Creating a Common Size Balance Sheet in Excel Simplified

In today's business landscape, financial reporting is crucial for understanding the fiscal health of a company. One of the tools used for this purpose is the Common Size Balance Sheet, which helps in comparing the financial structure of companies by converting each line item into a percentage of total assets or sales. This method simplifies comparative analysis across different companies or periods, making it invaluable for stakeholders.

What is a Common Size Balance Sheet?

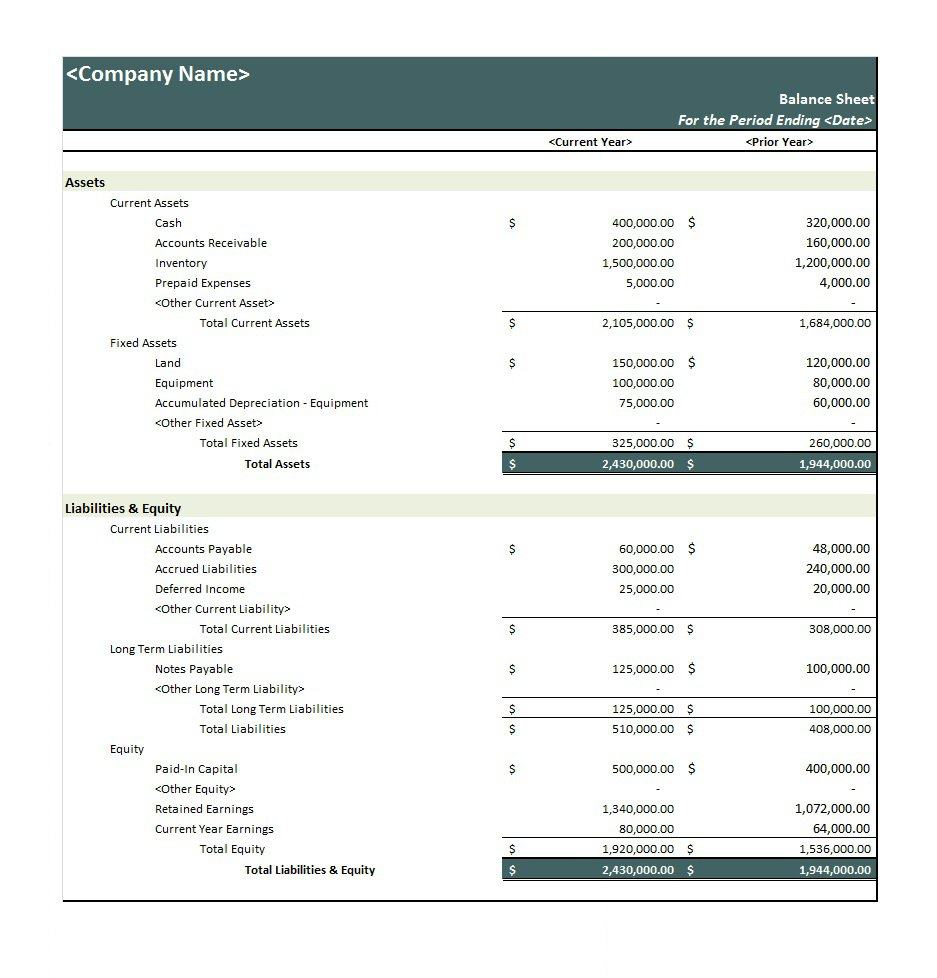

A Common Size Balance Sheet transforms the traditional balance sheet into one where each line item is expressed as a percentage of total assets. This format allows:

- Easy comparison over different years or companies.

- Quick identification of structural shifts in a company’s financials.

- Insight into how much of the company’s assets are financed by equity versus liabilities.

How to Create a Common Size Balance Sheet in Excel?

Here is a step-by-step guide to creating your own Common Size Balance Sheet in Excel:

1. Gather Your Data

- Input Traditional Balance Sheet: Start by creating a table with headers like “Assets,” “Liabilities,” “Equity,” and related sub-items.

- Insert data from your company’s balance sheet into these columns for the period you’re analyzing.

2. Calculate Percentages

| Step | Description |

|---|---|

| Total Assets Column | Sum the assets to get the Total Assets value. |

| Percentage Column | Divide each line item by the total assets and multiply by 100 to get percentages. |

📌 Note: Always double-check your calculations to ensure the sum of all percentages equals 100% to confirm accuracy.

3. Format Your Sheet

- Use Excel’s formatting tools to highlight the totals.

- Apply conditional formatting if you wish to highlight trends or significant changes over periods.

- Ensure your final sheet is clear and easy to read with appropriate fonts and cell styles.

4. Analyze the Results

With your Common Size Balance Sheet in Excel:

- Compare the percentages year over year or against competitors to analyze financial structure changes.

- Identify where the company’s funds are being used (e.g., high percentage in receivables or inventory).

- Observe trends in how the company finances its operations, either through debt or equity.

Benefits of Using a Common Size Balance Sheet

Utilizing a Common Size Balance Sheet provides:

- Comparability: It’s easier to compare the financial health and structure of different companies.

- Consistency: Removes the effect of company size, allowing for better trend analysis.

- Quick Analysis: Facilitates rapid insight into financial performance without diving into complex calculations.

In summary, creating a Common Size Balance Sheet in Excel not only streamlines financial analysis but also enhances the ability to make informed decisions based on a clear understanding of a company’s financial structure. Whether for internal analysis or for comparison with competitors, this tool proves invaluable in the strategic decision-making process.

Why is it important to use percentages in a Common Size Balance Sheet?

+

Percentages allow for an apples-to-apples comparison across different companies or time periods, eliminating the impact of absolute values and focusing on the relative significance of each line item.

Can I use Excel for other financial statements?

+

Yes, Excel is widely used for creating and analyzing various financial statements like income statements, cash flow statements, and more. Its versatility in data manipulation and analysis makes it ideal for financial reporting.

How often should I update my Common Size Balance Sheet?

+

It’s beneficial to update your balance sheet periodically, typically quarterly or annually, to reflect changes in your company’s financial structure accurately.

What are the limitations of a Common Size Balance Sheet?

+

While it provides great insights, it can overlook the scale of operations or absolute dollar amounts, which can be critical in certain analyses. Also, it does not account for changes in accounting policies or inflation.

How can I improve the analysis with a Common Size Balance Sheet?

+

Combine it with ratio analysis, trend analysis over multiple periods, or industry benchmarks for a more comprehensive understanding of financial health.