Essential Paperwork Guide for New Employees

Understanding Your New Hire Paperwork

Embarking on a new job can be an exhilarating journey, brimming with anticipation and opportunities for personal and professional growth. However, amidst the excitement, the administrative side of your employment – the paperwork – is critical to secure your position legally and ensure you receive the benefits and rights you’re entitled to. This comprehensive guide will take you through the essential documents that new employees must complete and understand.

Employment Agreement and Offer Letter

The first document you’ll likely encounter is the Employment Agreement or Offer Letter. This is essentially your contract with the employer, outlining the terms of your employment. Here’s what to look for:

- Job Title: Ensure the job role matches what you've agreed upon.

- Start Date: The official day your employment begins.

- Salary: Base salary or wage, overtime pay, bonuses, or commission structures.

- Hours of Work: Expected working hours, any on-call requirements, and shift details if applicable.

- Leave Entitlements: Annual leave, sick leave, and other types of leave such as maternity or paternity.

- Termination Clause: How and under what conditions either party can end the employment.

- Non-compete or Confidentiality Agreements: Any restrictions after leaving the company or protection of company secrets during employment.

🔍 Note: Read this document carefully; it legally binds you to your employer. If something isn't clear or you're unsure, seek clarification from HR or legal counsel.

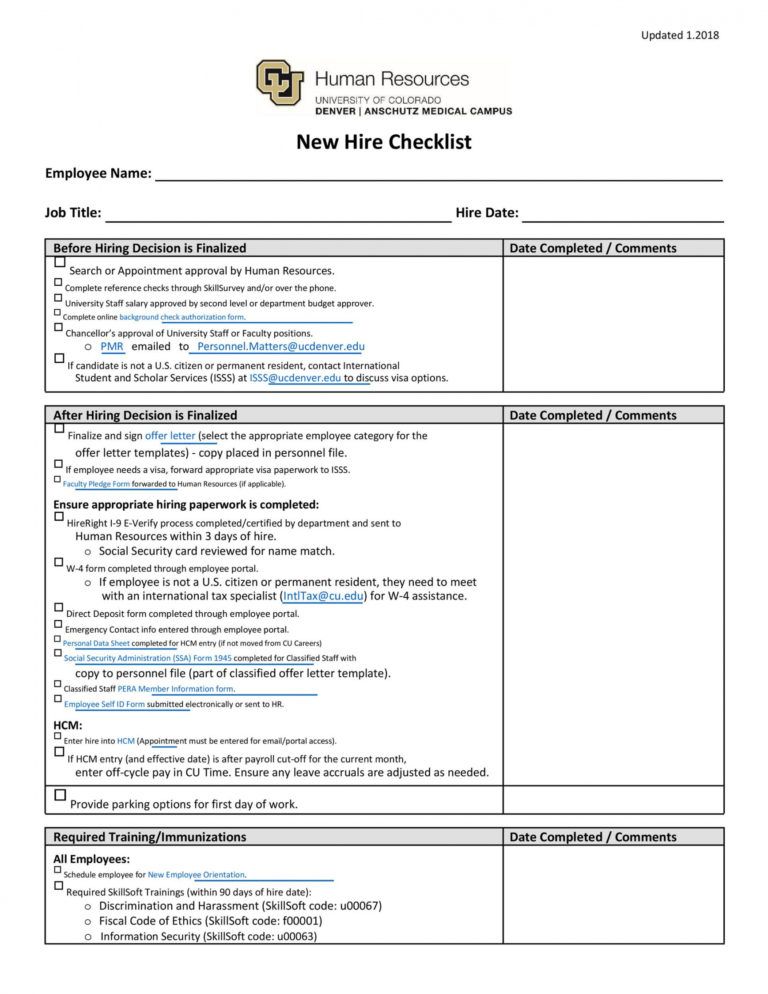

Form I-9: Employment Eligibility Verification

In the United States, every employer must verify the identity and employment authorization of each new hire. You’ll need to fill out Form I-9, which comprises two sections:

- Section 1: Completed by the employee on or before the first day of work. It asks for basic personal information and your attestation of your eligibility to work in the U.S.

- Section 2: Your employer must examine documents proving your identity and authorization to work. Common documents include:

- U.S. Passport

- Driver's License with Social Security Card

- Birth Certificate

- Permanent Resident Card or Alien Registration Receipt Card (Form I-551)

📝 Note: Keep a copy of your I-9 form for personal records, as it contains sensitive information you might need in the future.

W-4 Form: Employee’s Withholding Certificate

Your W-4 form determines how much federal income tax your employer should withhold from your paycheck. Here’s what you need to know:

- Personal Allowances Worksheet: Helps calculate the number of allowances based on your circumstances like marital status, child care, and other dependents.

- Additional Withholding: If you want more tax withheld, you can specify an additional amount per paycheck.

- Exemptions: In some cases, you might qualify for an exemption from withholding, although this is rare and specific to certain scenarios like no tax liability in the previous year.

💰 Note: If you over- or under-withhold, you can adjust your W-4 at any time, but changes will not retroactively change previous withholdings.

State and Local Tax Forms

Depending on where you work, you might also need to fill out state and local tax withholding forms. These can include:

- State Withholding Certificate: Similar to the W-4 but for state income tax.

- Local Tax Forms: Cities like New York or Philadelphia might require their own tax forms for local income taxes.

Benefits Enrollment

Here’s where things get interesting. Many companies provide various employee benefits, and you’ll have forms to enroll in:

| Benefit | Description |

|---|---|

| Health Insurance | Comprehensive medical coverage, including premiums, copayments, and deductibles. |

| Dental and Vision Plans | Optional plans for eye care and dental services. |

| Life and Disability Insurance | Protection in case of serious injury, illness, or death. |

| Retirement Savings Plans | 401(k) or similar plans where you can elect to contribute part of your salary pre-tax. |

| Flexible Spending Accounts | Allow you to set aside pre-tax money for medical or dependent care expenses. |

| Wellness Programs | Optional enrollment in initiatives for fitness, nutrition, or mental health support. |

🌟 Note: Choosing benefits is a personal decision. Consider your family's health needs, financial planning, and company contributions when deciding on your benefits package.

Direct Deposit Authorization

In the digital age, receiving your salary electronically is convenient. You’ll need to provide:

- Your bank account number

- Routing number

- Type of account (checking or savings)

🔐 Note: Be cautious with this form as it involves sensitive banking information. Ensure you're dealing with your HR department or an authorized representative.

In wrapping up this extensive guide to essential paperwork for new employees, it’s clear that understanding and managing your employment documents is not just about legal compliance but about setting yourself up for a successful employment journey. From the clarity of your employment agreement to the precise setup of your benefits, each piece of paperwork is a crucial step towards ensuring your time with the company is seamless and beneficial.

What happens if I don’t complete my paperwork on time?

+

Failing to complete your new hire paperwork can delay your official employment start date, impede your paycheck processing, or prevent you from enrolling in company benefits. Prompt completion is crucial.

Can I make changes to my benefits choices after I’ve enrolled?

+

Yes, many companies have an Open Enrollment period where you can make changes to your benefits selections. Changes outside this period are usually limited to major life events (marriage, childbirth, etc.).

What should I do if I lose my Employment Agreement?

+

Contact your HR department immediately to request a copy. It’s beneficial to have your own records in case of future disputes or for personal reference.