5 Steps to DIY Property Transfer Paperwork

Are you planning to transfer the ownership of a property but find the paperwork overwhelming? Property transfer can seem like a maze of legal jargon and endless forms. However, with the right approach, you can handle much of this process yourself. This blog post will walk you through 5 straightforward steps to successfully complete your DIY property transfer paperwork.

Step 1: Understand the Requirements

Before diving into the paperwork, familiarize yourself with the legal requirements of property transfer in your locality:

- Gather Information: Understand who needs to be involved, from real estate agents to lawyers, depending on your comfort level.

- Check Local Regulations: Every jurisdiction has its unique set of rules. Visit your local government's website or property transfer office to learn about necessary documents, fees, and the time frame for transfers.

- Title Insurance: Determine if your state requires title insurance, which protects against title defects.

⚠️ Note: Real estate laws change frequently; make sure your information is current by checking with local authorities or a legal advisor.

Step 2: Prepare the Necessary Documents

Once you have a grasp of the legal requirements, collect the following documents:

- Current Title Deed: This proves ownership of the property.

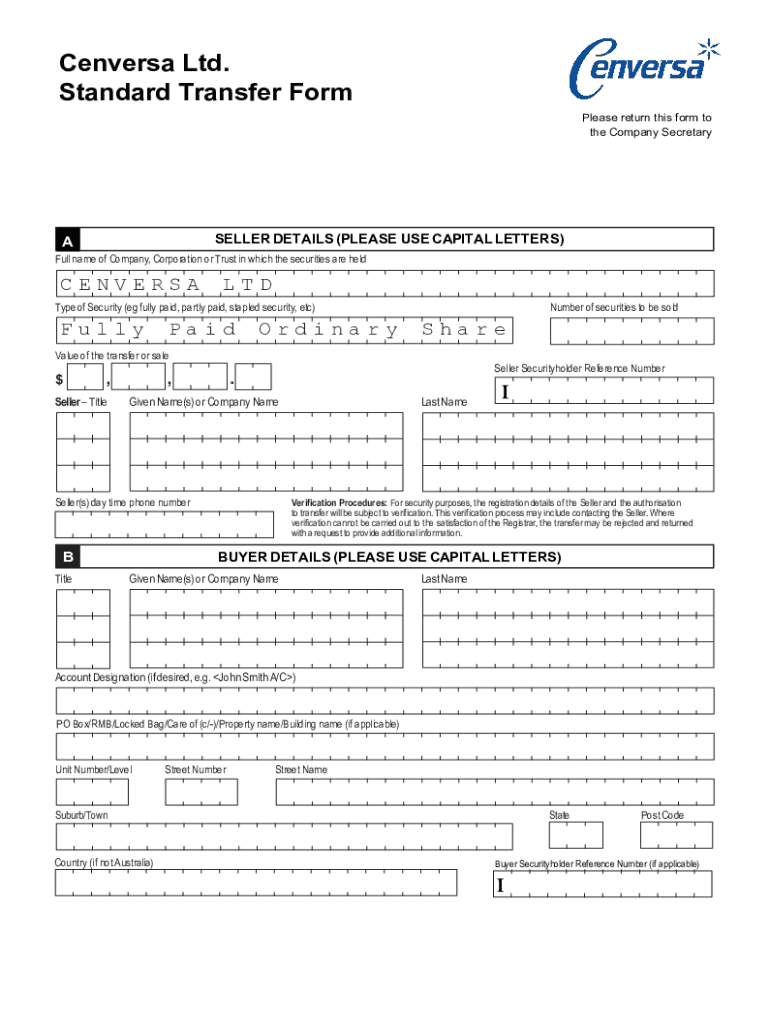

- Transfer Deed: Also known as the property transfer form or deed of conveyance.

- Property Tax Statement: Shows that all property taxes are up to date.

- Survey Plan: If needed, this document outlines the property boundaries.

📑 Note: If you are not sure how to fill out the transfer deed, many counties offer templates or instructions online.

Step 3: Engage Professional Help (Optional but Recommended)

While this is a DIY guide, considering the complexity of property law, it’s wise to engage:

- Real Estate Attorney: To review documents and ensure legal compliance.

- Title Company: For handling title searches, insurance, and closing the transfer.

Here’s when you might need each:

| Professional Help | When to Engage |

|---|---|

| Attorney | For legal advice, document review, or complex cases. |

| Title Company | To facilitate transfer, perform title searches, and issue insurance. |

Step 4: Execute the Transfer Documents

With all documents in hand:

- Fill out the Transfer Deed: Use the appropriate template and ensure all fields are completed correctly.

- Signatures: Both the seller and buyer must sign. Witnesses might be required.

- Notarization: Depending on your area, these documents need to be notarized to be legally binding.

📝 Note: Notarization is not only to make documents official but also to reduce the risk of fraud.

Step 5: Submit and Follow-Up

Now that your documents are ready:

- Submit: Take or mail the documents to your local deeds office or recorder’s office.

- Pay Fees: Don’t forget to include any required fees.

- Confirmation: Follow up to ensure your transfer has been recorded.

⏰ Note: Remember, processing time can vary. Keep in mind any deadlines or property closing dates.

The process of transferring property can be daunting, but by following these 5 steps, you can confidently navigate the necessary paperwork. This DIY approach not only saves money on legal fees but also gives you control over every aspect of your property transfer. While this guide provides a robust overview, local laws and circumstances can vary, so always double-check specific requirements or consult a professional if you're unsure.

Remember, property transfer is a significant legal event. Ensuring everything is done correctly at each step not only protects your investment but also ensures a smooth transition for both the current and new owners. With careful preparation and understanding of the process, you're well on your way to a successful property transfer.

What is the importance of title insurance?

+

Title insurance protects the buyer and lender from potential defects in the title or unforeseen claims against the property, ensuring you have clear ownership.

Can I avoid hiring a lawyer for a property transfer?

+

Yes, you can attempt a DIY property transfer. However, for complex issues or to ensure legal compliance, consulting a real estate attorney is advisable.

How long does a property transfer typically take?

+

The duration can vary widely, from a few weeks to several months, depending on local government processing times, document preparation, and any necessary inspections or corrections.