FMLA Paperwork Fees: What Can a Physician Charge?

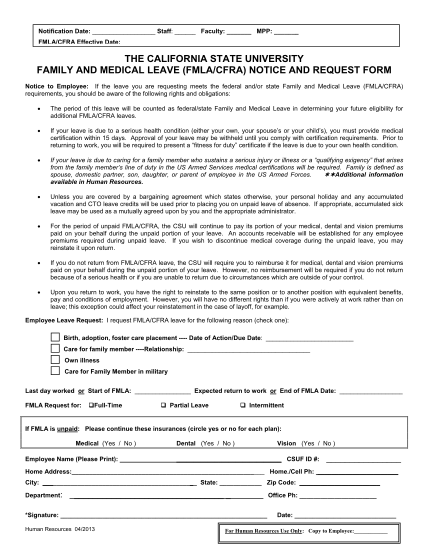

When it comes to understanding the cost of FMLA paperwork, many employees and employers alike can find themselves in a maze of confusion. The Family and Medical Leave Act (FMLA) allows eligible employees to take unpaid leave for certain medical and family reasons without jeopardizing their job security. However, the process often involves paperwork that requires certification by healthcare providers, which can incur costs. This post delves into what fees a physician can legally charge for FMLA-related services, the complexities involved, and how both employees and employers can navigate this aspect of the law.

The Role of Medical Certification in FMLA

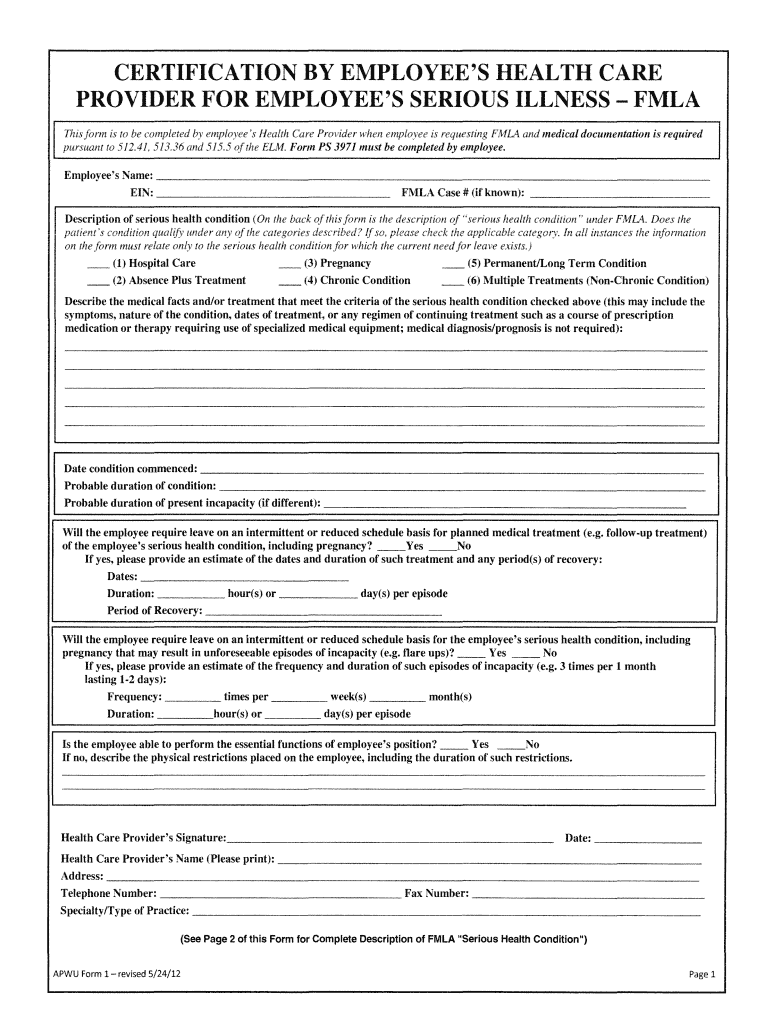

FMLA requires that employees provide sufficient documentation to prove their entitlement to leave. This medical certification typically includes:

- Type of Care Required: Details on whether the leave is for the employee’s own health condition or for caring for a family member.

- Duration of Care: An estimation of how long the leave might be required.

- Medical Necessity: Confirmation that the employee or family member has a serious health condition.

Medical certification helps to:

- Verify the need for leave.

- Establish the duration of the leave.

- Allow employers to better manage workforce planning.

What Can Physicians Charge?

According to the Department of Labor (DOL), while physicians are permitted to charge for FMLA-related paperwork, these charges are subject to certain regulations:

- Standard Fees: Physicians can charge for their services at their standard rate for completing forms or writing letters.

- Verification: Employers are allowed to ask for verification of the fee if it seems excessive.

- No Upfront Payment: Employers must typically pay for the certification unless the employee specifically requests their personal physician.

Employers’ Role in FMLA Certification Fees

Employers can be responsible for a part or all of the FMLA certification fees:

- Reimbursement: If an employee must use their personal physician and the certification was requested by the employer.

- Direct Payment: Employers can directly pay the physician for the certification when it benefits the company.

Legal Considerations

The Family and Medical Leave Act itself does not set a specific cap on what physicians can charge, but several laws and guidelines must be considered:

- FMLA Regulations: 29 C.F.R. §825.306 states that employers can ask for certification and must pay for it unless the employee chooses to use a personal healthcare provider.

- State Laws: Some states have laws that limit or even prohibit charges for FMLA certification.

Tips for Employees

Here are some tips for employees dealing with FMLA certification fees:

- Check with HR: Understand your company’s policy on FMLA certification fees.

- Choose Providers Wisely: Select a healthcare provider who offers reasonable fees for certification.

- Request Reimbursement: If you’re unsure if your employer will cover the fee, ask for reimbursement.

- Keep Records: Document all expenses related to FMLA certification for possible reimbursement or tax deductions.

Tips for Employers

Employers should consider:

- Policy Clarity: Clearly outline your FMLA policy to employees, including who covers certification fees.

- Verification: Be prepared to verify fees charged by healthcare providers.

- Budget for FMLA: Plan for potential costs associated with employee leaves, including certification.

💡 Note: Keep in mind that the practices and costs can vary by state. Always consult local labor laws or legal advisors for specific situations.

In navigating the complexities of FMLA paperwork fees, it's essential for both employees and employers to be well-informed. This summary provides insights into what physicians can legally charge for FMLA-related paperwork, the responsibilities of employers, and practical steps for employees. Understanding these aspects ensures that both parties can approach the FMLA process with clarity, reducing potential conflicts and fostering a supportive work environment.

Can my employer ask for second or third opinions on FMLA certification?

+

Yes, your employer can request a second opinion at their expense if they have reason to doubt the validity of the initial certification. If this second opinion contradicts the first, they can request a third opinion from a healthcare provider jointly approved by both parties.

Do I have to pay for the FMLA certification if I use my personal doctor?

+

Typically, employers must cover the cost of certification if it’s requested by them. However, if an employee chooses a personal physician, they might be responsible for the fee unless otherwise stated in the employer’s FMLA policy.

What if my employer refuses to cover FMLA certification costs?

+

If an employer refuses to cover the certification cost when legally obligated to do so, this could be a violation of FMLA. Employees might consider filing a complaint with the Department of Labor or seeking legal counsel to address the issue.