5 Essential Documents for Your Aflac Claim

When facing a health-related issue or an unexpected injury, having the right insurance can make all the difference. Aflac, a well-known insurance provider, offers supplemental policies that help cover costs that health insurance might not, like out-of-pocket expenses or lost income. However, filing an Aflac claim isn't just a matter of stating what happened; it requires specific documentation to process your claim efficiently. In this detailed guide, we will explore the five essential documents you need when submitting an Aflac claim, ensuring your process is as seamless as possible.

1. The Policy Contract

The bedrock of your claim is your insurance policy contract. Here’s what you need to know:

- Review the Policy: Understand the coverage, limitations, and terms of your policy. Knowing what’s covered can help you submit a claim appropriately.

- Keep a Copy: Always have an easily accessible copy of your policy. In case you misplace it, you can request another from Aflac or retrieve it online if available.

📝 Note: If you cannot find your policy, reach out to Aflac customer service for a duplicate copy.

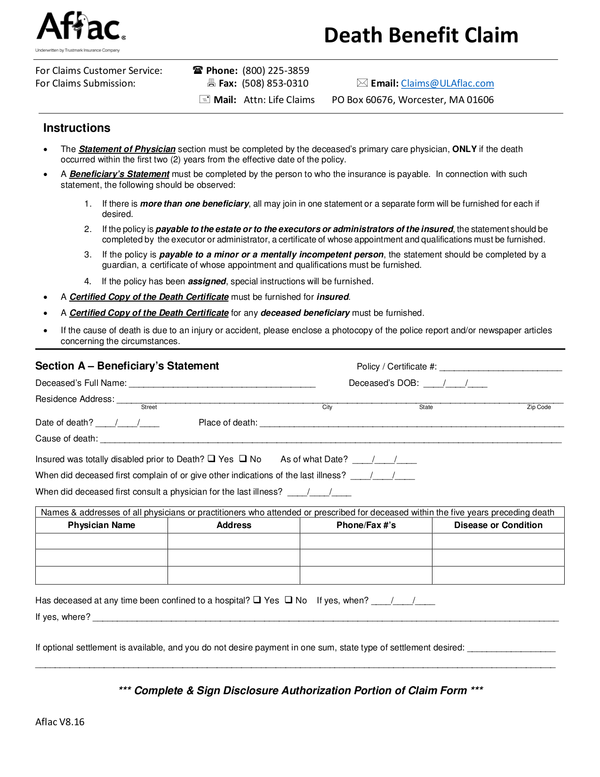

2. Claim Form

The claim form is your official request for compensation from Aflac:

- Complete It Accurately: Fill in every section. Incomplete forms can delay your claim processing.

- Ensure Legibility: Type or write clearly to avoid any misunderstandings.

3. Medical Documentation

This is one of the most critical components of your claim:

- Doctor’s Notes: Ensure your doctor provides detailed notes explaining your condition, treatments, and expected recovery time.

- Hospital Bills and Receipts: Submit all invoices or receipts related to your treatment. This includes medications, therapies, and any related out-of-pocket expenses.

4. Proof of Income Loss

If your Aflac policy covers loss of income, you’ll need to prove it:

- Pay Stubs: Provide the latest pay stubs before and after the event leading to income loss.

- Statement from Employer: A letter from your employer detailing your regular income and the income lost due to the condition or injury.

5. Beneficiary Details

For claims where payment is made to someone other than the policyholder:

- Beneficiary Information: Full names, relationship to the policyholder, and contact details of all beneficiaries.

- Legal Documentation: If needed, provide legal documents like wills or trust documents that outline the distribution of benefits.

Throughout your journey with an Aflac claim, these documents form the foundation for a smooth and efficient claims process. Each piece of documentation ensures that Aflac has all the necessary information to evaluate your claim correctly. Remember, the more organized and complete your submission, the quicker Aflac can review and respond to your request.

Tips for Effective Aflac Claim Filing

- Stay Organized: Keep all documents in order, making it easier to locate and submit them when needed.

- Submit Promptly: Delays in submission can delay processing. Send documents as soon as possible.

- Maintain Communication: Keep in touch with Aflac representatives for any updates or to provide additional information.

What should I do if I lose my Aflac policy?

+

Contact Aflac’s customer service to request a duplicate copy. They can provide you with your policy details again.

How long does Aflac take to process a claim?

+

The processing time can vary, but Aflac typically aims to process claims within 3-5 business days once all documents are received.

Can I file an Aflac claim online?

+

Yes, Aflac offers online claim submission, but you still need to provide all required documents, either by uploading them or sending them via mail.