Find Your Tax Paperwork: Where to Look

What are Tax Documents?

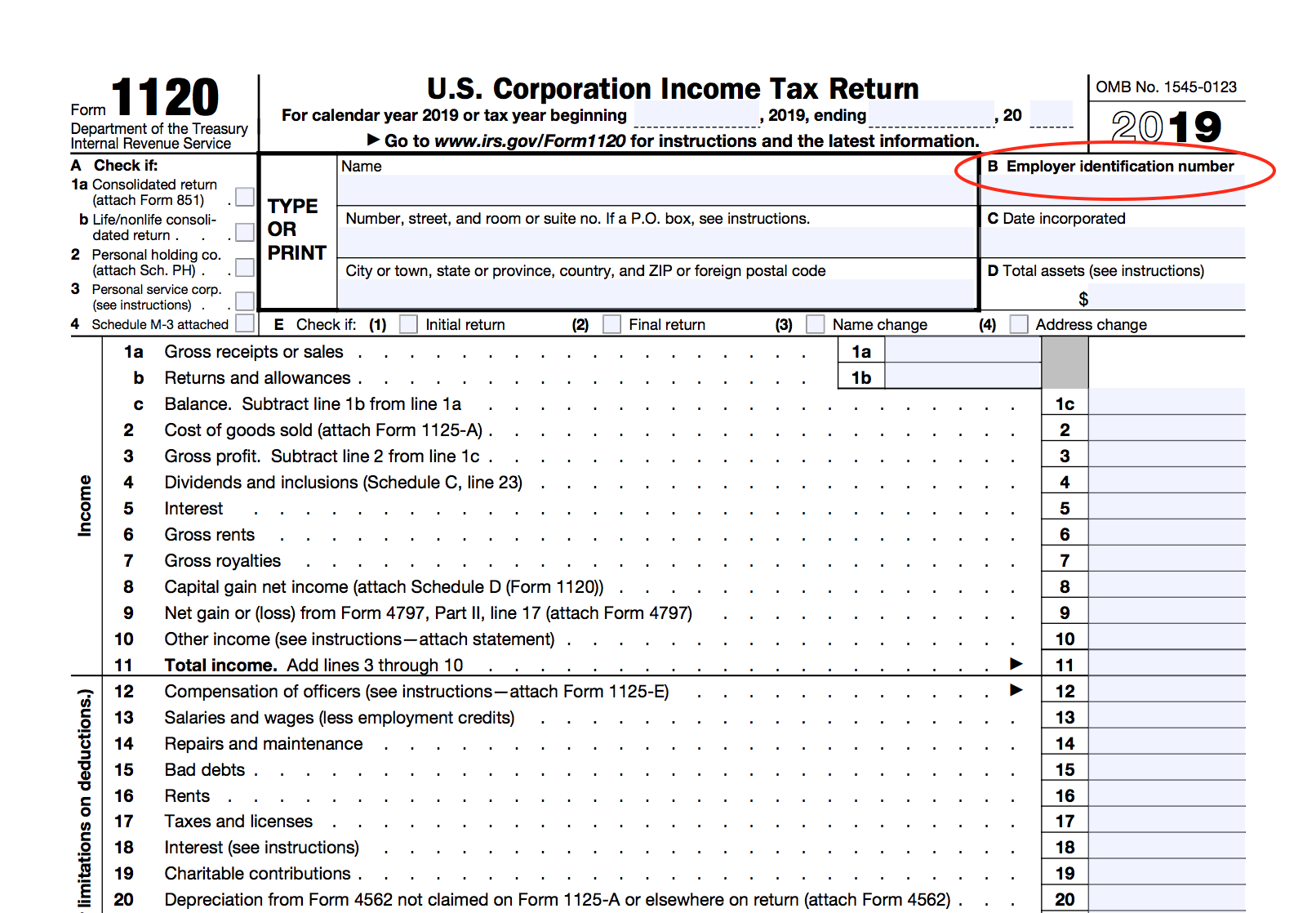

Tax documents are records that you need to provide when preparing your annual tax return. These documents not only help in determining your taxable income but also play a vital role in ensuring compliance with tax laws. Typically, tax documents include:

- W-2 Forms: These show how much you earned in a year and how much was withheld for taxes.

