7 Essential Documents to Keep: Simplify Your Paperwork

In today's digital age, managing paperwork can still feel overwhelming. Despite the transition to paperless offices, there are still certain documents that every individual should keep, either in physical form or securely backed up digitally. Here, we'll outline seven essential documents to keep, which will help you simplify your personal and financial life, ensure compliance with legal obligations, and safeguard against unforeseen circumstances.

Why Keeping Essential Documents is Important

Before diving into the list, understanding why these documents are crucial can provide you with motivation:

- Legal Compliance: Some documents are required by law to be kept for a certain period, or they might be needed for legal proceedings.

- Financial Proof: They serve as evidence for your financial dealings, making processes like tax filing, loan applications, or insurance claims smoother.

- Peace of Mind: Having these documents at hand can reduce stress in emergencies or during life transitions like moving, job changes, or estate planning.

1. Birth Certificate

Your birth certificate is perhaps the most fundamental document you’ll ever have:

- It’s your first proof of identity, required for getting your driver’s license, social security number, passport, and other forms of ID.

- Keep the original safe, but consider having a notarized copy for everyday uses.

2. Social Security Card

Your Social Security card is critical for:

- Employment eligibility verification.

- Accessing government benefits, including retirement benefits.

- Opening bank accounts or applying for loans and credit.

- Protect it carefully due to the risk of identity theft.

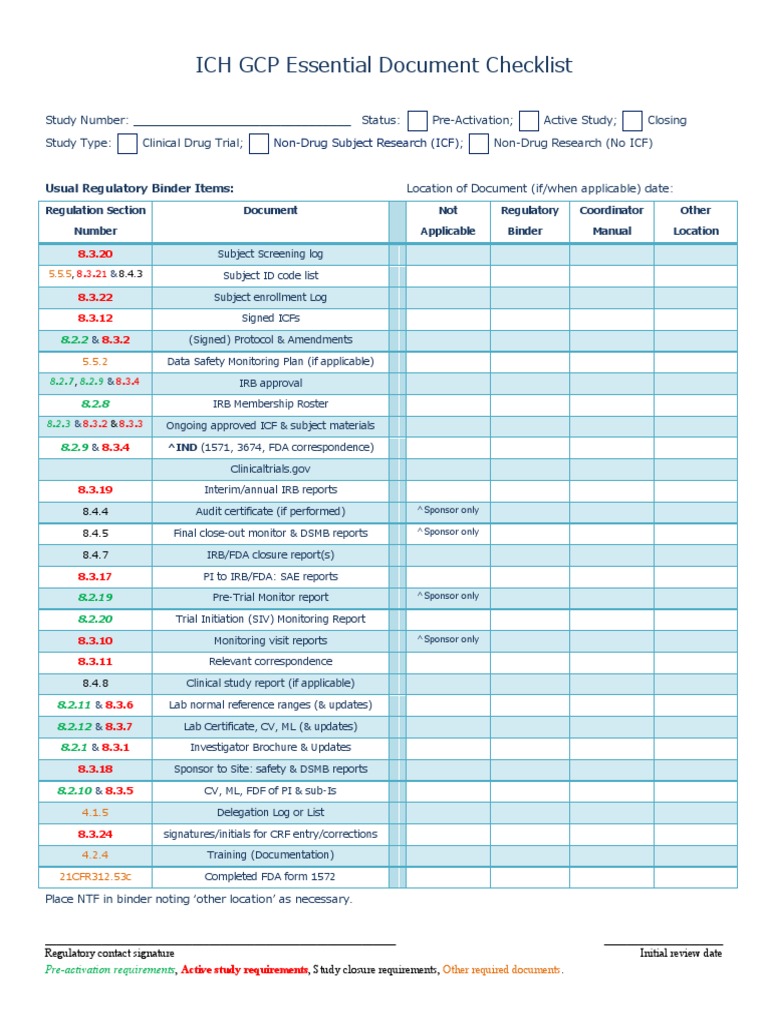

3. Health Insurance Documents

Healthcare-related paperwork is vital:

- Keep insurance cards, policy documents, and records of medical history handy.

- This includes your insurance policy, EOBs (Explanation of Benefits), and medical bills for tax purposes.

4. Tax Returns

Maintaining records of your tax returns is not just about compliance:

- The IRS generally requires you to keep tax records for at least three years, but sometimes up to seven years.

- Tax returns can be crucial for mortgage applications, audits, or if you need to prove your income for any reason.

📝 Note: The period for keeping tax records can differ depending on the country's regulations, ensure to verify with local laws.

