How To Make Balance Sheet In Excel

Creating a balance sheet in Microsoft Excel is an essential skill for business owners, accountants, or anyone who needs to get a clear financial picture of a company or organization. A balance sheet provides a snapshot of your financial position at a particular point in time, showing what you own (assets), what you owe (liabilities), and the equity invested by shareholders. Here's a detailed guide on how you can make an effective balance sheet using Excel.

Preparing Your Data

Before you start, gather all your financial data:

- Assets: This includes cash, accounts receivable, inventory, property, and equipment.

- Liabilities: Bank loans, accounts payable, accrued expenses, and long-term debts.

- Equity: Owner’s capital, retained earnings, and any stock issued.

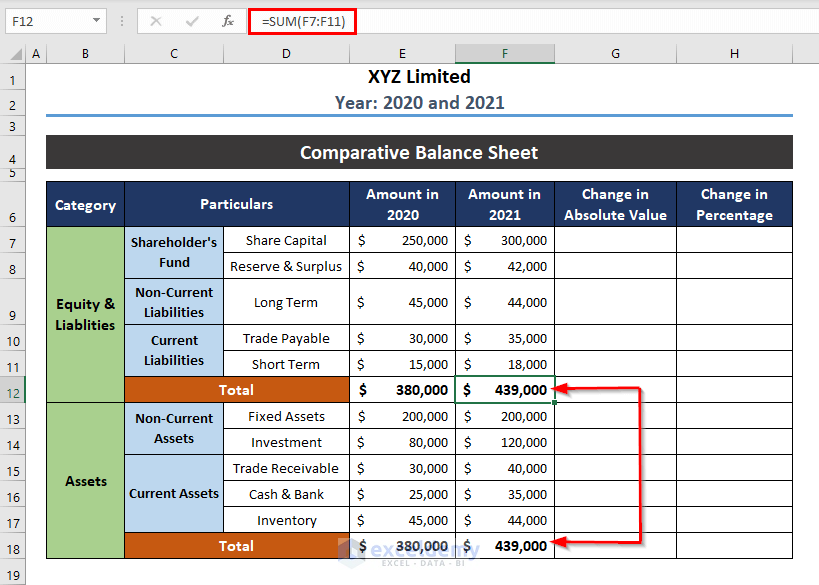

Formatting Excel for Balance Sheet

Begin by setting up your Excel sheet:

- Set Column Headers:

Column A Column B Column C Item Current Year Previous Year

- Format Cells: Use the Format Cells dialog to ensure that your numbers are formatted correctly, particularly monetary values. Set your preferred date format and ensure that there are two decimal places for currency.

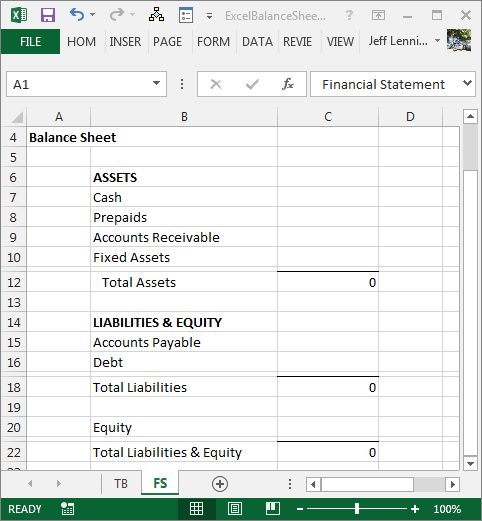

Entering Data into Your Balance Sheet

Now, let’s populate your balance sheet:

- Header: At the top of your sheet, input your company name, balance sheet title, and date.

- Assets Section:

- Start with Current Assets like cash, accounts receivable, inventory, etc.

- Add Fixed Assets like property, plant, and equipment (PPE).

- Include Intangible Assets if applicable, like patents or trademarks.

- Sum up for Total Assets.

- Liabilities Section:

- List Current Liabilities such as accounts payable, short-term loans.

- Then, Long-Term Liabilities like long-term debts or deferred tax liabilities.

- Calculate Total Liabilities.

- Equity Section:

- Add Owner’s Equity, including capital contributions and retained earnings.

- Include any Additional Paid-In Capital or other equity accounts.

- Total up for Total Equity.

- Balance Check: Ensure that Total Assets equals the sum of Total Liabilities and Total Equity.

