Master Your Student Loan with Excel: A Simple Guide

Introduction to Managing Student Loans

Student loans can seem daunting, but with the right tools and knowledge, you can manage them efficiently and work towards becoming debt-free faster. Microsoft Excel is one of the most versatile tools available for personal finance management, offering features that help you track, calculate, and plan your student loan repayment strategy effectively.

Setting Up Your Excel Workbook

Before diving into the specifics of tracking your loans, let's start by setting up your Excel workbook:

- Open Microsoft Excel and create a new workbook.

- Name the first sheet "Loan Summary" and add sheets like "Details", "Repayment Plan", etc., as you see fit.

💡 Note: Use different sheets to keep your data organized and easier to navigate.

Tracking Your Student Loans

Start by listing all your student loans in the "Details" sheet:

| Loan Name | Lender | Principal Amount | Interest Rate | Loan Term | Start Date | End Date |

|---|---|---|---|---|---|---|

| Federal Direct Subsidized | U.S. Dept. of Education | $5,500 | 3.73% | 10 Years | 09/2019 | 09/2031 |

| Private Loan 1 | Sallie Mae | $10,000 | 5.25% | 15 Years | 09/2019 | 09/2036 |

🔍 Note: Ensure all fields are filled accurately to reflect your loan details.

Calculating Interest and Monthly Payments

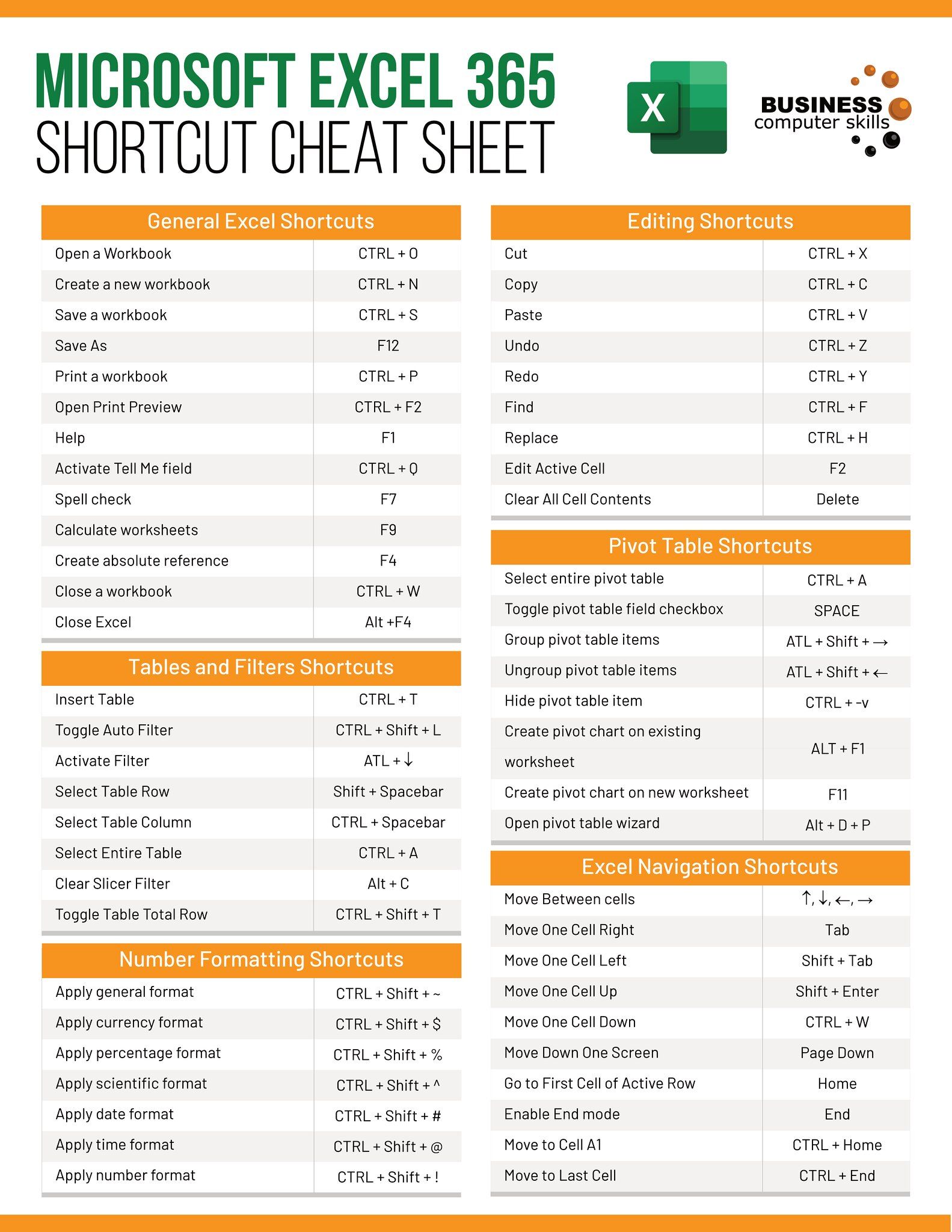

Excel can help you determine how much you're paying in interest over time and plan your monthly payments:

- Interest Calculation: Use the formula

=PRINCIPAL*(RATE/12)to calculate monthly interest. - Monthly Payment: Use the

=PMT(RATE/12, TERM*12, -LOAN_AMOUNT)formula to estimate monthly payments.

Creating a Loan Repayment Strategy

Developing a repayment strategy involves:

- Prioritizing Loans: Decide whether to tackle high-interest loans first or go with an income-based strategy.

- Additional Payments: Plan for making extra payments on your loans to reduce principal faster.

- Visual Aids: Use charts and graphs to visualize payoff scenarios.

📅 Note: Regularly update your workbook with actual payments made to keep your data current.

Handling Changes in Loan Terms

Loan terms might change due to refinancing, consolidation, or changes in interest rates:

- Create a new column in your "Details" sheet for any refinancing or consolidation details.

- Recalculate monthly payments and interest using the updated information.

Monitoring and Forecasting

To keep your student loan strategy dynamic and adaptive:

- Track Payments: Log each payment made, including date and amount.

- Loan Balance: Regularly update the remaining balance in your Excel sheet.

- What-if Analysis: Use Excel's What-If analysis tools to explore different repayment scenarios.

Utilizing Excel for Future Planning

Once you've mastered basic Excel functionalities for loan tracking, you can leverage Excel for:

- Long-term Financial Planning: Incorporate student loans into your broader financial goals.

- Emergency Funds: Plan for potential financial setbacks by setting aside savings in parallel with your loan repayment.

In summary, mastering your student loan management through Excel involves careful setup, consistent tracking, and strategic planning. By utilizing Excel's powerful capabilities, you can take control of your financial future, making informed decisions that pave the way for a debt-free life. Whether you're adjusting payment plans, analyzing potential refinancing benefits, or simply keeping tabs on your progress, Excel's tools can be your ally in navigating the complexities of student loans.

How do I handle loan consolidation in Excel?

+

To handle loan consolidation, update your “Details” sheet with the new consolidated loan details. Recalculate the monthly payment using the consolidated loan amount, term, and interest rate. Ensure you keep track of any remaining balances on the original loans for your records.

Can Excel predict changes in interest rates?

+

Excel cannot predict future interest rates, but it can model scenarios with different rates. Use What-If analysis to see how your repayment might change with different interest rate assumptions.

What if I make extra payments towards my student loans?

+

If you make extra payments, update your Excel workbook by subtracting these amounts from your principal. You can then recalculate the interest and monthly payments to see how your payoff date shifts.