Essential New Hire Paperwork Guide for Employers

In the dynamic world of business, hiring new employees is a vital step that ensures the growth and success of any organization. Yet, one of the critical aspects often overlooked in the hiring process is the correct handling of new hire paperwork. This guide aims to provide employers with an in-depth understanding of the essential documents required, the processes involved, and the compliance aspects when onboarding new team members. We'll delve into the documents necessary for seamless integration of new hires into your organization, ensuring you remain compliant with labor laws and regulations.

Understanding New Hire Paperwork

New hire paperwork is not just about formalities; it’s about establishing a legally compliant relationship with your employee from day one. Here are the key documents you'll need:

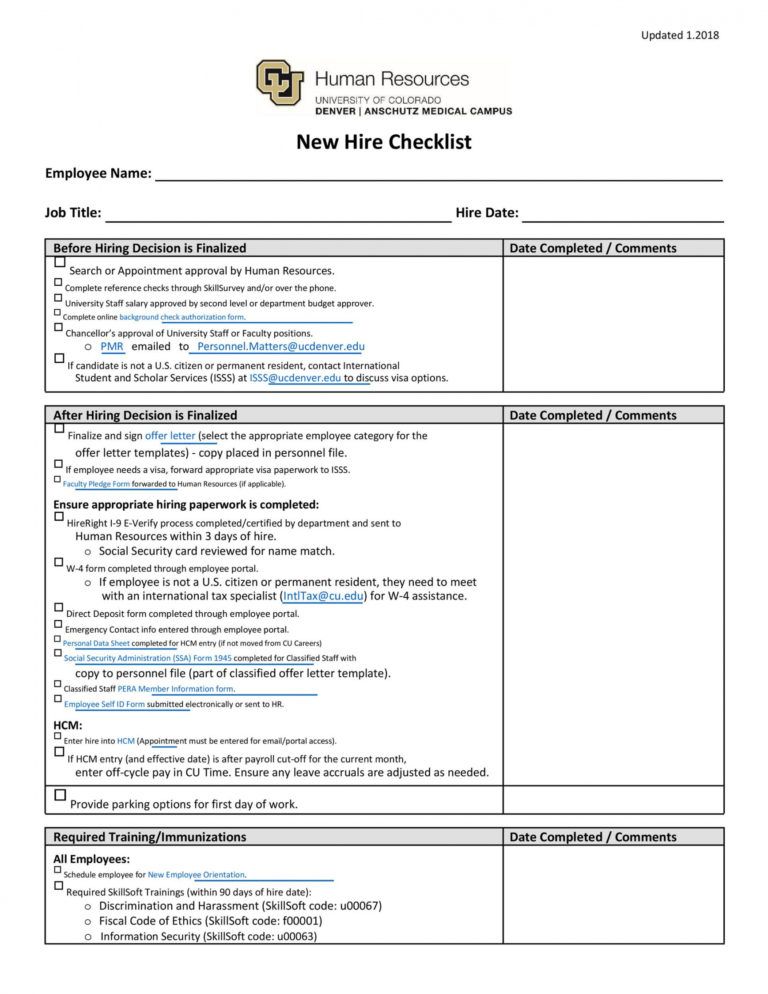

- Offer Letter: A written promise of employment to the candidate, detailing salary, job position, and conditions of employment.

- W-4 Form: For US employees, this form helps to determine the correct amount of federal income tax to withhold from their wages.

- I-9 Form: Required to verify the identity and employment authorization of new hires in the United States.

