Do Both Parties Need to Attend Bankruptcy Signing?

If you're contemplating bankruptcy, one of the crucial aspects to consider is the signing of the bankruptcy documents. A common question that arises is whether both parties need to attend the bankruptcy signing. Let's delve into this topic to understand the requirements and what it entails.

Understanding Bankruptcy Basics

Bankruptcy is a legal status of an individual or entity that cannot repay debts they owe to creditors. It can be a strategic financial reset for those who are overwhelmed by debt. Here are some key points:

- Types of Bankruptcy: Common types include Chapter 7 (liquidation) and Chapter 13 (reorganization).

- Petition: Filing for bankruptcy involves submitting a petition to the bankruptcy court.

- Automatic Stay: Upon filing, creditors are halted from taking collection actions.

Joint vs. Individual Bankruptcy Filings

The decision to file jointly or individually has implications for the need to attend bankruptcy signings:

- Joint Filing: When couples file for bankruptcy together, both parties typically need to attend all hearings.

- Individual Filing: If only one spouse files, only that individual would typically attend.

Who Must Attend the Bankruptcy Signing?

The attendance requirement for the bankruptcy signing depends on the type of filing:

- Both Parties: In a joint filing, both parties must sign the bankruptcy documents and attend the meeting of creditors, also known as the 341 hearing.

- One Party: In an individual filing, only the person filing for bankruptcy needs to attend and sign.

Exemptions for Attendance

While both parties are generally required for joint filings, there might be situations where one party can be excused:

- Medical Reasons: If one spouse cannot attend due to health issues, written medical documentation can be provided.

- Out-of-State Residents: If one spouse resides in another state, they might not need to attend physically.

- Court Permission: The court might allow one spouse to attend if there are sufficient reasons and both parties have signed the necessary documents.

The Role of Bankruptcy Attorneys

Bankruptcy attorneys play a pivotal role in:

- Preparing the bankruptcy petition and schedules.

- Advising on whether to file jointly or individually.

- Ensuring all parties fulfill their obligations, including attending necessary meetings.

📝 Note: Legal advice from a bankruptcy attorney is crucial to navigate through this process effectively.

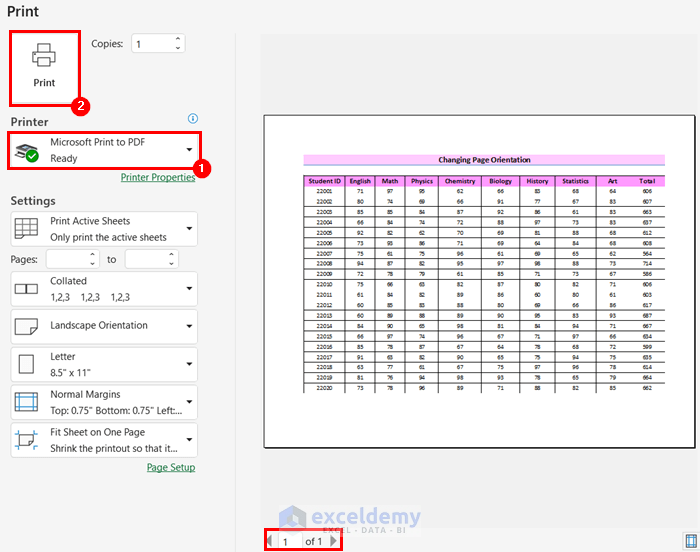

Steps for the Bankruptcy Signing Process

Here’s what happens during the bankruptcy signing process:

- Review Documentation: Both parties review all paperwork.

- Signing: Documents are signed by either one or both parties, depending on the filing type.

- Court Filing: The bankruptcy petition is filed with the court.

- 341 Hearing: Meeting of creditors where both parties might be required to attend.

- Confirmation: If it’s a Chapter 13 bankruptcy, a confirmation hearing follows.

The attendance at bankruptcy signings is critical for the smooth progression of the case. Here are some points to consider:

- Representation: In joint filings, both spouses should be represented or at least communicate their agreement with the filing process.

- Transparency: Both parties should be aware of the process and potential implications on their credit, future borrowings, and asset division.

Impact of Bankruptcy on Couples

Bankruptcy, whether filed jointly or individually, can have various impacts:

- Credit Score: Filing will temporarily lower the credit score of both parties in a joint filing.

- Asset Division: In some cases, community property laws come into play affecting asset distribution.

- Future Financial Planning: Post-bankruptcy financial planning might require both parties to work together if their finances are intertwined.

👥 Note: Couples should discuss bankruptcy openly, understanding its long-term effects on their financial future together or individually.

In summary, when considering bankruptcy, understanding the attendance requirements for the signing is key. If filing jointly, both parties are usually needed at the bankruptcy signing. However, exceptions can apply, and professional legal advice can guide you through these nuances. Remember that while bankruptcy can provide relief from overwhelming debt, it’s a significant step with long-lasting effects on both parties. Careful consideration and mutual understanding are essential to navigate this legal and financial journey successfully.

Can I file for bankruptcy without my spouse’s knowledge?

+

No, in a joint filing, both spouses must be aware and consent to the filing, as they are required to sign the necessary documents.

What happens if one spouse can’t attend the 341 hearing?

+

The attending spouse can still proceed with the hearing, but they might need to provide documentation or reasons for the absence, and it’s best to seek court permission.

Does bankruptcy affect both spouses in a joint filing?

+

Yes, in a joint filing, bankruptcy will impact both spouses’ credit and financial future, necessitating careful planning and communication.