3 Essential Documents for Tesla Tax Write-Offs

The idea of tax write-offs can often seem like a daunting labyrinth to navigate, especially for those unfamiliar with tax law intricacies. However, understanding the relevant documents needed to claim Tesla-related expenses can simplify this process significantly. Tesla vehicles have gained popularity not just for their innovative electric design, but also for their potential tax benefits for business owners. Here are the three essential documents you'll need to secure those write-offs:

The Purchase Invoice or Bill of Sale

The first and most critical document when claiming a tax deduction for a Tesla is the purchase invoice or bill of sale. This document serves as proof that you’ve legally acquired the vehicle.

- Details to Verify:

- The vehicle’s make, model, and year

- The Vehicle Identification Number (VIN)

- The date of purchase

- The price paid for the vehicle

- The document should also include the seller’s information (in this case, Tesla or an authorized dealer), your personal or business information, and any additional equipment or features included in the purchase.

📝 Note: Ensure that this invoice reflects the full cost of the vehicle, including any taxes, fees, and extended warranties, as these can also be written off if they relate to business use.

The Use Log or Mileage Tracking

The IRS requires that if you’re claiming a Tesla for business use, you must have a detailed record of how much of the vehicle’s mileage was for business purposes. Here’s what to include:

| Date | From | To | Total Mileage | Business Mileage |

|---|---|---|---|---|

| 01/15/2023 | Home | Client Meeting | 40 | 40 |

| 01/22/2023 | Office | Client Meeting | 30 | 25 |

| 02/01/2023 | Home | Business Lunch | 20 | 20 |

- App Options: Modern solutions include apps like MileIQ, which automatically track your mileage and allow you to categorize trips as business or personal.

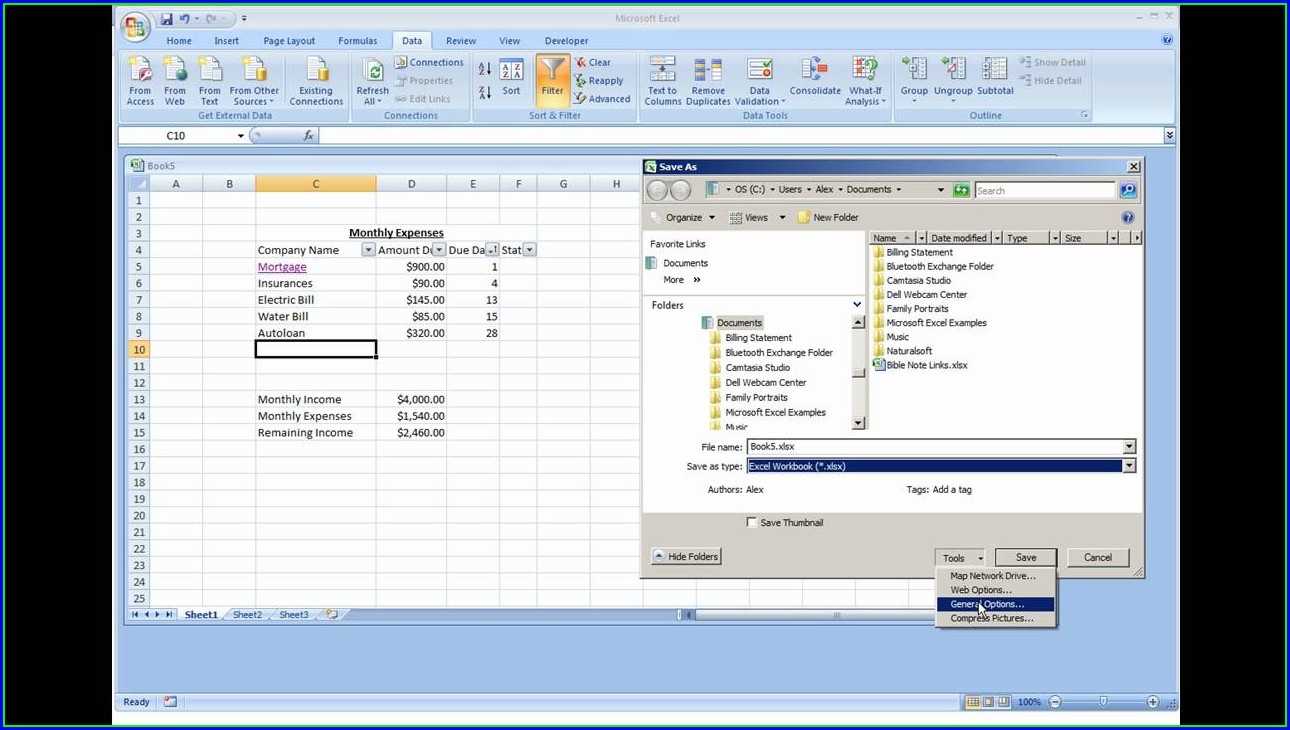

- If you prefer manual methods, a simple logbook or spreadsheet will suffice, as long as it’s detailed and accurately maintained.

Receipts for Tesla Maintenance and Modifications

Any expenditure related to the upkeep, maintenance, or modification of your Tesla for business purposes can also be deducted. Here’s what you need to keep:

- Service receipts for any repairs or routine maintenance.

- Receipts for charging costs if you’re paying for electricity used to charge your Tesla.

- Bills or receipts for modifications made to the vehicle for business utility (e.g., adding cargo space, safety features, or special equipment).

💡 Note: Be sure to clearly separate personal and business expenses. Only the business-related portion can be deducted.

To wrap up, obtaining the correct documentation for your Tesla vehicle for tax write-offs is crucial. The Purchase Invoice or Bill of Sale serves as proof of ownership and initial cost, while a detailed Use Log or Mileage Tracking documents the business use of the vehicle. Finally, retaining Receipts for Tesla Maintenance and Modifications allows for a more comprehensive write-off of related expenses. By meticulously keeping these documents, you can ensure that you're capitalizing on all possible tax benefits related to your Tesla. Remember, thorough documentation not only validates your write-offs but also prepares you for any IRS inquiries. With these steps in mind, claiming your Tesla for tax purposes becomes a straightforward and beneficial process.

What if I use my Tesla for both business and personal purposes?

+

You can only deduct the business percentage of the vehicle’s expenses, determined by the ratio of business miles to total miles driven.

Can I claim the federal EV tax credit on my business taxes?

+

The federal EV tax credit is generally for personal tax returns, but businesses might be able to benefit through alternative methods like leasing or as part of other tax incentives related to green initiatives.

What happens if I lose my purchase invoice or service receipts?

+

Reach out to your Tesla dealership or service provider for duplicates or proof of purchase. Keep electronic copies backed up as well for future reference.