5 Essential Documents for Hiring 1099 Contractors

In the realm of business, engaging 1099 contractors has become a popular way to bring in specialized skills without the long-term commitment of full-time hires. Whether you're running a small startup or managing a large corporation, it's crucial to ensure that all your contractor engagements are properly documented. This not only helps in maintaining clear communication but also ensures compliance with legal and tax obligations. Here are the five essential documents you should always have when hiring 1099 contractors:

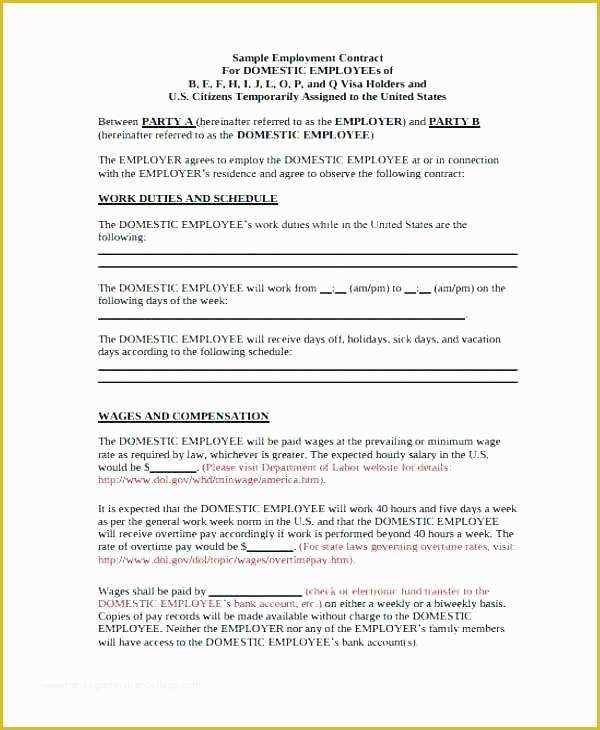

1. Independent Contractor Agreement

The cornerstone of any contractor relationship is the Independent Contractor Agreement. This document outlines the scope of work, payment terms, confidentiality clauses, and other legalities that define the relationship between you and the contractor.

- Scope of Work: Clearly define what services the contractor will provide.

- Payment Terms: Detail how and when the contractor will be compensated.

- Confidentiality and Non-Disclosure: Include clauses to protect your business's sensitive information.

- Termination: Specify conditions under which the contract can be terminated by either party.

- Dispute Resolution: Outline methods for resolving conflicts that might arise.

⚠️ Note: Make sure that the contract is explicit enough to avoid any misclassification issues. It should clearly indicate the contractor's independent status to prevent any IRS scrutiny.

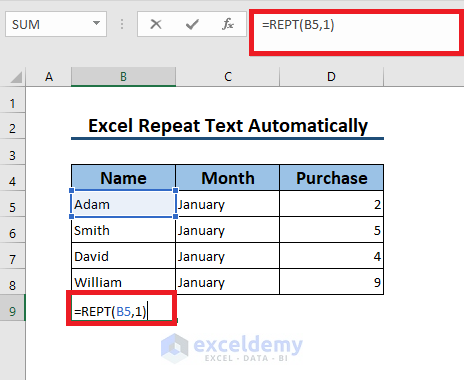

2. W-9 Form

The W-9 form, officially known as "Request for Taxpayer Identification Number and Certification," is a document provided by the IRS. It's essential for businesses to collect tax-related information from independent contractors:

- Legal Name: The contractor's name as it appears on their tax return.

- Taxpayer Identification Number (TIN): Either an Employer Identification Number (EIN) or Social Security Number (SSN).

- Address: Where the contractor can be officially contacted.

This form is vital for issuing 1099-MISC forms at the end of the fiscal year.

3. Work for Hire Agreement

A Work for Hire Agreement can be particularly important for projects involving creative works where intellectual property rights are a concern. This document ensures that the work produced by the contractor is owned by your company:

- Ownership: Clearly state that your company will own all intellectual property rights related to the contractor's work.

- Usage Rights: Detail how the work can be used, modified, and distributed.

- Sign-off: Include provisions for final approval of the work to ensure it meets your expectations.

Without this agreement, you might face issues regarding ownership and control over the deliverables.

4. Non-Disclosure Agreement (NDA)

An NDA is indispensable when contractors might be exposed to confidential information:

- Confidential Information: Define what constitutes confidential information.

- Duration: Specify the time frame for which the information must remain confidential.

- Exclusions: Clarify what does not fall under confidentiality, like publicly known information or information independently developed by the contractor.

Having an NDA in place protects your business from potential leaks or misuse of sensitive data.

5. Liability Insurance Proof

Requesting proof of liability insurance, particularly for contractors involved in work that could potentially lead to damages or injury, is prudent:

- Certificate of Insurance: Obtain a document proving the contractor has the necessary coverage.

- Coverage Limits: Check that the coverage limits are adequate for the type of work being performed.

This step can mitigate risks and protect your company in case of contractor-related accidents or incidents.

🔎 Note: It's essential to review these documents periodically. Changes in work scope, contractor roles, or business operations might necessitate updates or amendments to these agreements.

In conclusion, managing 1099 contractors involves a careful balance of legal compliance and business relationship management. These five documents are not just administrative formalities; they are the backbone of a secure and well-structured contractor relationship. By ensuring these documents are in place, you establish clear expectations, protect your business interests, and foster a professional environment conducive to successful project outcomes.

What is the difference between a W-2 employee and a 1099 contractor?

+

A W-2 employee has taxes withheld from their earnings by the employer, receives benefits like health insurance, and has a more permanent relationship with the company. Conversely, a 1099 contractor is responsible for their own taxes, often pays self-employment tax, does not receive traditional employee benefits, and usually works on a project-to-project basis.

Can I just give a 1099 contractor a W-9 form and not bother with other documents?

+

No, a W-9 form alone is not sufficient. It’s used for tax purposes but does not define the relationship, protect your intellectual property, or ensure confidentiality. Other documents like an Independent Contractor Agreement and possibly an NDA are crucial for a well-rounded legal framework.

What happens if I misclassify an employee as a contractor?

+

Misclassification can lead to significant legal and financial penalties. It could result in back taxes, fines, benefits liabilities, and potential lawsuits. Proper documentation and adherence to IRS guidelines are essential to avoid these issues.

How often should I update the Independent Contractor Agreement?

+

It’s advisable to review and possibly update the agreement annually or whenever there are significant changes in the project scope, laws, or business practices. This helps in keeping the agreement current and reflective of your business needs.

Is it necessary to have an attorney draft these documents?

+

While templates exist, having an attorney review or draft these documents ensures they are legally sound and tailored to your specific needs, reducing potential risks and misunderstandings. This investment can save you from costly legal issues down the line.