Excel Salary Sheet Management Tips

Introduction to Excel Salary Sheet Management

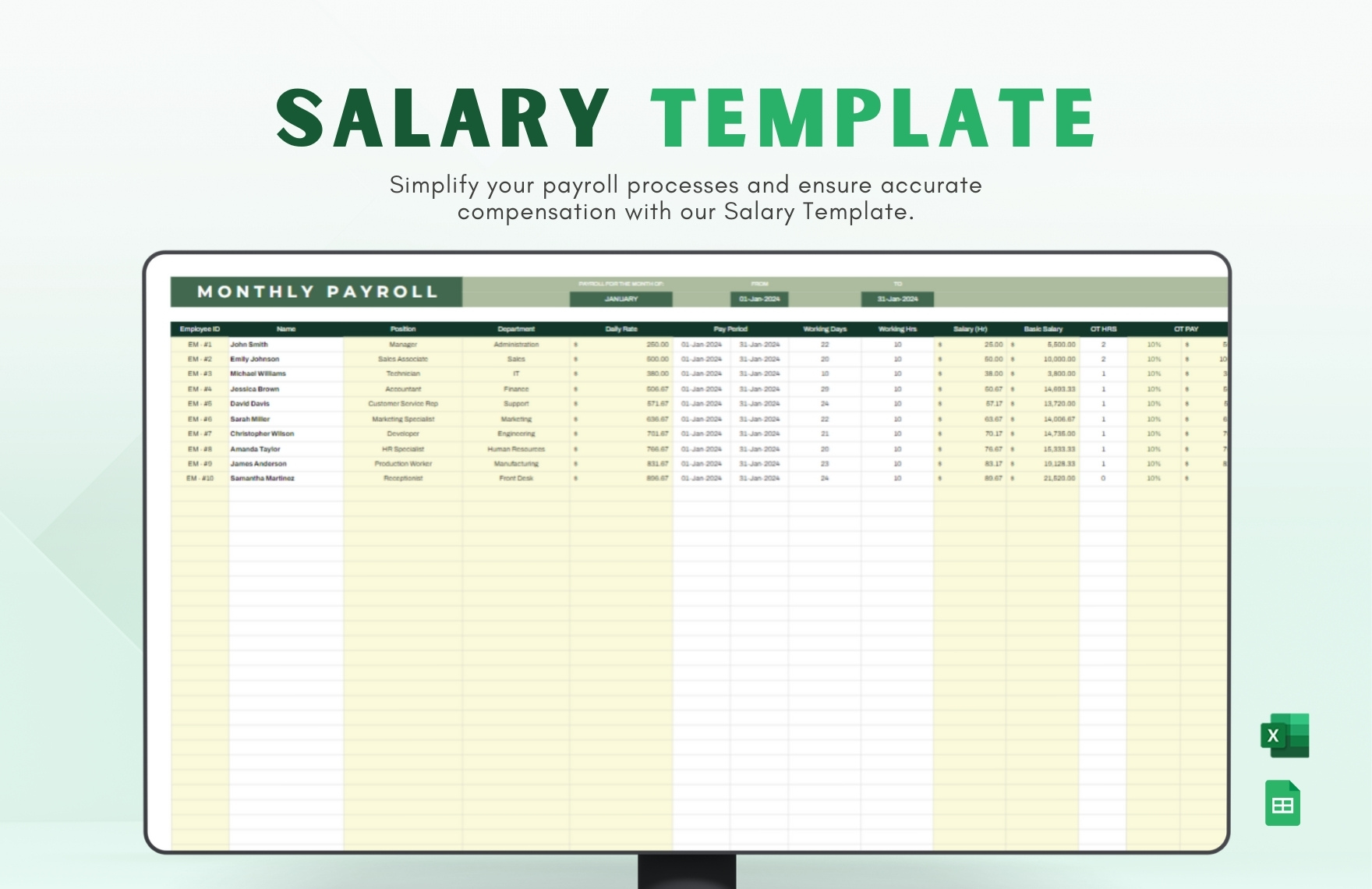

Managing payroll and salary sheets is an essential task for any business, whether small or large. Using Microsoft Excel, one of the most prevalent tools for financial data management, can streamline this process significantly. In this detailed guide, we’ll explore practical tips and techniques to manage your salary sheets effectively in Excel, ensuring accuracy, confidentiality, and ease of use.

Setting Up Your Salary Sheet

Planning Your Salary Sheet Layout

Before you dive into Excel, planning is key:

- Columns: Think about the data you’ll need such as employee ID, name, position, basic salary, deductions, net salary, etc.

- Rows: Each row can represent an employee’s complete salary information.

- Headers: Use descriptive headers to make navigation easy.

Basic Structure

Here’s how to set up the initial Excel sheet:

| Employee ID | Name | Position | Basic Salary | Deductions | Gross Salary | Net Salary |

|---|

📝 Note: Ensure to include headers for potential columns like overtime, bonuses, or any allowances if applicable.

Entering Data

- Enter employee data accurately. Double-check all entries.

- Use the Data Validation feature to control input for certain fields, ensuring consistency and reducing errors.

Advanced Excel Functions for Salary Calculation

Formulas for Salary Calculations

=SUM(Basic Salary - Deductions)for Net Salary.=IF(Employee Status, Bonus, 0)to add conditional bonuses or deductions.

Use of Named Ranges

Create named ranges for frequently used cells or ranges to make your formulas cleaner and more understandable:

=SUM(Salary_Range) - SUM(Deductions_Range)

Ensuring Data Security and Privacy

Password Protection

Protecting sensitive salary information is crucial:

- Use the Review > Protect Sheet feature to lock your salary sheet with a password.

Access Rights

Limit access to the sheet or workbook:

- Share workbooks through Excel’s sharing features with read-only permissions.

- Utilize Cell Locking: Lock cells that contain sensitive information or formulas so they can’t be edited accidentally or maliciously.

Data Analysis and Reporting

Formulas and Functions

Excel provides powerful tools for analysis:

- SUM, AVERAGE, COUNT for basic statistics.

- PIVOT TABLES: Create pivot tables to summarize data by department, position, or any other criteria.

Visualization

Visual representation of data can be very insightful:

- Use Charts to illustrate trends like salary increments, bonus distributions, etc.

Wrapping Up

Effective management of salary sheets in Excel involves a blend of careful planning, robust data security, and advanced Excel functionalities. By following these tips, you can enhance accuracy, maintain privacy, and make your payroll process more efficient. Excel provides a versatile platform for payroll management, from setting up the initial sheet to advanced reporting and visualization, ensuring that both HR and finance departments can handle salary information with confidence.

How often should salary sheets be updated in Excel?

+

Salary sheets should be updated monthly or as per your company’s payroll schedule. Ensure updates occur before the payday to reflect any changes like raises, bonuses, or new hires.

What are the best practices for maintaining privacy in salary sheets?

+Use password protection, limit access, encrypt sensitive information, and regularly audit access logs to maintain data privacy and security.

Can Excel handle complex payroll calculations?

+Yes, with advanced functions like VLOOKUP, INDEX-MATCH, and custom formulas, Excel can manage complex payroll tasks effectively, though for very large enterprises, specialized payroll software might be preferred.