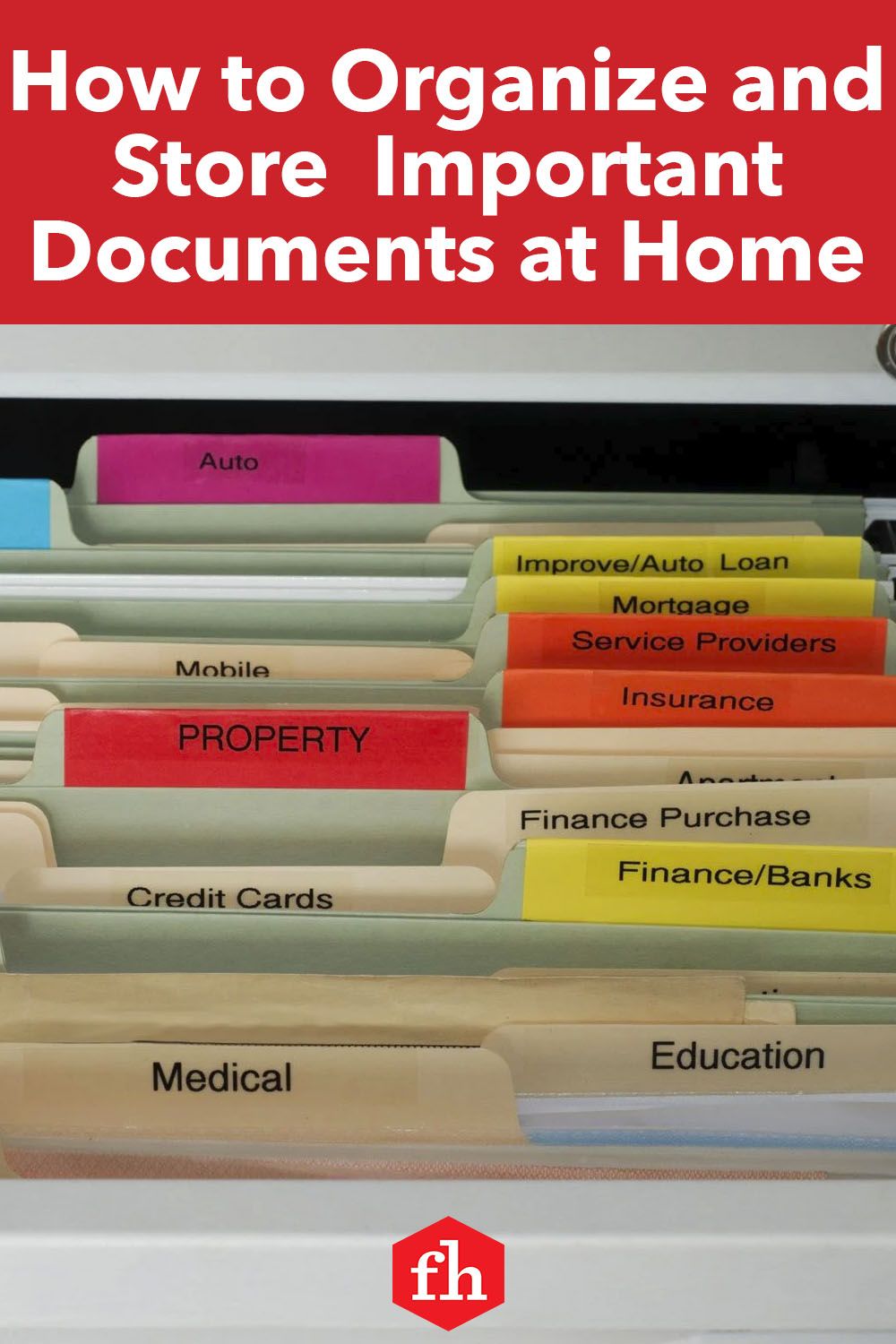

5. Property Deeds and Ownership Records

Whether you own real estate, a car, or other valuable assets:

- Deeds, titles, or registration papers need to be kept securely. They serve as proof of ownership.

- Homeowners should also keep records of mortgage documents, home improvement receipts, and property tax payments.

6. Will, Trust, and Estate Planning Documents

Estate planning is about more than just deciding who gets what after your passing:

- A will ensures your wishes are respected concerning your assets, guardianship for minors, and other personal matters.

- Trusts can help manage your assets for tax purposes, privacy, or if you want to bypass probate.

- Including powers of attorney, healthcare directives, and beneficiary designations helps provide clear instructions in case of incapacitation or death.

7. Financial Statements and Account Information

Having a good grip on your finances is fundamental:

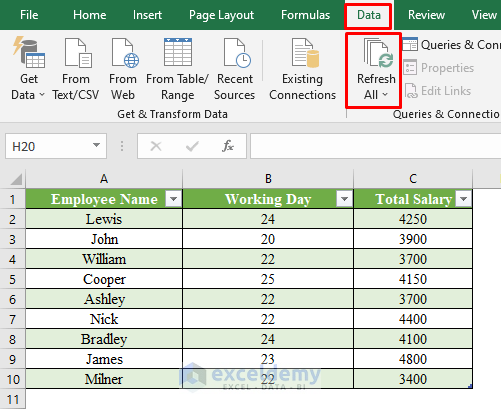

- Regularly keep records of bank statements, investment account statements, and loan agreements.

- It’s helpful for budgeting, credit monitoring, and dealing with any financial disputes.

Here's a simple table to give an overview of these documents and their purposes:

| Document | Purpose |

|---|---|

| Birth Certificate | Identity Verification, Citizenship |

| Social Security Card | Employment, Government Benefits |

| Health Insurance Documents | Healthcare Access, Claiming Benefits |

| Tax Returns | Compliance, Proof of Income |

| Property Deeds | Ownership, Legal Records |

| Will, Trust, Estate Planning | Asset Distribution, Legal Guidance |

| Financial Statements | Financial Tracking, Dispute Resolution |

Remember, the information provided here is general. For personalized advice, consulting with a legal or financial advisor can be beneficial, especially when dealing with sensitive documents or intricate estate planning.

How long should I keep my tax returns?

+

Generally, the IRS requires you to keep tax returns for three years, but there are exceptions where seven years might be necessary. Always verify with your local tax authority or a tax professional for precise guidelines.

Can I digitize all these documents?

+

Yes, you can digitize many of these documents, especially for backup purposes. However, some, like original birth certificates or property deeds, might need to remain in original form for legal reasons.

What should I do if I lose an essential document?

+

Depending on the document, you’ll need to take steps like contacting the issuing authority, placing a fraud alert, or going through a replacement process. Some documents can be replaced quite easily, while others might require additional effort.