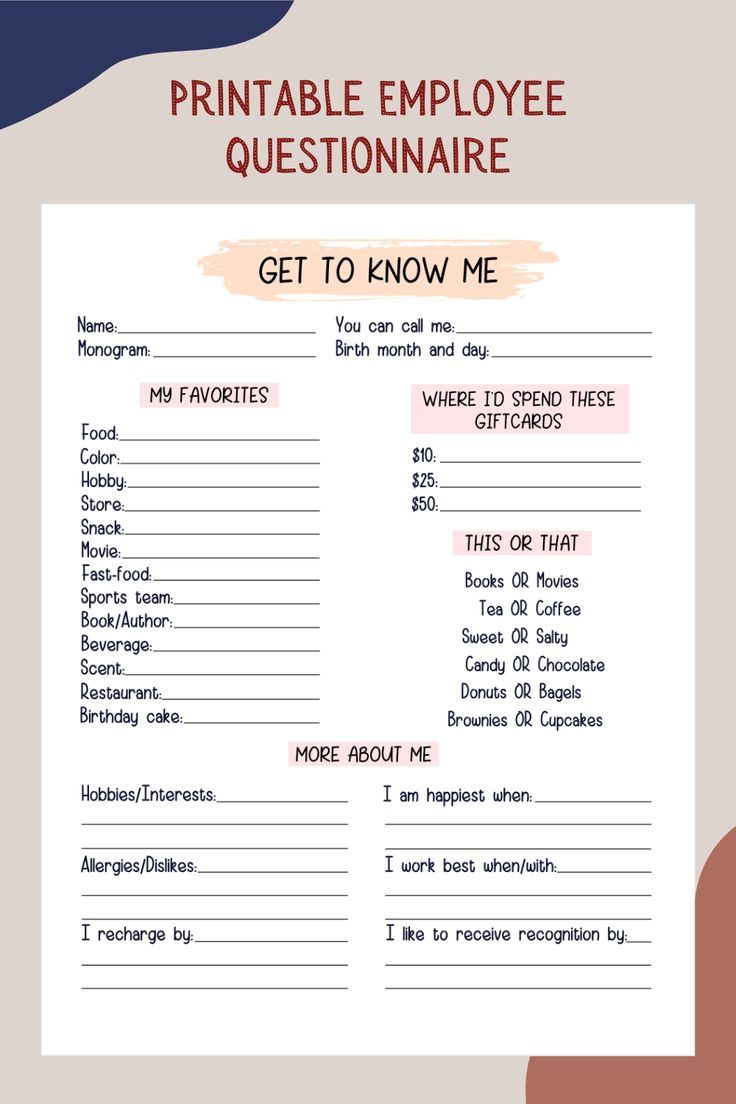

- Employee Details Form: This form captures basic information like contact details, emergency contacts, and tax filing status.

- Confidentiality Agreements: To protect your company's sensitive information and proprietary data.

- Direct Deposit Authorization: For automatic payroll deposits.

- Employee Handbook Acknowledgement: To confirm that the new hire has received and read the company's policies.

- Benefit Enrollment Forms: For healthcare, retirement plans, and other benefits your company offers.

Completing the Paperwork: A Step-by-Step Guide

1. Offer Letter

Prepare an offer letter which outlines the terms of employment including start date, salary, benefits, and job title. Make sure it’s signed by both parties.

2. W-4 Form

Have the new hire complete the W-4 form to avoid any issues with tax withholdings. Ensure it’s filled out correctly to prevent underpayment or overpayment of taxes.

3. I-9 Form

The I-9 form must be completed within three business days of hire. This form verifies the employee’s identity and right to work in the US. You must:

- Ensure all sections are filled out by the employee and employer.

- Verify the employee’s documents to confirm their eligibility to work in the US.

- Keep the form for three years after the hire date or one year after termination, whichever is later.

4. Employee Details Form

Collect personal information for payroll and record-keeping purposes. This includes:

- Full name, social security number, address, and contact information.

- Emergency contacts and dependents.

- Tax filing status (for W-4 form purposes).

5. Confidentiality Agreements

New hires should sign confidentiality agreements to protect company secrets. Explain the terms and get their signatures.

📜 Note: Ensure that confidentiality agreements are clearly written and understood by the employee to avoid any future disputes.

6. Direct Deposit Authorization

Setup direct deposit for smoother payroll processing. Provide the employee with your bank details and have them sign the authorization form.

7. Employee Handbook Acknowledgement

Hand over the company handbook and get a signed acknowledgment from the employee that they have received, read, and understood it.

8. Benefit Enrollment Forms

Guide new hires through the process of enrolling in benefits like health insurance or retirement plans. Provide them with deadlines and necessary forms.

Best Practices for Managing New Hire Paperwork

Here are some key tips to ensure your onboarding process is efficient and compliant:

- Keep Records Organized: Maintain both physical and digital copies of all paperwork for easy access and to meet legal requirements.

- Stay Updated: Labor laws and regulations change; keep your forms and processes updated to comply with current standards.

- Training HR Staff: Ensure HR personnel are well-trained to handle all aspects of new hire documentation.

- Use Electronic Systems: Consider using HR software to automate and streamline the onboarding process, reducing errors and time.

- Clear Communication: Explain the importance of each form to new hires, ensuring they understand the implications of signing them.

- Privacy: Handle personal information with care to comply with privacy laws like HIPAA or GDPR.

The Importance of Compliance

Non-compliance with labor laws can result in severe penalties, including fines and legal action. Here’s why maintaining proper paperwork is crucial:

- Legal Protection: Provides evidence of a legitimate employment relationship, protecting both the employer and employee.

- Audit Readiness: Ensures your organization is always prepared for potential audits by labor departments or tax authorities.

- Compliance with Tax Laws: Proper documentation ensures accurate tax withholdings and reporting.

By ensuring all new hire paperwork is correctly handled, you not only avoid potential legal issues but also set the stage for a transparent, trusting, and compliant work environment.

Wrapping up, the process of managing new hire paperwork is an essential aspect of the hiring process. From the offer letter to the benefit enrollment forms, each document plays a critical role in establishing the employment relationship legally and efficiently. By following the outlined steps and best practices, employers can ensure compliance, protect their company's interests, and provide a positive onboarding experience for new employees. Remember, while paperwork might seem mundane, it forms the backbone of a well-structured and compliant organization.

What is the I-9 form used for?

+

The I-9 form is used to verify the identity and employment authorization of individuals hired for employment in the United States.

How long do employers need to keep I-9 forms?

+

Employers must retain I-9 forms for three years after the date of hire or one year after the date employment ends, whichever is later.

What happens if an employee does not complete their W-4 form?

+If an employee does not complete their W-4 form, the employer must withhold tax at the highest rate for single filers with no allowances, potentially leading to overpayment of taxes.