5 Steps to Create an Employee Salary Sheet in Excel

Creating an employee salary sheet in Excel is a fundamental task for any organization's HR and finance departments. Excel provides a versatile platform to manage payroll efficiently, ensuring accuracy in calculations, ease in maintenance, and the ability to generate various reports quickly. Here's how you can set up an effective salary sheet step-by-step:

Step 1: Setting Up the Basic Structure

Start by opening a new Excel workbook. Here’s what you need to do:

- Label the Columns: The first row should include column headers like Employee ID, Name, Basic Salary, Deductions, Allowances, Gross Salary, Net Salary, etc. Ensure these labels are descriptive enough to avoid confusion.

- Format Cells: Right-click on column headers, select ‘Format Cells’, and choose the appropriate number format for monetary values. Use the currency format, setting the locale as per your company’s standards.

- Freeze Panes: To keep these headers visible as you scroll through the data, go to the ‘View’ tab, click ‘Freeze Panes’, and select ‘Freeze Top Row’.

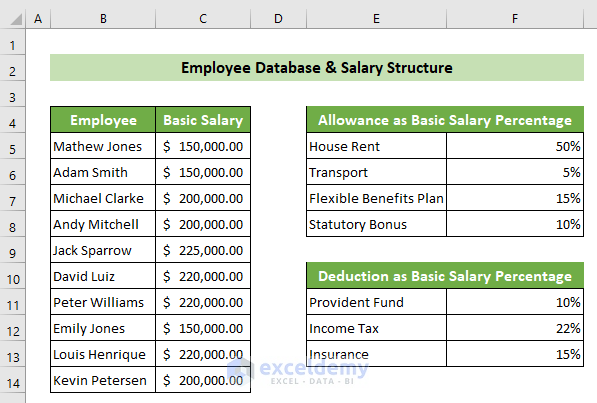

Step 2: Inputting Employee Data

Begin populating your sheet with employee details:

- Employee ID: A unique identifier for each employee.

- Name: First and last name of the employee.

- Position: Their job title or position within the organization.

- Basic Salary: Enter the monthly or yearly base salary agreed upon in employment contracts.

Step 3: Automating Calculations

Excel shines with its calculation capabilities:

- Allowances and Deductions: These can include overtime, bonuses, medical insurance, taxes, and social security contributions. Use formulas to calculate these:

- For Overtime: =Basic Salary / (Standard Work Hours * Days in a Month) * Overtime Hours

- For Gross Salary: =Basic Salary + Allowances

- For Net Salary: =Gross Salary - Deductions

- Named Ranges: Use named ranges for key values like tax rates or standard deductions to simplify formula adjustments.

- Data Validation: To ensure data integrity, apply data validation rules. For instance, restrict the Overtime Hours field to not exceed 24 hours in a day.

Step 4: Advanced Excel Features for HR Management

Leverage Excel’s advanced tools to enhance payroll management:

- Conditional Formatting: Highlight cells based on conditions like payroll status or anomalies in salary calculations.

- Pivot Tables: Analyze data quickly by creating pivot tables for department-wise salary summaries or to identify salary trends over time.

- VBA Macros: For automating repetitive tasks, like monthly payroll processing, consider learning VBA or employing predefined macros.

⚙️ Note: While Excel is user-friendly, for larger organizations, dedicated payroll software might be more efficient for compliance with regulations, payroll integration, and time management.

Step 5: Review and Maintenance

Maintaining the integrity of your salary sheet is crucial:

- Regular Audits: Perform audits to catch errors or discrepancies in salary calculations.

- Update Formulas: As policies or tax laws change, update your formulas and values.

- Employee Exit and New Hires: Adjust the sheet to include new employees or to remove those who have left the organization.

After setting up your salary sheet, it's essential to regularly review and update the information. This ensures that the payroll data remains accurate, complies with current regulations, and reflects changes in employee status. The efficient management of payroll through Excel not only saves time but also reduces the likelihood of errors, thereby maintaining employee satisfaction and trust.

Can I protect sensitive payroll information in Excel?

+

Yes, Excel allows you to protect sheets or cells by setting a password. You can also hide formulas to prevent unauthorized changes or viewing of calculations.

What if I need to calculate salary for irregular employment?

+

Excel allows for custom formulas. You can create special columns or use macros to handle different employment scenarios like part-time or contract-based work.

Is there a way to generate payslips directly from Excel?

+

Yes, you can create templates for payslips within Excel and use formulas or macros to populate them with payroll data. You could also link Excel to Word for custom printing.