enter this data into payroll software or manually into records. |

| 4. Ensure Compliance | Regularly update with changes in tax laws or allowances. |

| 5. Reporting | Include the allowance details in relevant payroll reports and tax documents. |

📌 Note: Always verify and adjust tax calculations with each tax year's changes to ensure accuracy in payroll processing.

Key Components of the Personal Allowance Sheet

When looking at a Personal Allowance Sheet, you'll typically find:

- Employee Details: Name, employee ID, and National Insurance number or equivalent.

- Tax Year: The specific tax year to which the allowances apply.

- Allowance Amount: The exact personal allowance amount, which may differ due to factors like income from other sources.

- Tax Rates: A breakdown of the current tax rates for various income thresholds.

- Cumulative Totals: Year-to-date income, tax paid, and remaining allowances.

Common Mistakes to Avoid

Mistakes in handling the Personal Allowance Sheet can lead to significant errors in payroll calculations. Here are some common pitfalls:

- Outdated Information: Failing to update for changes in tax law or allowance amounts.

- Incorrect Application: Applying the wrong allowances for employees based on their personal circumstances.

- Omission of Entitlements: Not accounting for special tax reliefs or benefits employees might be eligible for.

⚠️ Note: Always double-check tax calculations and seek advice from tax experts to avoid common errors in payroll processing.

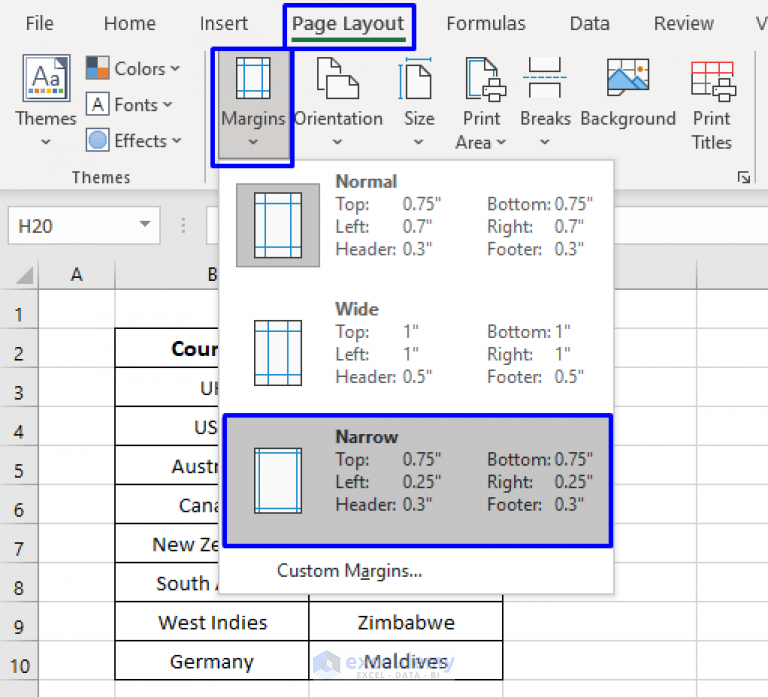

Impact on Payroll Systems

The integration of Personal Allowance Sheets into payroll systems facilitates:

- Automation: Modern payroll software often incorporates automatic updates for tax laws, reducing manual effort.

- Real-Time Adjustments: Allows for immediate reflection of changes in an employee's personal or financial situation affecting their tax.

- Compliance Reporting: Provides necessary data for statutory tax submissions, enhancing accuracy and timeliness.

Final Thoughts

The Personal Allowance Sheet serves as more than just a piece of payroll paperwork; it is a critical tool for tax compliance, employee satisfaction, and accurate financial management. By understanding and effectively managing these sheets, businesses can ensure their payroll processes are both efficient and compliant with current tax laws. This ensures that employees are fairly compensated and aware of their net income, fostering a transparent and trusting work environment.

Why is the Personal Allowance Sheet important for payroll?

+

It ensures that employees receive the correct net salary after tax deductions and helps employers comply with tax regulations, reducing the risk of penalties.

How often should a Personal Allowance Sheet be reviewed?

+

It should be reviewed and potentially updated annually with the start of the new tax year or upon any changes in tax law or an employee’s personal circumstances.

What happens if a Personal Allowance Sheet is not updated?

+

Failure to update can result in incorrect tax deductions, leading to potential fines for the employer and overpayment or underpayment of taxes for the employee.

Can the Personal Allowance amount change?

+

Yes, it can change based on government decisions, inflation adjustments, or personal changes in circumstances like additional income sources.

How does the Personal Allowance Sheet integrate with modern payroll software?

+

Modern payroll software often updates automatically to reflect changes in tax laws, incorporates data from the Personal Allowance Sheet to calculate deductions accurately, and provides reporting tools for compliance.