Master Your Paperwork: Organize Bills Efficiently

The Importance of Organizing Your Bills

In today’s fast-paced life, managing finances can be a daunting task. Between remembering due dates, ensuring payments are processed on time, and maintaining your credit score, the sheer volume of paperwork related to bills can be overwhelming. Proper organization of bills not only helps in maintaining financial health but also reduces stress and saves time. In this detailed guide, we will explore practical strategies to streamline your bill management process.

Gathering All Your Bills

The first step towards organizing bills efficiently is to gather all your financial documents in one place. Here’s how you can do it:

- Designate a Physical or Digital Space: Choose a physical folder or a digital document management system. Physical options might include:

- A filing cabinet

- A binder with section dividers

- A shoebox (for temporary storage)

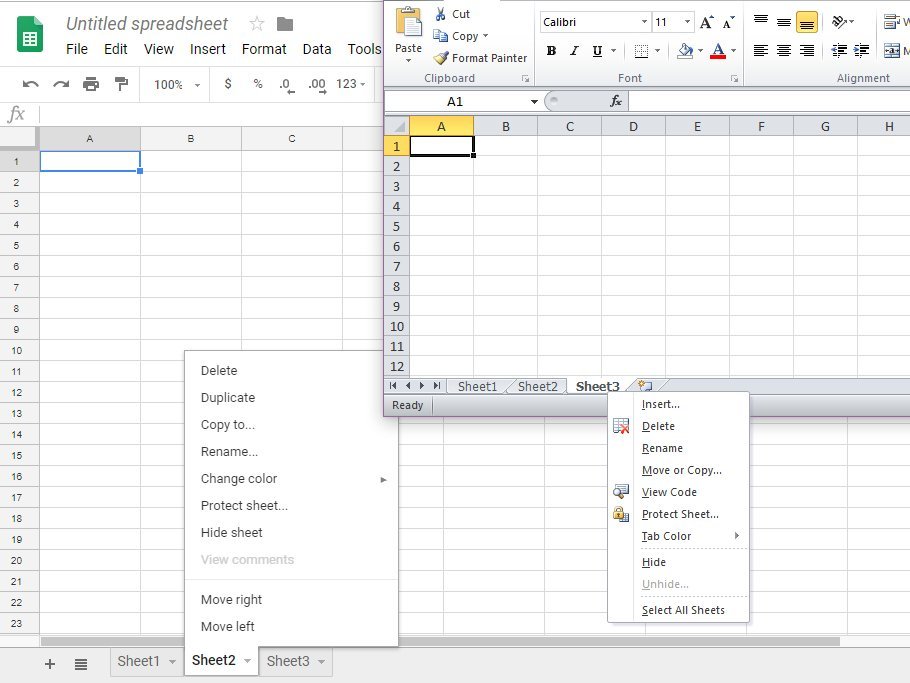

Digital solutions include: - Cloud storage services like Google Drive or Dropbox - Desktop document management software - Mobile apps designed for bill management

Categorize Your Bills: Once you have a space to work with, categorize your bills. Common categories might include:

- Utilities (water, electricity, gas)

- Telecommunications (phone, internet, cable)

- Loans (student, car, personal)

- Credit Cards

- Rent/Mortgage

- Subscriptions (magazines, software)

Create a Checklist: After categorizing, create a checklist of all the bills you receive regularly. This helps in:

- Tracking bill arrivals

- Setting reminders for payments

🎯 Note: Keep in mind that missing even a single bill can lead to penalties, so ensure all bills are accounted for.

Implementing an Organization System

Once you’ve gathered your bills, implementing a system to manage them efficiently is crucial:

- Set Up Automatic Payments: Automating bill payments can:

- Eliminate the risk of missing a payment

- Save time as you don’t have to manually pay each bill

Most service providers offer options to set up automatic payments. Here’s how:

Visit your service provider’s website

Enter your payment method details

Choose the date for automatic payment

Create a Bill Payment Schedule: Even with automatic payments, keeping track of due dates is essential:

- Use a calendar (physical or digital) to mark payment dates

- Allocate specific days to review and pay bills manually if needed

Here’s a simple example of a bill payment schedule:

| Bill | Date Due | Amount | Status |

|---|---|---|---|

| Rent | 1st of Month | 1500</td> <td>Auto-Pay</td> </tr> <tr> <td>Electricity</td> <td>10th of Month</td> <td>80 | Manual |

| Credit Card | 15th of Month | $200 | Auto-Pay |

💡 Note: Some bills might not have fixed due dates or might change, so keep updating your schedule.

Archiving and Filing

After payments, archiving becomes essential for:

- Tax purposes

- Warranty claims

- Audits

Archiving Strategies:

Digital Archiving: Scan and save bills in cloud services or local storage:

- Name documents clearly (e.g., Utility_Jan_2023.pdf)

- Use tags or folders to categorize further

Physical Archiving: Keep physical copies in:

- Accordion files labeled by year and category

- Boxes for archival purposes

Filing Methods:

- Alphabetical: Arrange bills in alphabetical order within categories for quick retrieval

- Chronological: Arrange bills by date or month for those requiring chronological tracking

📁 Note: Regularly back up digital files to avoid data loss, and protect physical files from damage.

Using Technology to Your Advantage

Technology offers numerous tools to make bill management more efficient:

Bill Payment Apps: Many apps consolidate all your bills into one platform:

- Set payment reminders

- Analyze spending patterns

Digital Banks and Virtual Wallets: These often provide:

- Quick payment options

- Real-time balance checks

- Scheduled payments

Smart Inbox Rules: Email clients can sort bills automatically:

- Set rules to categorize bills into folders

- Use labels or flags for quick scanning

Here’s how you might benefit from technology:

- Automation: Automate bill scanning and categorization

- Tracking: Track due dates, payments, and trends in your expenses

- Paperless: Go paperless by opting for electronic bills

Final Thoughts

Organizing bills efficiently isn’t just about maintaining financial health; it’s about reclaiming control over your finances, reducing stress, and optimizing your time. By following the steps outlined above, you can create a system that works for your lifestyle, whether it’s through digital means, physical filing, or a combination of both. Remember, consistency and regularity are the keys to success in managing bills. Over time, these habits will not only streamline your financial life but also provide a sense of peace and order.

Why should I automate my bill payments?

+

Automating bill payments ensures that your bills are paid on time, reducing the risk of late fees and maintaining your credit score. It also saves you time and effort as you don’t need to manually process each payment.

How can I find the time to manage my bills effectively?

+

Schedule a regular time each week or month to review and manage your bills. Setting reminders, using apps, and organizing your bills in one place can significantly reduce the time needed for this task.

What’s the best way to categorize my bills?

+

Categorize your bills based on frequency, importance, or type (utilities, credit, loans, etc.). Consistency in categorization helps in quickly locating and tracking your bills.