5 Estate Planning Tips Without Paperwork Headaches

Dealing with estate planning often brings to mind complex legal documents, confusing jargon, and endless meetings with lawyers. Yet, it doesn’t have to be this way. Effective estate planning can be streamlined, ensuring your assets are distributed according to your wishes, with minimal stress and paperwork. Here are five key tips to simplify your estate planning:

1. Choose the Right Beneficiaries

Naming the right beneficiaries is crucial in estate planning. Here’s how you can streamline this process:

- Understand the Significance: Your beneficiaries are who will inherit your assets directly, bypassing the probate process.

- Keep it Updated: Regularly review and update your beneficiary designations. Life changes like marriages, divorces, births, or deaths can necessitate changes.

- Avoid Probate: Assets with named beneficiaries, like life insurance policies, retirement accounts, and payable-on-death bank accounts, skip probate, which saves time and reduces legal fees.

- Clarity: Ensure that your beneficiaries understand your intentions to minimize disputes after your passing.

⚠️ Note: Beneficiaries must be clearly defined to prevent any unintended consequences or disputes among family members.

2. Use a Will to Cover Anything Unnamed

While beneficiary designations cover specific assets, a will can account for everything else, providing a structured plan for:

- Assets Without Named Beneficiaries: A will dictates how property, personal items, or money not otherwise assigned should be distributed.

- Executor Appointment: Choose someone you trust to handle your estate, making decisions based on your wishes.

- Guardianship: If you have minor children or dependents, your will is where you name guardians for them.

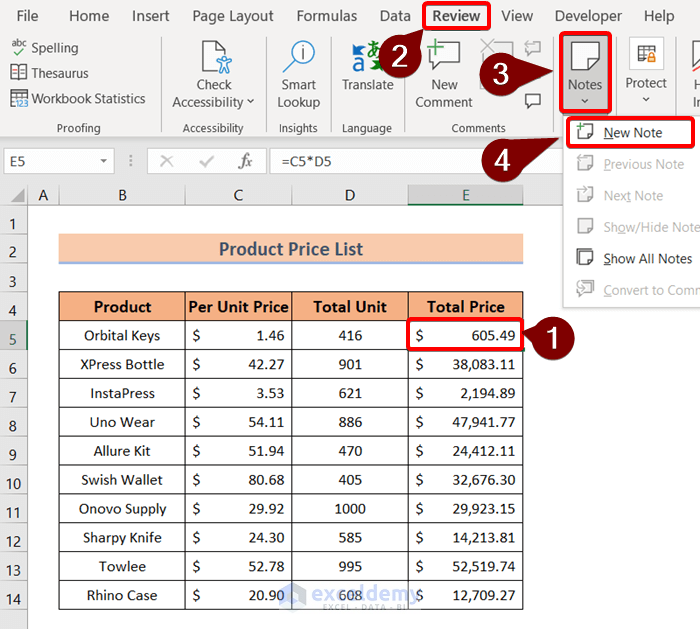

3. Leverage Digital Solutions

In the modern age, technology can simplify estate planning significantly:

- Online Will Creation Services: Many reputable websites offer templates and guidance for creating a will. Ensure you choose one that complies with your state’s laws.

- Digital Estate Management: Platforms like Everplans or Trust & Will provide tools for managing your digital assets, from social media accounts to online banking.

- E-Signatures: Electronic signatures are legally binding in many jurisdictions, streamlining the process of signing documents.

📝 Note: Ensure you understand the legal requirements for digital wills in your state or country to avoid invalidating your plan.

4. Consider a Living Trust

While a will can cover most of your estate, a living trust offers several advantages:

- Avoid Probate: Like beneficiary designations, a trust avoids the costly and time-consuming probate process.

- Privacy: Trusts are not public documents, unlike wills, which can become part of the public record during probate.

- Flexibility: You can amend a trust or even revoke it as long as you are mentally competent, providing flexibility in managing your assets.

- Management During Incapacity: A living trust can also manage your assets if you become incapacitated, ensuring that your estate continues to be handled as you wish.

| Option | Avoids Probate | Private | Manages Incapacity |

|---|---|---|---|

| Will | No | No | No |

| Living Trust | Yes | Yes | Yes |

5. Communicate Clearly

Effective estate planning involves more than just legal documents; it involves people:

- Inform Beneficiaries: Let your beneficiaries know about your plans to ensure they are prepared and can provide feedback if necessary.

- Executors and Trustees: Ensure those named in your will or trust understand their roles and responsibilities.

- Regular Family Meetings: Discuss your intentions periodically, especially after significant life events, to keep everyone informed.

- Cultural Sensitivity: Be mindful of family dynamics and cultural expectations which can influence how your estate plan is perceived.

In essence, simplifying estate planning involves careful planning, choosing the right tools, and maintaining open communication. By implementing these tips, you can reduce the burden on your loved ones and ensure your wishes are clearly understood and followed.

What happens if I don’t name any beneficiaries?

+

If you fail to name beneficiaries, your assets may go through probate, and the state laws will determine distribution, potentially contradicting your wishes.

Can I use a DIY will template online?

+

Yes, you can use online templates, but ensure they comply with local laws. Consider consulting with an attorney if your estate is complex or if you live in a state with specific requirements for wills.

How often should I update my estate plan?

+

It’s advisable to review your estate plan every 3 to 5 years or after significant life events like marriage, divorce, the birth of a child, or a major change in your financial situation.

Can my digital assets be part of my estate plan?

+

Yes, digital assets can and should be included in your estate plan. You need to specify access and instructions for handling or disposing of these assets post-mortem.

What if my estate plan is contested?

+

If your estate plan is contested, it may go to court where the validity of your plan will be decided. Clear documentation, proper legal formalities, and avoiding any appearances of duress or undue influence can help reduce the likelihood of contestation.