Crafting Salary Slips in Excel: A Step-by-Step Guide

Introduction to Excel Salary Slips

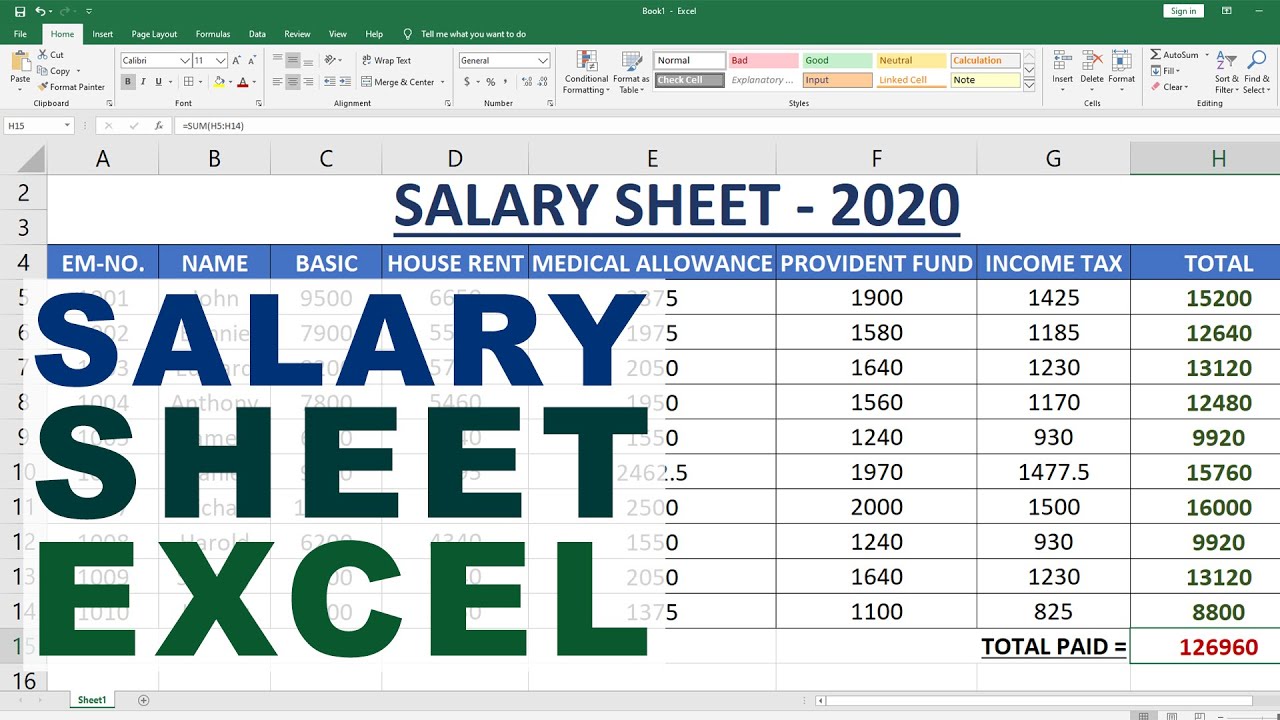

Excel is an incredibly versatile tool that can simplify a wide array of financial tasks, including the generation of salary slips for employees. A salary slip, also known as a payslip or paycheck stub, provides a detailed breakdown of an employee’s earnings, deductions, and net pay for a specific pay period. In this guide, we’ll walk through the steps to create an accurate and professional-looking salary slip in Microsoft Excel, ensuring you can manage this task effectively.

Setting Up Your Excel Worksheet

Before diving into the salary slip itself, it’s crucial to prepare your Excel worksheet:

- Name the Sheet: For better organization, rename your worksheet to something like “Salary Slip”.

- Set Up Headers: Use the top rows to include headers like “Employee Information,” “Earnings,” “Deductions,” and “Net Pay.”

Adding Employee Information

Begin your salary slip by entering the employee’s personal and job-related details:

| Employee Name |

| Employee ID |

| Designation |

| Department |

| Pay Period |

💡 Note: Ensure the pay period is clearly stated to avoid confusion.

Calculating Earnings

Under the earnings section, list out all forms of income that the employee receives:

- Basic Salary

- Bonus or Commission

- Overtime Pay

- Other Allowances (such as House Rent Allowance or Travel Allowance)

Here’s how to set up these calculations:

- Basic Salary: Enter the fixed monthly salary amount.

- Bonus: Use a formula like

=IF(commission_basis =“sales”,actual_sales*bonus_percentage,0)for conditional bonuses. - Overtime Pay: Calculate with

=overtime_hours * hourly_rate. - Allowances: Input fixed amounts or percentages of basic salary.

- Gross Pay: Sum up all earnings:

=SUM(B10:B13).

Handling Deductions

Deductions can be complex as they include statutory and non-statutory items:

- Taxes (Income Tax, Social Security)

- Health Insurance

- Retirement Contributions

- Other Deductions (like loan repayments)

To accurately reflect these:

- Income Tax: Use a formula to calculate tax based on the tax slab.

- Health Insurance: Enter the monthly premium amount.

- Retirement Contributions: Calculate a percentage of gross pay.

- Other Deductions: Include any other fixed or variable deductions.

- Total Deductions: Sum all deductions with

=SUM(B16:B20).

Computing Net Pay

Net pay is the final figure after subtracting all deductions from the gross pay. The formula is straightforward:

=Gross_Pay - Total_Deductions

This amount should be clearly displayed as the net salary to be paid to the employee.

Formatting and Finalizing

To make your salary slip visually appealing and professional:

- Use borders to separate different sections.

- Ensure consistent formatting with fonts, colors, and alignments.

- Add the company logo or any identifying marks.

- Include any additional information like year-to-date totals or leave balances.

📝 Note: Proper formatting not only enhances readability but also conveys professionalism to the employee.

Using Excel Functions for Dynamic Calculations

Excel functions can automate and streamline your salary slip creation:

- VLOOKUP/HLOOKUP: Useful for fetching data from another table.

- IF/AND/OR: For conditional formatting or calculations.

- SUMIFS/SUMPRODUCT: To aggregate data based on specific conditions.

Tips for Ensuring Accuracy and Compliance

Here are some tips to keep your salary slips accurate and compliant with legal standards:

- Regularly update tax laws and rates.

- Double-check all calculations to avoid errors.

- Keep records of all payslips for audit purposes.

- Consider using data validation to ensure entries are correct.

By following these steps, you can produce clear, detailed, and accurate salary slips in Excel, ensuring that your employees have all the necessary information regarding their pay. This not only simplifies HR processes but also fosters transparency and trust between employers and employees. Efficient salary slip creation in Excel not only streamlines payroll but also helps in keeping track of employee compensation, benefits, and statutory deductions, making it a cornerstone of effective HR management.

How do I ensure the accuracy of the calculations on the salary slip?

+

To ensure accuracy, use Excel’s built-in functions for calculations, double-check formulas, and use auditing tools like ‘Trace Precedents’ and ‘Trace Dependents’.

Can Excel salary slips be customized for different employees?

+

Yes, Excel allows for customization through conditional formatting, data validation, and the use of dynamic functions like VLOOKUP to fetch different data for each employee.

What should I do if I need to update my salary slip template frequently?

+

Maintain a master template on a separate sheet that can be referenced or updated as needed, allowing you to easily adjust all related salary slips.