Essential Paperwork Checklist for Starting Your Business

Introduction

Starting a business is an exciting venture, but it’s also one where preparation is key. To ensure your business takes off on the right foot, it’s crucial to have all your legal and administrative paperwork in order. This comprehensive guide will walk you through the essential documents you need to get your new enterprise up and running smoothly.

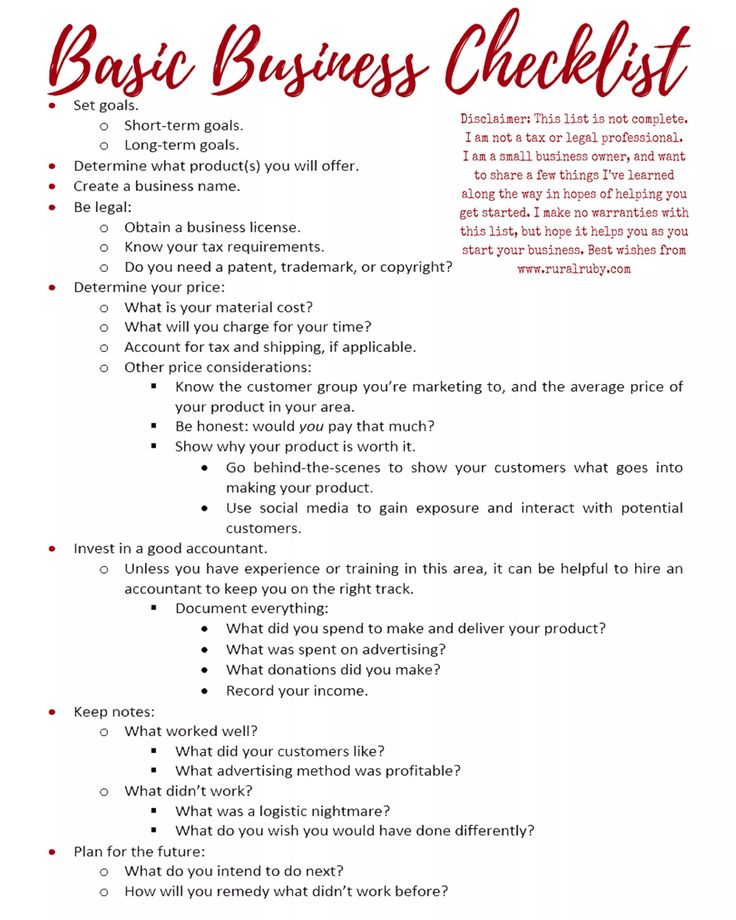

Choosing Your Business Structure

Before you dive into paperwork, decide on the structure of your business:

- Sole Proprietorship: Simplest and least regulated structure.

- Partnership: For businesses with multiple owners.

- Corporation (Inc. or Corp.): More formal with greater protection for owners.

- Limited Liability Company (LLC): Combines pass-through taxation of a partnership with the liability protection of a corporation.

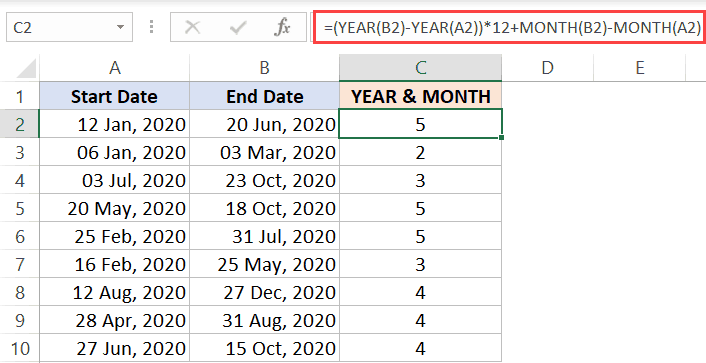

Documentation for Business Structure

Here’s what you’ll need:

| Business Structure | Documents Required |

|---|---|

| Sole Proprietorship | DBA (Doing Business As) filing if using a fictitious name |

| Partnership | Partnership Agreement |

| Corporation | Articles of Incorporation, Corporate Bylaws, Organizational Minutes |

| LLC | Articles of Organization, Operating Agreement |

💡 Note: Each state might have variations in requirements; always check with your state's Secretary of State for exact documents needed.

