Save Money with Excel: Easy Tips

Microsoft Excel is not just a tool for crunching numbers and creating charts; it's also an incredible platform for managing personal finances. Whether you're budgeting for the first time, saving for a big purchase, or tracking your financial growth, Excel offers versatile features to help you save money effectively. This post will guide you through several easy tips on how to use Excel to enhance your financial management and save money.

The Basics of Excel for Personal Finance

Before diving into the specifics, understanding the basics of Excel for personal finance is essential:

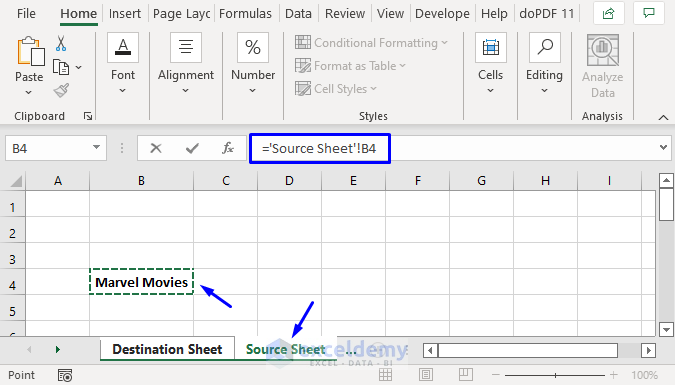

- Worksheet Structure: Excel’s workbook consists of worksheets where each sheet can represent different aspects of your finances, like income, expenses, and savings.

- Cell Referencing: Use cell references to automate calculations, reducing the chance of manual errors.

- Formulas and Functions: Functions like SUM, AVERAGE, and IF are particularly useful for financial computations.

Setting Up Your Financial Workbook

To start saving with Excel, set up a dedicated workbook with:

- An Income Sheet to record all sources of income.

- An Expense Sheet to track where your money goes.

- A Savings Goal Sheet to manage your savings targets.

Here’s a quick guide to setting these up:

| Sheet Name | Purpose |

|---|---|

| Income | List and sum all incomes |

| Expenses | Track all outgoings categorized |

| Savings Goals | Plan and monitor savings |

Track Your Income and Expenses

Keeping an accurate record of your income and expenses is the cornerstone of effective financial management:

- Record every income source - salary, investments, etc., in the Income Sheet with dates and amounts.

- In the Expense Sheet, categorize spending into groups like utilities, groceries, entertainment, etc., using the SORT and FILTER functions to organize data.

Create a Budget and Stick to It

Budgeting helps you control your spending:

- Use the SUMIF function to categorize your monthly expenses and compare against your income.

- Track deviations from your budget to identify areas where you can save.

Visualize Your Savings

Visual aids in Excel can provide powerful insights:

- Create charts or graphs to visualize your income vs. expenses, showing how much you're saving or overspending.

- Use conditional formatting to highlight positive and negative trends in your financial journey.

Set and Track Savings Goals

Setting goals can motivate you:

- Set specific savings targets like an emergency fund or vacation fund.

- Track your progress using formulas like FV for future value to see how your savings are growing.

Analyze Spending Patterns

Excel can help you find trends in your spending:

- Use PivotTables to analyze expense categories over time or compare spending in different months or years.

- Utilize the VLOOKUP function to integrate data from different sheets for comprehensive analysis.

💡 Note: Regularly reviewing and updating your Excel workbook ensures it remains a useful tool in your financial management.

Incorporating these Excel tips into your financial planning will not only help you save money but also provide a clear, visual representation of your financial health. As you grow accustomed to using Excel, you’ll find it easier to adapt your financial strategies, set new goals, and manage your money more effectively.

How often should I update my Excel financial workbook?

+

Updating your workbook regularly, ideally weekly, ensures that your financial data is current and accurate. Monthly reviews can help you track larger trends and goals.

Can I use Excel for business finances too?

+

Absolutely, Excel is widely used in business for financial tracking, forecasting, and reporting. The principles applied here can be scaled up for business use.

What are the most useful Excel functions for financial management?

+

Functions like SUM, AVERAGE, IF, FV (Future Value), NPV (Net Present Value), and PMT (Loan Payments) are very handy for financial analysis in Excel.