5 Essential Documents You Need to Buy a Car in the UK

Introduction to Car Buying in the UK

Buying a car is an exciting time in anyone’s life, but it also involves navigating through a maze of paperwork and documentation. Ensuring you have all the necessary documents before you make your purchase can save you time, money, and potential legal headaches. This guide will walk you through the 5 essential documents you need to buy a car in the UK, simplifying your journey to vehicle ownership.

1. Proof of Identity

Having Proof of Identity is crucial when you’re buying a car in the UK. Here’s what you’ll need:

- Valid Passport or UK Driving Licence: Either of these documents serves as an official identification that confirms your identity.

- Utility Bill or Bank Statement: These documents must show your current address to prove residency.

ℹ Note: Having digital or electronic copies might not suffice. Originals are often required.

2. Proof of Address

When you’re financing or purchasing a vehicle, the dealership or the finance company will want to verify your address to prevent fraud. Here are the common documents:

- Utility Bill: Gas, electricity, or water bills from the last three months.

- Council Tax Bill: Official tax documents from the local council can serve as proof.

- Bank Statement: Must be less than three months old and display your name and address.

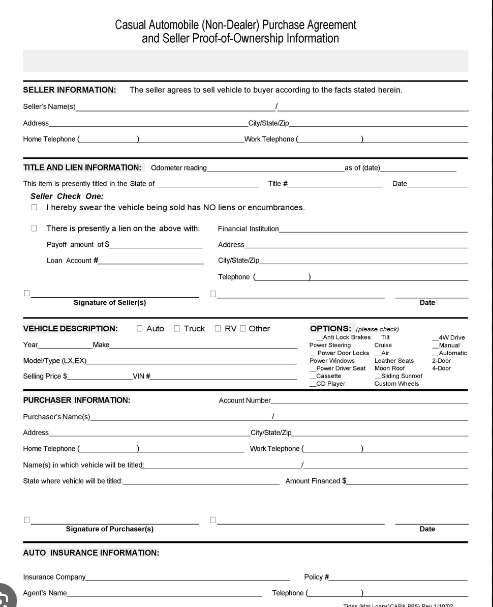

3. Finance Approval Letter (if applicable)

If you’re not buying the car outright, you’ll need to secure Finance Approval. Here’s how you prepare:

- Pre-approval Letter: Obtain this from your bank or an automotive finance provider to show you’re approved for a loan.

- Loan Agreement: If you’ve arranged finance, the loan agreement documents from the lender will detail the terms.

⚠️ Note: Check for any special conditions in your finance agreement that might affect your car purchase.

4. V5C (Vehicle Registration Certificate)

The V5C Certificate is one of the most important documents related to the car itself. Here are the key points:

- Ownership Confirmation: The V5C confirms who owns the vehicle legally.

- Registration Details: It includes vehicle registration number, make, model, VIN, and more.

- Change of Ownership: The V5C is used to notify the DVLA of a new owner when you buy or sell a car.

5. Insurance Certificate

You must have car insurance before you drive off the lot. Here are the key aspects:

- Policy Certificate: This document proves you have insurance coverage.

- Proof of Coverage: Some dealers or private sellers might want to see that the insurance covers the vehicle’s value.

Summing Up: Your Roadmap to Car Ownership

Preparing for the acquisition of a vehicle in the UK involves several key documents to ensure a hassle-free process. You need to gather your Proof of Identity and Address, secure Finance Approval if necessary, ensure you have the V5C Certificate, and have an active Insurance Certificate before you can drive your new car off the lot. Keeping track of these documents will not only make your purchase smooth but also protect you from potential fraud or legal issues.

Why do I need a utility bill or bank statement for buying a car?

+

These documents prove your current address, which is crucial for anti-fraud measures and for verifying your identity during the car purchase process.

What if I can’t produce a utility bill or bank statement?

+

In such cases, consider alternatives like a council tax bill or official letters from government bodies. Always check with the dealership or seller beforehand to confirm acceptable proofs of address.

Can I drive my newly purchased car if I don’t have immediate insurance?

+

No, it’s illegal to drive a car without insurance in the UK. Ensure you have at least the minimum required third-party insurance coverage before you drive off the lot.

What do I do if the car’s V5C is missing?

+

Missing the V5C is a red flag. You should consider requesting a replacement from the DVLA or reconsidering the purchase. A seller should have a recent version of the V5C.

How long does it take to get finance approval?

+

The process varies. Some finance approvals can be obtained within hours, while others might take several days, especially if further checks are required. Always plan ahead to ensure your purchase goes smoothly.