5 Essential Documents Needed to Sell Your House

Embarking on the journey to sell your home can be thrilling yet daunting. You'll need to prepare several key documents to ensure a smooth transaction. Let's walk through the five essential documents you'll need to have ready when selling your house.

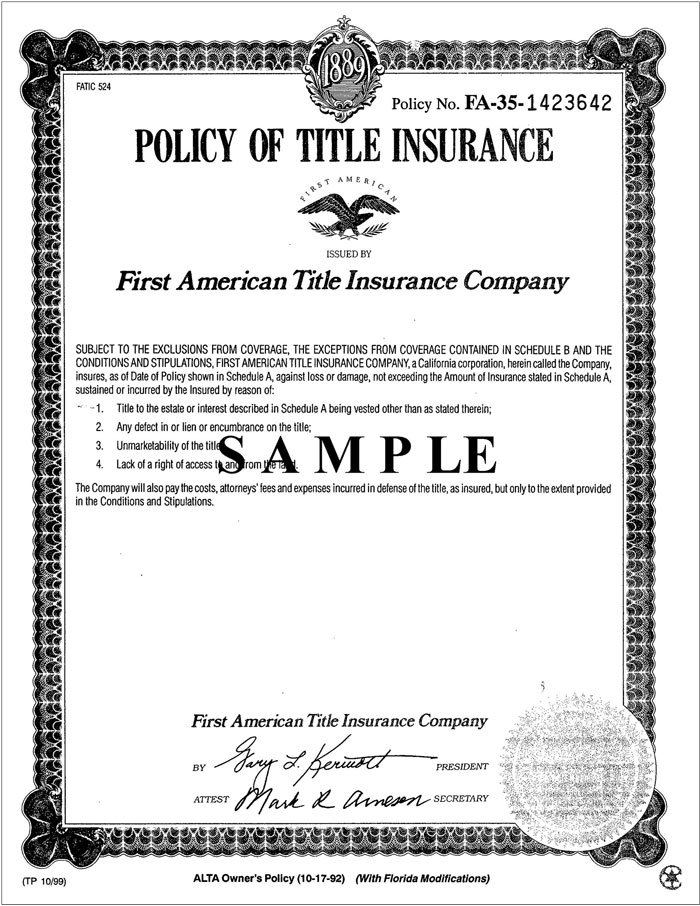

1. Title Deed

The Title Deed, or property deed, is arguably the most important document when selling your house. It legally proves your ownership of the property. Here’s what it includes:

- The owner’s name

- The property’s address

- The legal description of the property

- Encumbrances, if any

- Conveyance history

🏠 Note: Make sure the title is free of liens or disputes before listing your house for sale.

2. Property Survey

A property survey establishes the boundaries of your land, pinpoints any encroachments, and can verify that structures are within the legal property lines. This document:

- Shows the exact measurements of your property

- Identifies any easements or rights-of-way

- May reveal improvements or encroachments

📏 Note: A recent survey might be necessary if you can't locate one from your purchase or if boundary disputes have occurred.

3. Home Inspection Report

While not mandatory, providing a home inspection report can speed up the selling process and give potential buyers confidence in your property’s condition. Key points to cover:

- Structural integrity of the home

- Condition of major systems (HVAC, plumbing, electrical)

- Assessment of issues like mold, pests, and roof condition

- Possible recommendations for repairs or maintenance

Having this report can:

- Reduce buyer's concerns

- Minimize price negotiations post-offer

- Streamline the process by addressing repairs beforehand

4. Disclosures

Seller disclosures are legally required in most states and include information about the property's known defects, past repairs, or problems. Here’s what to consider:

- Presence of lead-based paint (for homes built before 1978)

- Natural hazards like flood zones or seismic activity

- Any significant repairs or alterations made

- Known issues with the property

These disclosures protect both you and the buyer by ensuring all parties are aware of the property's condition.

5. Proof of Mortgage Payment or Lien Release

If there’s an existing mortgage on the property, you’ll need to provide:

- A statement from your mortgage lender showing the balance

- A payoff letter detailing how much is needed to clear the mortgage

- Evidence that the lien has been released if your mortgage has already been paid off

The final sum will often be settled at closing, with any remaining funds going to you or being used to pay off other debts.

To Wrap Up

As you gear up to sell your house, remember that having these five documents in order will make the process smoother:

- The Title Deed to prove ownership

- A Property Survey to confirm boundaries

- A Home Inspection Report to assure buyers

- Seller Disclosures for transparency

- Proof of Mortgage Payment or Lien Release to show the financial status of the property

Getting these documents ready ahead of time can avoid delays and make your home sale more appealing to potential buyers. With preparation, you can navigate this journey with confidence and clarity.

Can I sell my house if there’s a lien on it?

+

Yes, but you’ll need to clear the lien or provide a plan for its resolution at closing to proceed with the sale.

What happens if I can’t find my property survey?

+

You might need to obtain a new survey, which can be costly but is often worth it to avoid any boundary disputes later.

Do I have to make all the repairs listed in a home inspection report?

+

No, but addressing major issues can make your home more attractive to buyers and potentially speed up the sale process.

What if I’m selling an inherited property without a title?

+

You’ll need to go through the legal process of establishing ownership, often with an attorney’s assistance, before selling.