Create a Balance Sheet in Excel: Easy Steps

To create a balance sheet in Excel, you're engaging in an essential financial exercise that offers a clear picture of your business's financial health at a specific moment. A balance sheet reflects your company's assets, liabilities, and shareholders' equity, helping you understand the financial stability and potential. Here's how to structure it:

Understanding the Basics of a Balance Sheet

The balance sheet is built on the fundamental equation:

- Assets = Liabilities + Equity

This equation is key to maintaining the balance in the document, ensuring that the sum of liabilities and equity equals your total assets. Here's what each part represents:

- Assets: Everything of value that your company owns or controls, like cash, investments, property, and inventory.

- Liabilities: What your company owes, including loans, accounts payable, and mortgages.

- Equity: Also known as shareholder's equity, this reflects the owner's investment and retained earnings.

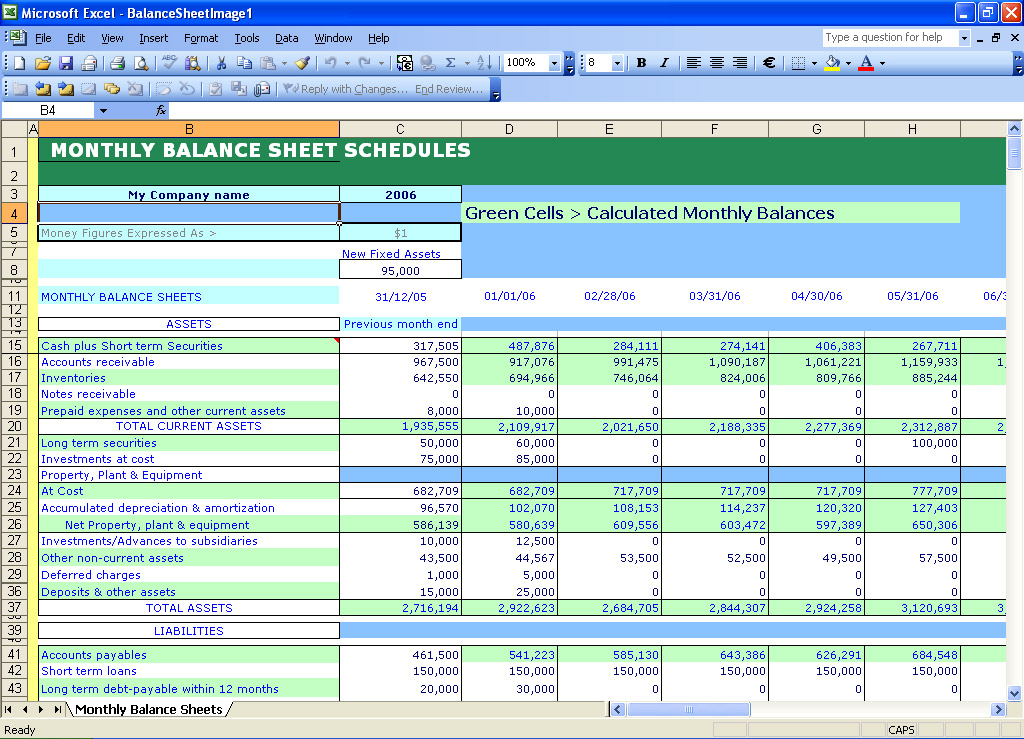

Setting Up Your Excel Spreadsheet

- Open Excel: Start with a new or blank workbook.

- Worksheet Setup: Label your first three columns:

- Column A for the Categories

- Column B for the Amounts

- Column C for Notes or Descriptions

Creating the Balance Sheet

Assets Section

Begin by listing all your assets from most to least liquid:

- In column A, input headers for each asset category. Here’s an example:

- Current Assets (Cash, Accounts Receivable, Inventory)

- Fixed Assets (Property, Plant & Equipment)

- Intangible Assets (Goodwill, Patents)

- In column B, enter the value of each asset as of the balance sheet date.

- Column C can be used for short descriptions or notes about the valuation method or any relevant details.

Liabilities Section

Next, list your liabilities:

- In column A, add headers like:

- Current Liabilities (Accounts Payable, Short-term Debt)

- Long-term Liabilities (Long-term Debt, Pension Liabilities)

- In column B, fill in the corresponding amounts.

- Column C for notes or explanations.

Equity Section

Now, calculate and list equity:

- Include headers for:

- Owner’s Equity or Shareholder’s Equity

- Retained Earnings

- Calculate the Equity by subtracting total Liabilities from total Assets in column B.

- Add notes or descriptions if needed.

Formatting Your Balance Sheet

- Use bold for headers and sums to make them stand out.

- Italicize any comments or notes in Column C to differentiate from numerical data.

- Apply a color-coded format for:

- Assets in green or light blue for easy distinction

- Liabilities in red to signify debt or obligations

- Equity in a distinct shade like purple

- Ensure your numbers are formatted correctly, aligning decimals and using number formats appropriate for financial statements.

- Use SUM formulas to calculate totals for each category and grand totals at the bottom.

Checking for Balance

To confirm your balance sheet balances:

- Sum the total assets.

- Sum the total liabilities and equity.

- Compare these sums to ensure they are equal.

🔔 Note: A common mistake is missing items or miscalculations; double-check your entries.

Finalizing the Sheet

Here are some final touches:

- Check for spelling, formatting consistency, and readability.

- Save your Excel file with a descriptive name.

- Consider password-protecting the file if it contains sensitive financial information.

Your balance sheet in Excel is now ready. It's a valuable tool for understanding your business's financial health, aiding in decision-making, and complying with reporting requirements. Regularly update it to track changes and trends over time.

Tips for Effective Balance Sheet Management

- Maintain Regular Updates: Update your balance sheet at least quarterly or monthly to keep it current.

- Use Templates: Consider creating templates for uniformity and speed in data entry.

- Reconcile: Regularly reconcile balance sheet entries with bank statements, accounts receivable, and payable ledgers.

- Double-Check Calculations: Utilize Excel's SUM and VLOOKUP functions to minimize calculation errors.

What should be included in the assets of a balance sheet?

+

Include all resources of value that the business owns or controls. This encompasses cash, accounts receivable, inventory, investments, prepaid expenses, property, plant, equipment, and intangible assets like patents or trademarks.

How do I categorize different types of assets?

+

Assets are typically categorized into:

- Current Assets: Those that can be converted into cash within one year (e.g., cash, accounts receivable, inventory).

- Fixed Assets: Long-term physical resources like property, plant, and equipment.

- Intangible Assets: Non-physical assets like goodwill, trademarks, and patents.

Why is it important for a balance sheet to balance?

+

It’s crucial for a balance sheet to balance because it represents the fundamental accounting equation: Assets = Liabilities + Equity. If it doesn’t balance, there are likely errors in your entries, miscalculations, or unrecorded transactions, which could lead to inaccurate financial reporting.