Property Tax Paperwork: Whose Name Should Appear?

Property Tax Paperwork: Whose Name Should Appear?

When it comes to filing property tax paperwork, understanding whose name should appear on these documents is crucial for legal accuracy, clarity, and to avoid potential tax complications. Property tax paperwork, often associated with ownership, responsibilities, and benefits, involves multiple stakeholders, each with specific rights and obligations. This post explores the intricacies of naming conventions on property tax forms, offering insights into common scenarios, legal implications, and best practices.

Understanding Property Ownership

Property ownership can take various forms:

- Sole Ownership: When only one individual holds full ownership rights.

- Joint Ownership: Where two or more individuals own the property together, either as tenants in common or joint tenants with right of survivorship.

- Trusts: Property held in a trust where the trust, rather than an individual, is the legal owner.

- Corporate Entities: When a property is owned by a corporation or LLC.

Common Scenarios

Single Ownership

In cases of single ownership, the tax bills and paperwork are straightforward:

- The name of the sole owner appears on all tax-related documents.

Joint Ownership

With joint ownership, both or all owners might appear on the tax documents, or just one, depending on the agreement and local tax laws:

- Tenants in Common: Each owner’s share of the tax can be split according to their ownership interest. All names might appear or only the contact person for the property.

- Joint Tenants: Often, the names of all joint tenants are listed.

Married Couples

For married couples:

- Traditionally, both names might be listed, especially if the property was acquired after marriage.

- However, local laws can dictate different naming conventions, such as listing only one name if the property is community property.

Trusts

Properties held in trusts:

- The trust itself is often listed as the owner. Trustees, not the beneficiaries, manage tax obligations.

- The name appearing on the tax paperwork will be that of the trust, e.g., “The Smith Family Trust.”

