5 Easy Steps to Create a Balance Sheet in Excel

The balance sheet is a crucial financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists assets, liabilities, and owner’s equity, offering insights into the health of a business. For small business owners, freelancers, or individuals managing personal finances, knowing how to create a balance sheet in Excel can be highly beneficial. Here are five simple steps to help you get started.

Step 1: Set Up Your Excel Workbook

First, open a new Excel workbook. To ensure accuracy and consistency, set up your sheet with the following:

- Select a suitable date format for your header.

- Use the Merge & Center feature to consolidate cell for the title.

- Set up columns for Assets, Liabilities, and Equity.

📌 Note: This step is foundational to creating an organized and easy-to-read balance sheet.

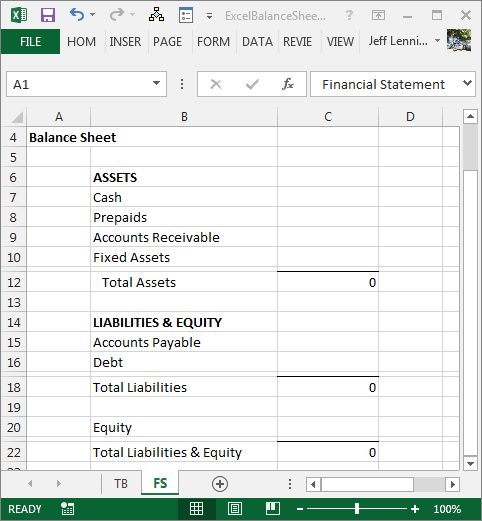

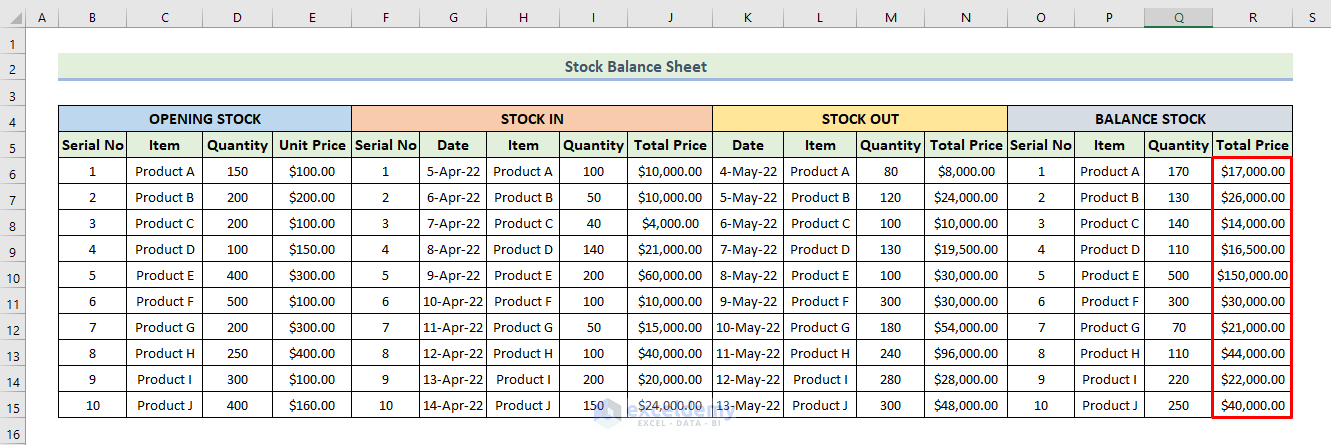

Step 2: Enter Your Assets

Assets are what your business owns, and they are categorized into current (cash, inventory, accounts receivable) and non-current (property, plant, equipment) assets. Here’s how to list them:

| Asset Category | Example |

|---|---|

| Current Assets | Cash, Accounts Receivable, Inventory |

| Non-Current Assets | Property, Plant, Equipment, Long-Term Investments |

Use formulas in Excel to add up the total assets:

- Use

=SUM(B3:B10)to total current assets if they are listed from B3 to B10. - Add non-current assets separately and then sum both totals.

💡 Note: Always double-check your inputs to avoid errors in calculations.

Step 3: List Liabilities and Equity

Liabilities are what your business owes, and equity is what you or investors have invested in your business. Follow this structure:

- Current Liabilities: Accounts Payable, Accrued Expenses, Short-term Loans.

- Non-Current Liabilities: Long-term Loans, Bonds Payable.

- Owner’s Equity: Capital, Retained Earnings, Drawing Account.

Use the SUM function similarly to calculate the total liabilities and equity:

=SUM(D3:D10)for current liabilities.- Add non-current liabilities separately.

Step 4: Balance the Sheet

One of the key aspects of the balance sheet is that it must balance. Here’s how to ensure this:

- Total Assets should equal the sum of Total Liabilities and Owner’s Equity.

- Use a formula in Excel to check if your balance sheet balances:

=C10 = (D10 + E10) where C10 is total assets, D10 is total liabilities, and E10 is owner’s equity.

Remember that if the equation does not balance, you’ll need to review your entries.

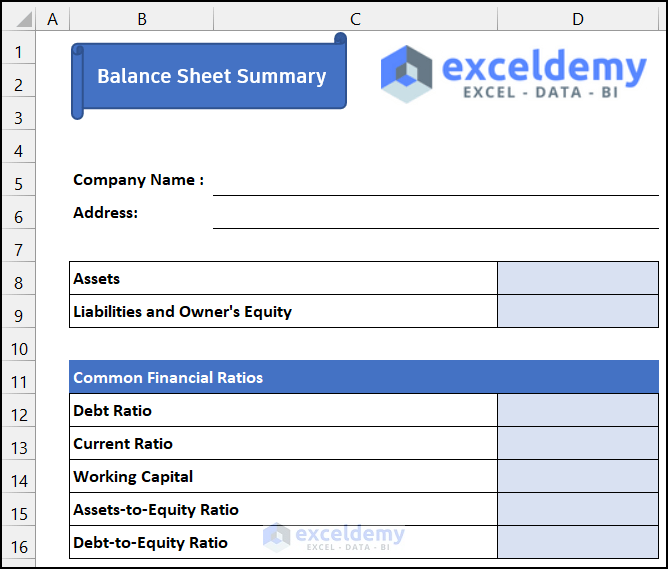

Step 5: Review and Format

The final step is to refine your balance sheet for clarity and presentation:

- Proofread: Check for any typos, miscalculations, or data entry errors.

- Formatting: Use conditional formatting to highlight key figures or negative numbers.

- Visualize: Add charts or graphs for visual representation of key financial metrics.

This step ensures your balance sheet is not only accurate but also visually appealing, making it easier to analyze and interpret.

By following these steps, you'll have created a detailed and accurate balance sheet in Excel, providing a clear picture of your financial standing. Creating such financial statements regularly is essential for tracking your business's financial health and making informed decisions.

What is the purpose of a balance sheet?

+

A balance sheet helps stakeholders understand the financial health of a business by showing its assets, liabilities, and equity at a specific point in time. It’s crucial for assessing liquidity, solvency, and financial flexibility.

Can I use a template to create a balance sheet in Excel?

+

Yes, many online resources offer templates that can be modified to suit your specific needs. This can save time and ensure accuracy if you’re new to creating balance sheets.

How often should I update my balance sheet?

+

For businesses, it’s good practice to update your balance sheet at least quarterly, although monthly updates can provide more granular insight into financial changes.

Do I need to be an accountant to create a balance sheet?

+

No, while accounting knowledge can be helpful, Excel provides tools that make creating a basic balance sheet accessible to anyone with a fundamental understanding of business finance.