- 1099 Forms: Various types of income, such as freelance income, interest from bank accounts, and retirement distributions, are reported on 1099 forms.

- Receipts and Proof of Deductions: These documents can include receipts for business expenses, charitable contributions, and other deductible expenses.

- Investment Statements: They show the cost basis, capital gains or losses, and dividends or interest earned from investments.

- Mortgage and Property Tax Statements: For homeowners, these documents are essential for claiming property tax deductions or mortgage interest.

Having a clear understanding of what each document represents and its importance can significantly reduce the stress associated with tax filing.

Where to Look for Tax Documents

Your tax documents can come from various sources, and knowing where to look can save you time and frustration:

Employer and Payroll Services

W-2 Forms: Typically, your employer should provide you with a W-2 form by January 31st each year. You might receive this:

- In your work email inbox if you have electronic delivery enabled.

- Directly from your company’s HR or payroll department, either via mail or in person.

Financial Institutions and Investment Accounts

1099 Forms: You will receive different types of 1099 forms depending on your financial activities:

- 1099-INT: Interest Income from savings or checking accounts.

- 1099-DIV: Dividends and distributions from investments.

- 1099-B: Proceeds from broker and barter exchange transactions.

These forms are usually mailed or sent electronically by late January or early February. If you’re unsure:

- Check your email spam folder for any overlooked notifications.

- Visit the online account management portal for your bank or investment firm.

Personal Records

Your personal records can help you claim deductions, so keeping good records throughout the year is crucial:

- Charitable Contribution Receipts: Look for donation acknowledgments from charities.

- Medical Expense Records: Keep bills, payment receipts, and insurance Explanation of Benefits (EOB) statements.

- Home Office Expenses: Receipts for office supplies, utilities, and a portion of your rent or mortgage can qualify if you work from home.

- Business Expenses: If self-employed, keep all invoices and receipts related to business expenses.

Government and Local Agencies

Property Tax Statements: These are often sent out by local tax authorities:

- Check your mail or online accounts if available through your county assessor’s website.

- If you’ve recently purchased a home, reach out to the previous owner or your escrow agent for copies.

Cloud Storage and Online Accounts

If you use cloud services for document management:

- Scan your cloud storage (like Google Drive, Dropbox, etc.) for folders labeled ‘Tax Documents’ or similar.

- Review documents shared via email or cloud collaboration tools from your employer or financial advisors.

📝 Note: Keep digital copies of all tax documents in a secure, password-protected folder. Consider using cloud services for backup and easy access.

Digital Organization for Future Years

Once you’ve gathered your current tax documents, consider how you can organize them for future tax seasons:

- Create a ‘Taxes’ folder on your computer or in the cloud with sub-folders for each year.

- Scan paper documents and upload them to these folders, reducing clutter and ensuring they’re easily accessible.

- Use naming conventions like “Year_DocumentType_Description” for clarity.

Summary of Key Points

Finding your tax documents involves understanding the different types of documents you’ll need, knowing where to find them, and maintaining good records for future tax filings. Here are the key points to remember:

- Ensure you understand what documents you need for tax filing.

- Look for W-2s, 1099s, and personal records in various places like emails, mail, and online accounts.

- Organize documents digitally for future years to streamline your tax preparation process.

How long should I keep my tax documents?

+

It is recommended to keep tax documents for at least three years after filing your return, or seven years if you underreport your income by 25% or more. Retain records for longer if you claimed deductions that could potentially be audited.

What should I do if I can’t find a tax document?

+

If you’re missing a document, contact the issuer (like your employer for W-2 or financial institutions for 1099 forms). You can also request a transcript from the IRS if necessary, which provides the data reported to the IRS by your employer or financial institution.

Can I file my taxes without all my documents?

+

While it’s not recommended, you can file an extension with Form 4868 to give yourself more time. Remember, you’ll still need to estimate your tax liability as accurately as possible. If you get additional information, you can file an amended return.