Obtaining Licenses and Permits

Operating legally means obtaining the necessary licenses and permits:

- General Business License: Needed by most local governments.

- Professional or Occupational License: Specific to your industry (e.g., medical, legal, engineering).

- Federal and State Permits: For certain activities like selling alcohol or handling hazardous materials.

Financial and Tax Paperwork

Business Tax ID Numbers

You’ll need to apply for:

- Federal Employer Identification Number (EIN): For tax purposes, from the IRS.

- State Tax Registration: If you’re selling taxable goods or services.

Bank Accounts and Financial Setup

To open business bank accounts, you’ll typically need:

- Business Incorporation or Registration Documents

- Employer Identification Number (EIN)

- Passport, Driver’s License, or other Photo ID of owners or authorized signatories

📌 Note: Keeping personal and business finances separate is crucial for tax purposes and business credibility.

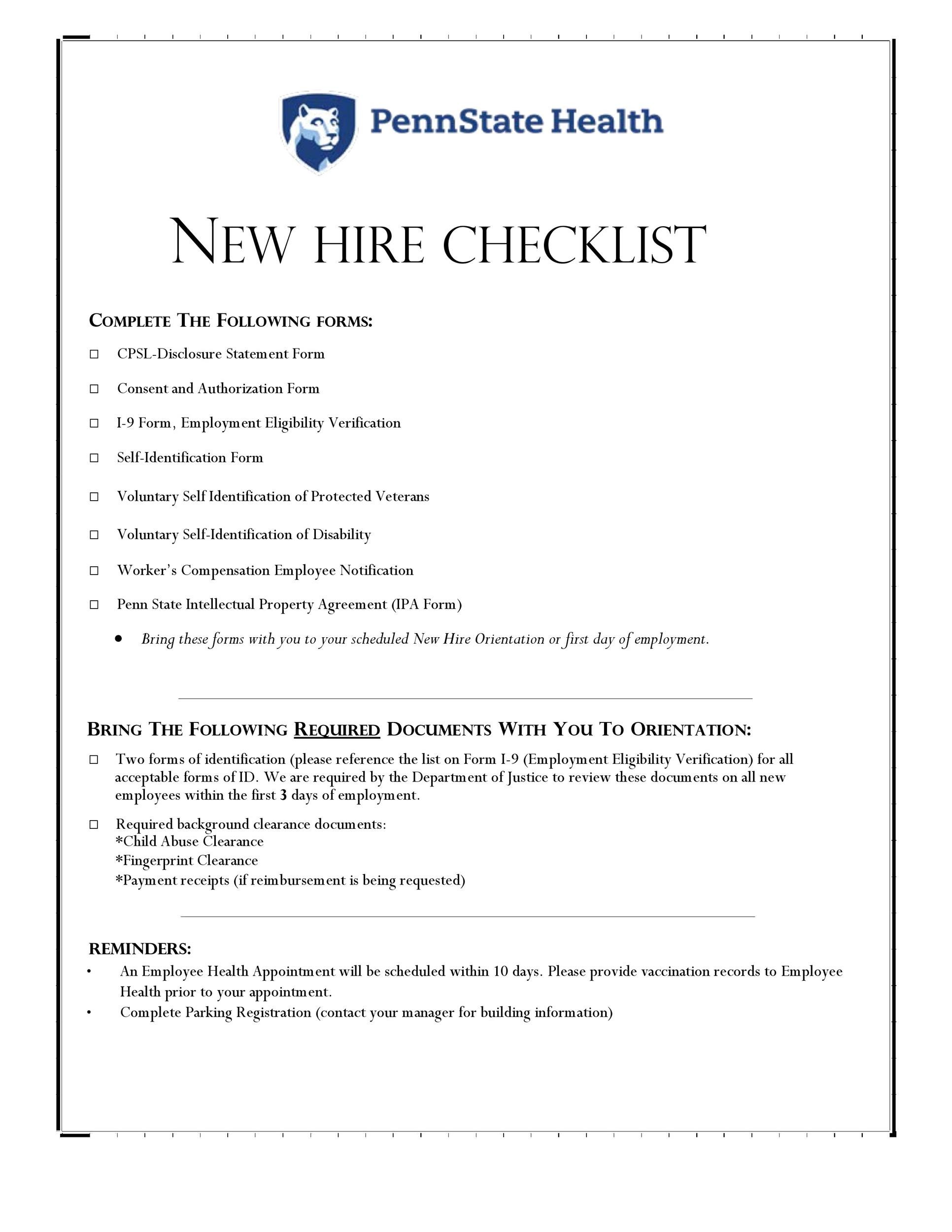

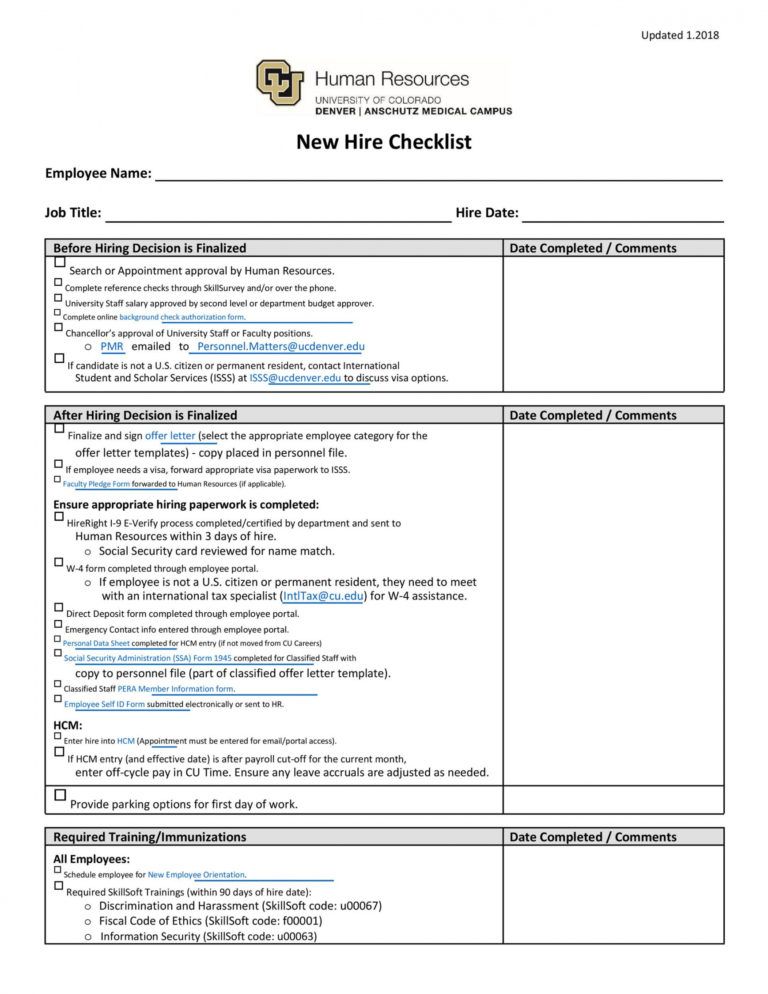

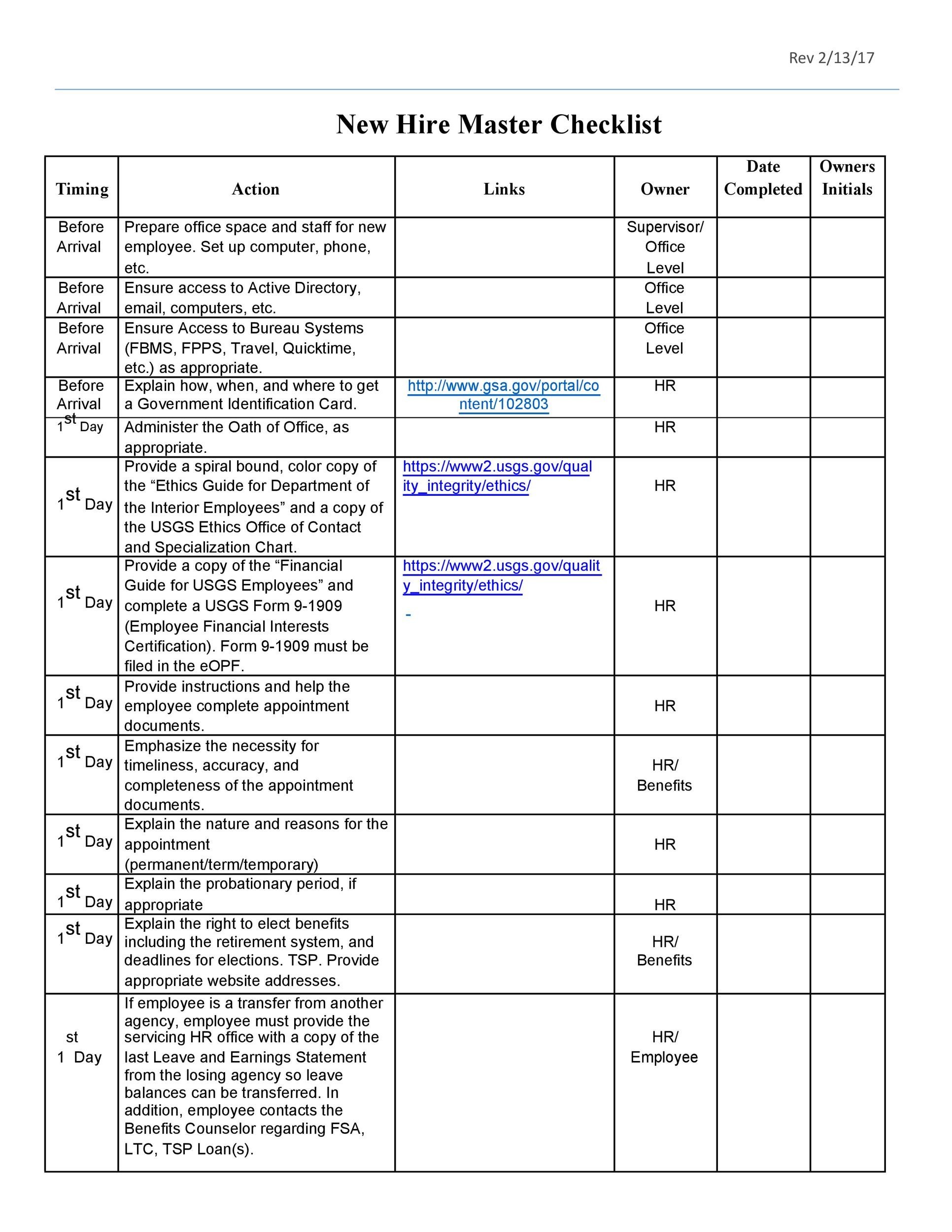

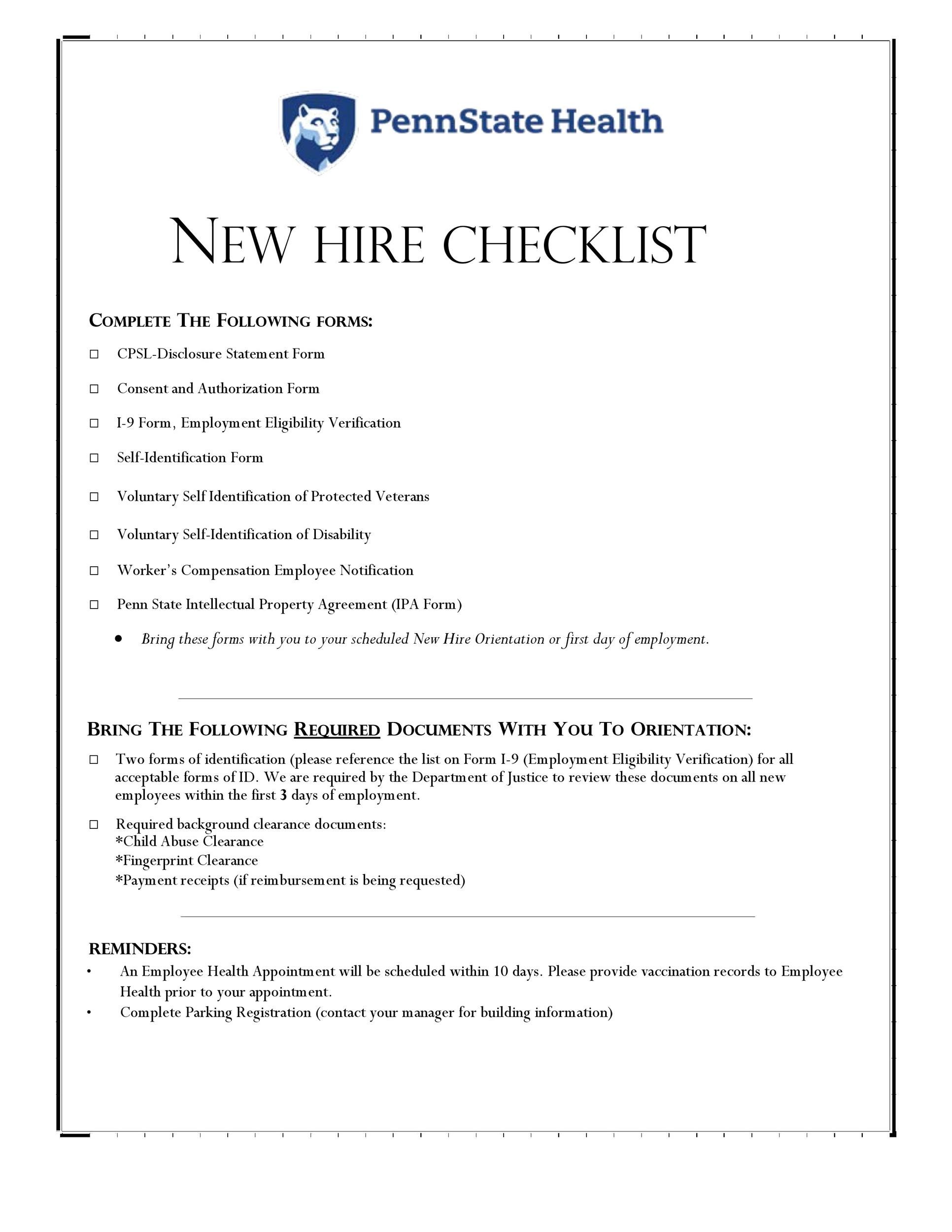

Compliance with Employment Laws

Employment-related Documents

- Form I-9: Verification of employment eligibility for employees.

- W-4 Form: For withholding taxes.

- Labor Law Posters: Display required federal and state labor posters.

- Employee Handbook: Detail company policies, procedures, and work expectations.

Insurance and Protection

- General Liability Insurance: To protect against claims of bodily injury or property damage.

- Workers’ Compensation Insurance: Mandatory in most states to cover work-related injuries.

- Health and Disability Insurance: Optional, but highly recommended for employee satisfaction.

