Paperwork After Spouse's Death: Your Essential Guide

Navigating the emotional storm of losing a spouse is challenging enough without the added burden of sorting through legal documents and administrative tasks. This guide will walk you through the essential paperwork and procedures you need to manage after the death of your spouse, ensuring you cover all necessary bases with compassion and precision.

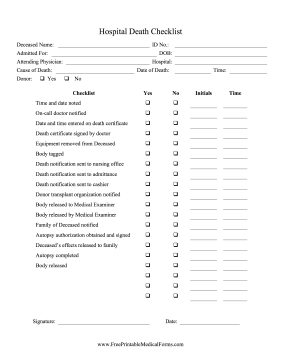

Immediate Actions After Death

- Obtain Death Certificate: The funeral home usually handles this, but you’ll need multiple copies for various administrative purposes.

- Notify Social Security Administration: If your spouse was receiving Social Security benefits, notify them as soon as possible to prevent overpayment issues.

- Inform Insurance Companies: This includes life insurance, car insurance, and home insurance. Make sure to collect all policy documents.

Financial and Legal Affairs

The following steps involve managing financial assets and legal documents:

- Locate the Will: Find your spouse’s will. This document guides how their assets should be distributed.

- Contact an Attorney: If your spouse’s estate is complex, involving significant assets or if there are any disputes, consulting with a probate attorney can be beneficial.

- Update Joint Accounts: Here’s what you need to do:

- Close or update joint bank accounts.

- Change ownership or move assets if necessary.

- Investment Accounts: Update beneficiaries on retirement accounts like IRAs, 401(k)s, or any mutual funds.

Government and Social Services

- Pensions and Government Benefits: Reach out to any employer where your spouse worked to handle pension benefits. Also, update with relevant government agencies regarding survivor benefits or changes in benefits status.

- Change of Address: If you’re moving or changing your address, do this promptly to avoid losing critical mail.

- Vehicle Titles: Update ownership on vehicle titles if they were in your spouse’s name.

Personal Items and Insurance

Personal belongings and insurance policies require your attention as well:

- Collect Insurance Policies: Gather all life insurance, health insurance, and any other personal insurance policies.

- Assess Valuable Items: Determine what to do with valuable items like jewelry, art, or collectibles.

- Notify Credit Reporting Agencies: This helps prevent fraud and identity theft post-death.

🔑 Note: Handling your spouse's personal effects can be emotionally challenging. Consider taking breaks and seeking support from friends or family.

Miscellaneous Legal and Administrative Tasks

Here are additional administrative tasks that need attention:

- Marriage Certificate: Keep your marriage certificate handy as proof of spousal relationship when needed.

- Employer Notification: Inform your spouse’s employer for any benefits or payroll adjustments.

- Library Cards and Memberships: Cancel or transfer memberships and subscriptions that were in your spouse’s name.

- Power of Attorney: If your spouse had a power of attorney document, consult with the attorney involved to understand any implications or next steps.

| Task | Description |

|---|---|

| Will | Locate and have this document on hand for legal proceedings. |

| Attorney Consultation | Seek legal advice for estate handling or disputes. |

| Social Security | Inform SSA to manage benefits and prevent overpayments. |

| Insurance Policies | Collect and review to claim benefits or update ownership. |

| Vehicle Titles | Change titles to reflect your ownership or other beneficiaries. |

⚠️ Note: When dealing with paperwork, ensure every step is done thoughtfully. This period is challenging, so don't rush your decisions.

After completing these tasks, the sense of closure can be comforting. Each step you take helps in wrapping up your spouse's affairs in a manner that respects their memory and legacy. Moving forward, you'll find solace in knowing that all administrative duties have been handled, allowing you to focus on healing and remembrance.

What documents are most important immediately after a spouse’s death?

+

Key documents include the death certificate, marriage certificate, and your spouse’s will or trust agreements. Also, gather insurance policies, recent tax returns, and important contact information for financial advisors, attorneys, and insurance providers.

How long do I have to claim life insurance after the death of my spouse?

+

Insurance companies typically give beneficiaries 90 days to two years to make a claim, though it varies by policy. Prompt notification and documentation submission are advisable to avoid any delays or complications.

Can I continue my deceased spouse’s health insurance?

+

If your spouse’s employer provided health insurance, you might be eligible for continuation under COBRA or similar legislation, allowing you to maintain coverage for up to 36 months, though you’ll need to pay the full premium.