Essential Paperwork for Selling Your Business: A Checklist

Introduction

When you decide to sell your business, having the right paperwork in place is crucial for a smooth and successful transaction. Whether you’re a seasoned entrepreneur or this is your first venture into the world of business sales, understanding what documents are needed can streamline the process, ensure legal compliance, and build trust with potential buyers. This article provides a comprehensive checklist of the essential documents you need to prepare when selling your business.

Key Documents for Selling Your Business

Here’s a detailed list of documents that will help you navigate the sale of your business:

Business Overview and Financial Records

- Company Registration and Legal Structure Documents: Provide proof of incorporation or business registration. This includes your articles of incorporation, partnership agreements, or any documents detailing the legal structure of your business.

- Financial Statements: Include at least the last three to five years of financials, which should encompass:

- Income Statements

- Balance Sheets

- Cash Flow Statements

- Tax Returns: The last three years of tax returns can give buyers insight into your business’s tax health and compliance.

Operational Documents

- Asset Inventory: A detailed list of all physical and intellectual assets owned by the business, including equipment, vehicles, inventory, patents, trademarks, and software.

- Contracts and Agreements: This includes:

- Lease Agreements (for property or equipment)

- Client and Supplier Contracts

- Employee Contracts

- Non-Disclosure Agreements (NDAs)

- Service or Product Agreements

- Licenses, Permits, and Certifications: Any operational license or permit that your business holds, such as zoning permits, health permits, or professional certifications.

Legal and Compliance Documents

- Shareholder Agreements: If applicable, provide any agreements that outline the rights and obligations of shareholders.

- Litigation History: Disclosure of any past or ongoing legal disputes, including settlements or judgments.

- Compliance Documents: Evidence of compliance with industry standards, regulations, or any regulatory body oversight.

Employee and Management Information

- Employee Details: A list of employees, including their roles, tenure, compensation details, and benefits.

- Management Structure: An organizational chart outlining the management hierarchy and key personnel.

Marketing and Sales Information

- Marketing Plans and Strategies: Current and past marketing campaigns, performance metrics, and advertising materials.

- Sales Data: Sales history, customer base analysis, and market segmentation information.

Valuation and Appraisal Reports

- Recent Business Valuation: A professional valuation report can substantiate your asking price.

- Property Appraisal: If your business owns real estate, an updated appraisal should be included.

⚠️ Note: Ensure all documents are current, properly organized, and legally compliant. Incomplete or outdated documentation can delay or jeopardize the sale.

Finalizing the Sale

Once you’ve compiled these documents:

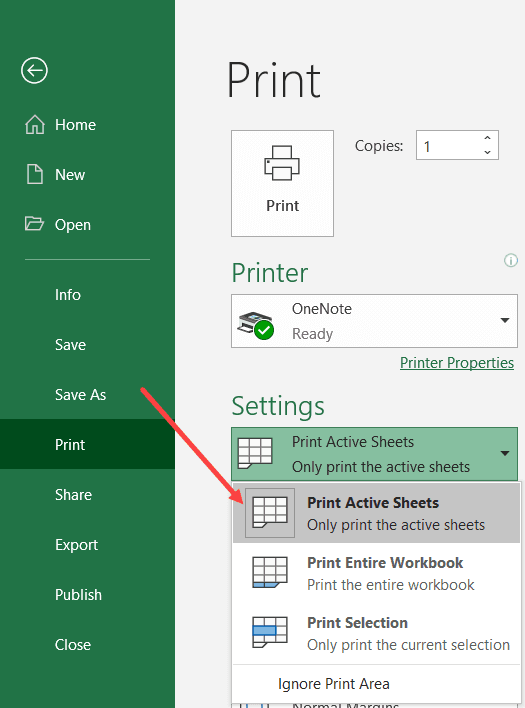

- Organize them into a well-structured data room for potential buyers.

- Securely share documents with interested parties through a Virtual Data Room (VDR).

- Work with legal and financial advisors to review and finalize agreements.

Post-Sale Considerations

After the sale, certain documents will still be relevant:

- Bill of Sale: This formalizes the transfer of ownership.

- Non-Compete Agreements: These can protect the buyer by limiting your involvement in similar businesses post-sale.

- Transition Plan: A detailed document outlining how the new owner will take over operations.

📝 Note: A well-documented handover can ensure a smooth transition and avoid future disputes.

By meticulously preparing these documents, you set the stage for an efficient sale process, instilling confidence in buyers about the integrity and viability of your business. The effort put into organizing these records not only helps in due diligence but also aids in negotiations, potentially increasing the value of your business in the eyes of investors.

What happens if I don’t have some of the documents?

+

If you lack certain documents, you might need to obtain or recreate them, or disclose their absence during negotiations, which could impact the sale process or terms.

Can I sell my business without financial records?

+

It’s highly unlikely as buyers will need to assess the financial health of the business. You might consider providing estimated financials or secure an accountant’s help to compile them.

Should I get legal advice before selling my business?

+Yes, legal advice is crucial to ensure all documents are prepared correctly, potential liabilities are disclosed, and your interests are protected during the sale.

How long does the due diligence process usually take?

+Due diligence can vary from a few weeks to several months, depending on the complexity of the business, the readiness of the documents, and the thoroughness of the buyer’s review.

What if there are unresolved legal issues?

+Unresolved legal issues must be disclosed, and how they impact the sale will depend on their nature and potential risk to the buyer. Legal advice is essential in these scenarios.