⚠️ Note: Insurance policies should be reviewed annually or when business operations change significantly.

Legal Agreements and Contracts

Documenting relationships and obligations with contracts:

- Leases: For office space, equipment, or other long-term commitments.

- Vendor Agreements: To formalize supply relationships.

- Client Contracts: Define scope of work, payment terms, and confidentiality.

- Non-disclosure Agreements (NDAs): To protect proprietary information.

- Partnership Agreement: If not already covered by the business structure.

In summary, setting up your business requires careful preparation of several documents to ensure compliance, protect your interests, and lay a solid foundation for growth. By methodically working through this checklist, you’ll be well-prepared to navigate the legal landscape of entrepreneurship. Remember, legal requirements can vary by location, so always check local regulations or consult with a business attorney to ensure all bases are covered.

What documents are essential for starting a business?

+

Essential documents include articles of incorporation/organization, business licenses, tax registration, and various insurance policies. Depending on your business type, additional agreements and contracts are also necessary.

Do I need a business license to operate in any industry?

+

Most businesses require some form of a general business license, but specific professional or occupational licenses might be needed for certain industries like healthcare, law, or engineering.

How do I decide which business structure is best for me?

+

This decision often depends on several factors including liability protection, taxation, ownership structure, and future growth plans. Consulting with a business attorney or CPA can provide personalized advice.