Corporate or LLC Ownership

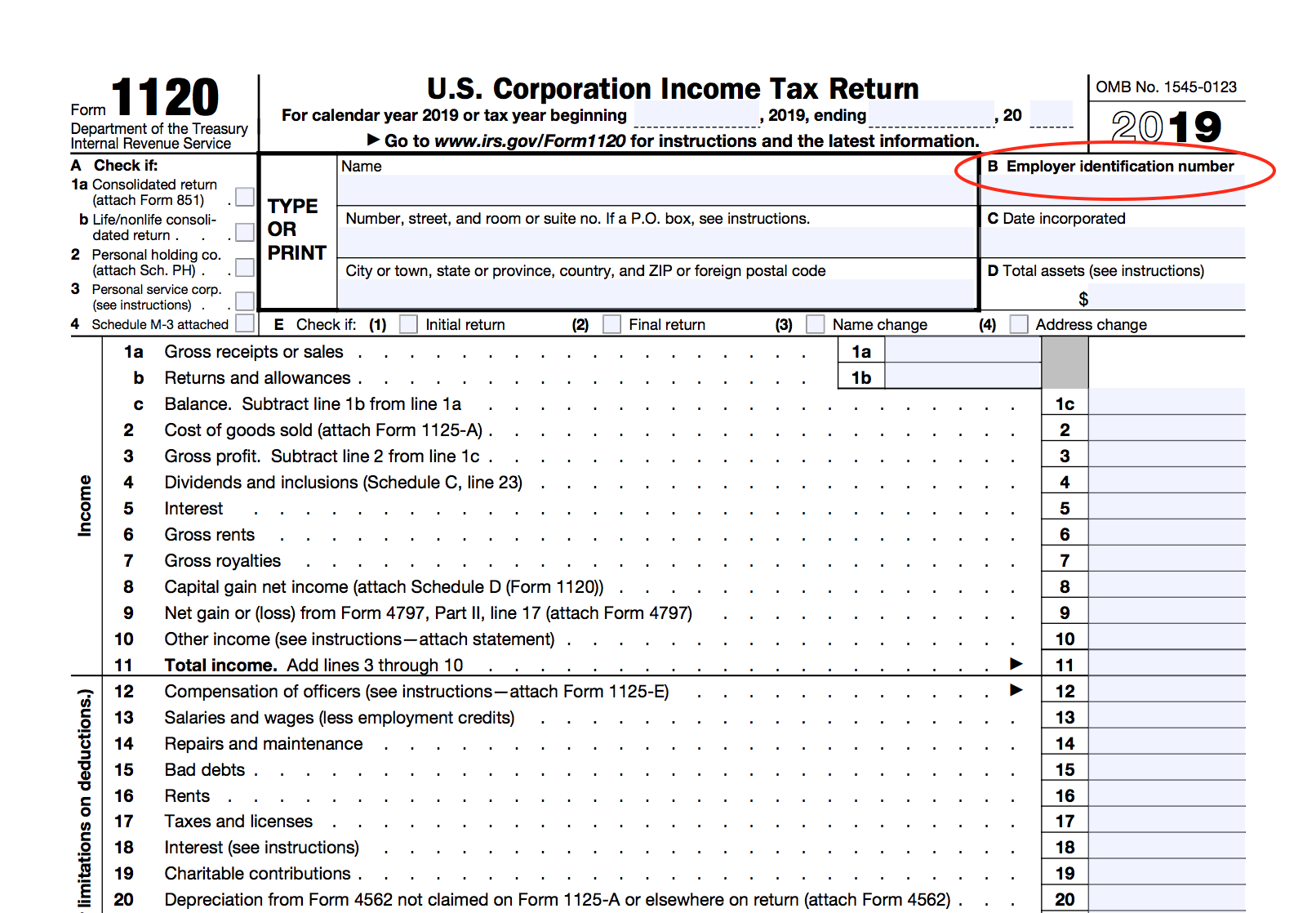

If a property is owned by a corporate entity:

- The corporation or LLC’s name will be on the tax documents.

Implications of Listing Names

Tax Liability

The person or entity named on property tax documents:

- Has the legal responsibility to ensure property taxes are paid.

- Can face penalties if taxes are unpaid.

Legal Rights

Naming conventions can impact:

- Who has the right to challenge assessed values.

- Who is notified in case of changes in property assessments or exemptions.

Privacy

In some regions, property tax records are public:

- Listing one’s name might expose personal information, which can be a concern for privacy-conscious individuals.

Exemptions and Deductions

Homeowner exemptions, homestead exemptions, and tax deductions might require:

- The primary occupant’s name to be on the tax bill for eligibility.

Changing Names on Property Tax Documents

If there is a need to change the names on property tax paperwork:

- Legal processes like probate, transfer of title, or property tax reassessment might be necessary.

- Local tax authorities often have specific forms and procedures for name changes.

- Notifying local tax offices of changes in ownership or name is crucial to prevent errors and maintain legal standing.

Notes

🔍 Note: Always consult local tax laws or a tax professional before making changes to property tax documents. Procedures vary by jurisdiction, and mishandling can lead to penalties or missed benefits.

💡 Note: Updating legal documents like deeds and wills should be done simultaneously to reflect changes in property ownership or name to avoid discrepancies.

Understanding whose name should appear on property tax paperwork is more than a formality; it's a legal necessity with implications for tax obligations, rights, privacy, and potential benefits. By knowing the ownership structure, local laws, and the implications of naming, property owners can navigate tax season with confidence. Whether you're a sole owner, part of a couple, or involved in more complex ownership structures like trusts or LLCs, ensuring accuracy in these documents is crucial for smooth property management. Proper documentation not only simplifies your dealings with tax authorities but also protects your property rights and interests in the long run. From ensuring timely tax payments to protecting your personal privacy, the right name on your property tax bill can make all the difference in your financial and legal responsibilities.

Can I Change the Name on Property Tax Records?

+

Yes, you can change the name on property tax records. This typically requires updating legal documents like the deed and notifying local tax authorities through their prescribed processes.

What If I Missed Updating My Name After Marriage?

+If you missed updating your name after marriage, you can still make changes by following local procedures. This might involve updating your deed, notifying tax authorities, and possibly a title company if there’s a mortgage.

Is It Necessary to List All Owners on Property Tax Documents?

+It depends on local tax laws and ownership structures. For jointly owned properties, listing all owners might be common, but in some cases, just one contact person’s name might suffice. Consult local regulations or a tax advisor for clarity.