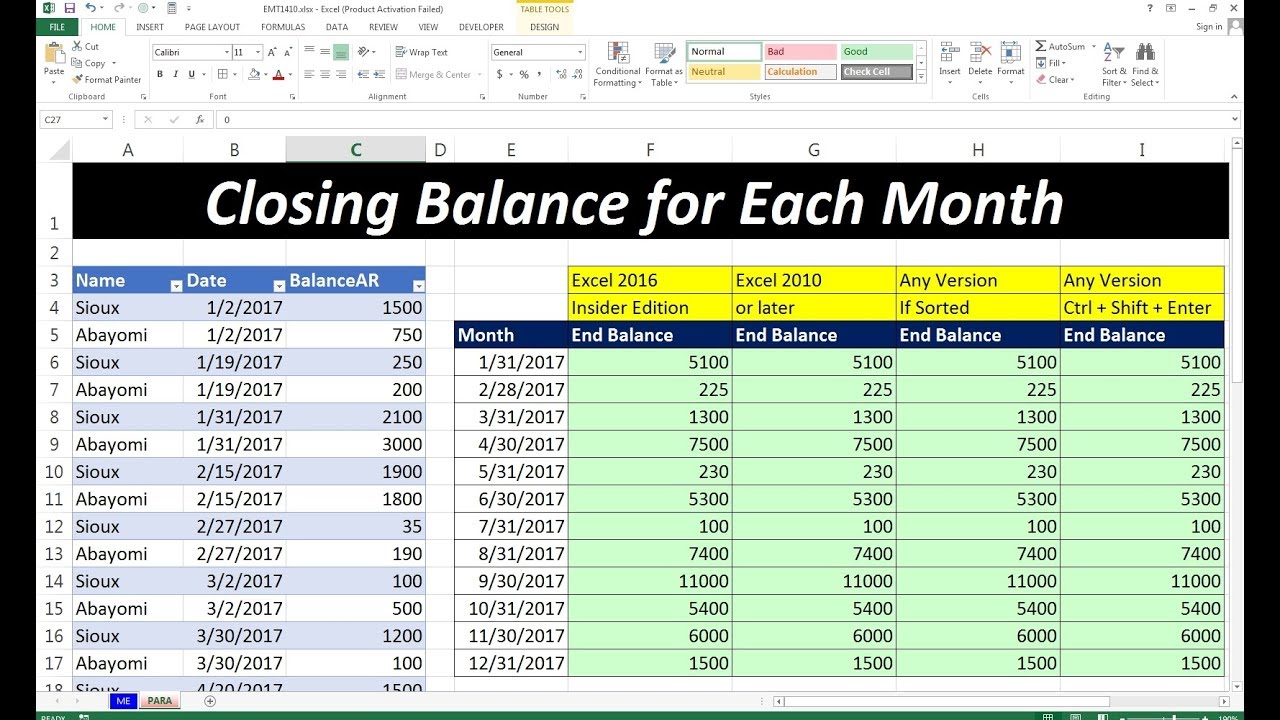

🔍 Note: Use Excel's built-in functions like SUM() to automate calculations for sums, ensuring data accuracy and saving time.

Styling and Visual Clarity

Make your balance sheet user-friendly and visually appealing:

- Use borders or shading to separate sections or highlight totals.

- Consider using color-coding to distinguish between assets, liabilities, and equity.

- Add conditional formatting to highlight negative balances or variances from the previous year.

Review and Analysis

Here are some analytical steps to consider:

- Vertical Analysis: Look at each line item as a percentage of total assets. This helps in understanding the company’s structure.

- Horizontal Analysis: Compare changes year over year to identify trends or significant variances.

- Ratio Analysis: Compute key financial ratios like debt-to-equity ratio, current ratio, etc.

💡 Note: Use Excel's graphing tools to create visual representations of trends or significant financial metrics for quick analysis.

Wrapping Up

After you’ve input all your data, double-check your formulas and ensure that the balance sheet balances. Here are some final steps:

- Save your balance sheet and consider using version control for tracking changes.

- Create a backup in cloud storage like OneDrive or Google Drive.

- Document your work with comments in cells to explain complex calculations or assumptions.

In conclusion, a balance sheet in Excel offers not just a snapshot of a company's financial health but also becomes a tool for deeper analysis and decision-making. By following these steps, you can ensure your balance sheet is both functional for accounting and insightful for strategic planning. It provides a clear view of assets, liabilities, and equity, helping stakeholders understand the financial standing of the business at any given time.

How often should a balance sheet be created?

+

A balance sheet is typically prepared at the end of each accounting period, which could be quarterly, semi-annually, or annually, depending on the company’s reporting needs and regulatory requirements.

Can Excel handle large data sets for balance sheets?

+

Yes, Excel can handle large data sets; however, for extremely large datasets or complex analysis, you might want to consider using more robust tools like SQL databases or specialized ERP systems for financial reporting.

Is there a way to automate the process of creating a balance sheet in Excel?

+

Yes, you can automate much of the process by using macros (VBA), Excel’s built-in templates, or linking Excel to accounting software that can export balance sheet data automatically.