Mastering Balance Sheets in Excel 2007: A Step-by-Step Guide

Excel 2007, with its versatile features, offers a robust platform for financial modeling, including creating balance sheets. A balance sheet provides a snapshot of a company's financial health at a specific point in time, showing assets, liabilities, and shareholder equity. Here's how you can master the creation of balance sheets in Excel 2007.

Setting Up Your Workbook

To start, open Excel 2007 and create a new workbook. Here’s what to do:

- Open Excel.

- Select Blank Workbook to create a new workbook.

- Save your workbook with a relevant name like “Balance_Sheet_2023.”

Inputting the Essential Data

Before you can create a balance sheet, you’ll need:

- Detailed financial data on your company’s assets, liabilities, and equity.

- Have data organized by categories and subcategories.

Here’s how to structure your input:

| Category | Subcategory | Value |

|---|---|---|

| Assets | Current Assets | XXX,XXX</td> </tr> <tr> <td>Assets</td> <td>Fixed Assets</td> <td>YYY,YYY |

| Liabilities | Current Liabilities | ZZZ,ZZZ</td> </tr> <tr> <td>Equity</td> <td>Retained Earnings</td> <td>ABC,DEF |

💡 Note: Ensure all data is accurate and consistent to avoid discrepancies in your balance sheet.

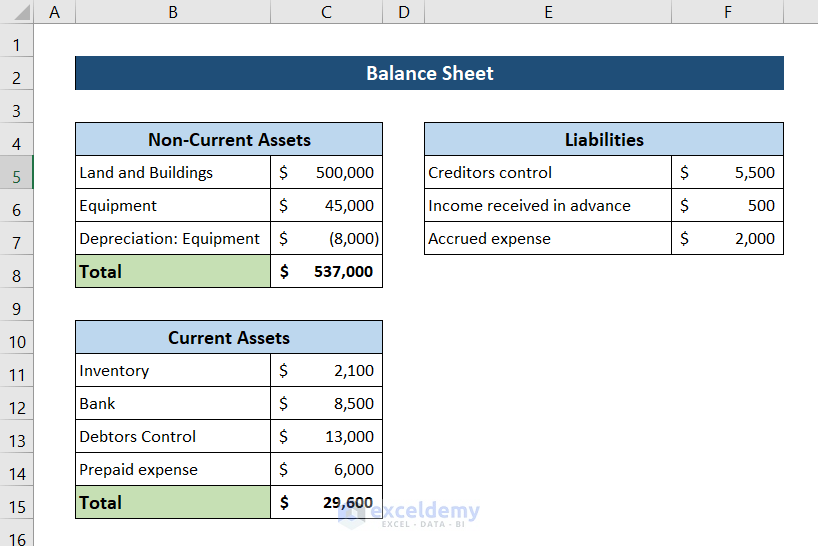

Formatting Your Balance Sheet

Now, let’s format your balance sheet:

- Select cell A1 and type in “Balance Sheet.” Format this text in bold to highlight the heading.

- Below that, create columns labeled “Assets,” “Liabilities,” and “Equity.”

- Under these headings, list each category and subcategory using proper spacing and indents.

- Use the Borders tool to create a neat grid around your balance sheet data for better readability.

- Format cells containing monetary values for currency using the “Accounting Number Format” found under the “Number” group.

Summarizing and Analyzing

After inputting and formatting data:

- Calculate the total for each section (Assets, Liabilities, Equity).

- Sum up the totals and ensure the balance sheet is balanced (Assets = Liabilities + Equity).

- Use conditional formatting to highlight variances or errors if any discrepancies exist.

💡 Note: Regularly updating your balance sheet can provide insights into the financial health of your business.

Using Excel Features for Analysis

Excel 2007 has tools that can aid in financial analysis:

- Charts and Graphs: Create visual representations of data.

- Data Validation: Set up rules to prevent incorrect data entry.

- Macros: Automate repetitive tasks with VBA for efficiency.

Wrapping Up

Creating a balance sheet in Excel 2007 is not just about presenting data, it’s about understanding and managing your company’s financial health. With the steps and tips provided, you should now be able to craft an informative and well-formatted balance sheet. Regularly updating and analyzing this document can help you make informed financial decisions and keep your business on track.

Can Excel 2007 handle multiple sheets for different balance sheets?

+

Yes, Excel 2007 allows for the creation of multiple sheets within one workbook, which can be used to maintain separate balance sheets for different periods or departments.

How often should I update my balance sheet?

+

It’s recommended to update your balance sheet at least quarterly to reflect changes in your company’s financial status.

What if my balance sheet does not balance?

+

If your balance sheet does not balance, review your data entries for errors, check for unrecorded transactions, or double-counted figures. Reconcile discrepancies by adjusting entries or revisiting your initial calculations.