5 Easy Steps to Create a Balance Sheet in Excel

Creating a balance sheet in Microsoft Excel is an essential skill for business owners, accountants, and finance students alike. A balance sheet provides a snapshot of a company's financial position at a particular point in time, detailing assets, liabilities, and shareholders' equity. In this comprehensive guide, we will walk through five straightforward steps to effectively construct this financial document in Excel, ensuring clarity and accuracy in your financial reporting.

Step 1: Set Up Your Workbook

The first step is preparing your Excel workbook for creating a balance sheet. Here’s what you need to do:

- Open a new Excel workbook.

- Select the first sheet where you will input your balance sheet data.

- Rename the sheet for clarity, for instance, “Balance Sheet YYYY” where YYYY is the fiscal year.

Setting up your workbook correctly from the start will streamline your work and enhance organization:

📝 Note: You can set up multiple sheets if you need to compare balance sheets from different periods.

Step 2: Create Headers and Categories

After setting up your workbook, you’ll need to organize your balance sheet with appropriate headers and categories:

- In cell A1, enter the name of your company.

- In cell A2, input “Balance Sheet” followed by the date or fiscal year in cell A3.

- From cell A5, begin listing your categories:

- Assets (Current Assets, Non-Current Assets)

- Liabilities (Current Liabilities, Long-Term Liabilities)

- Shareholders’ Equity

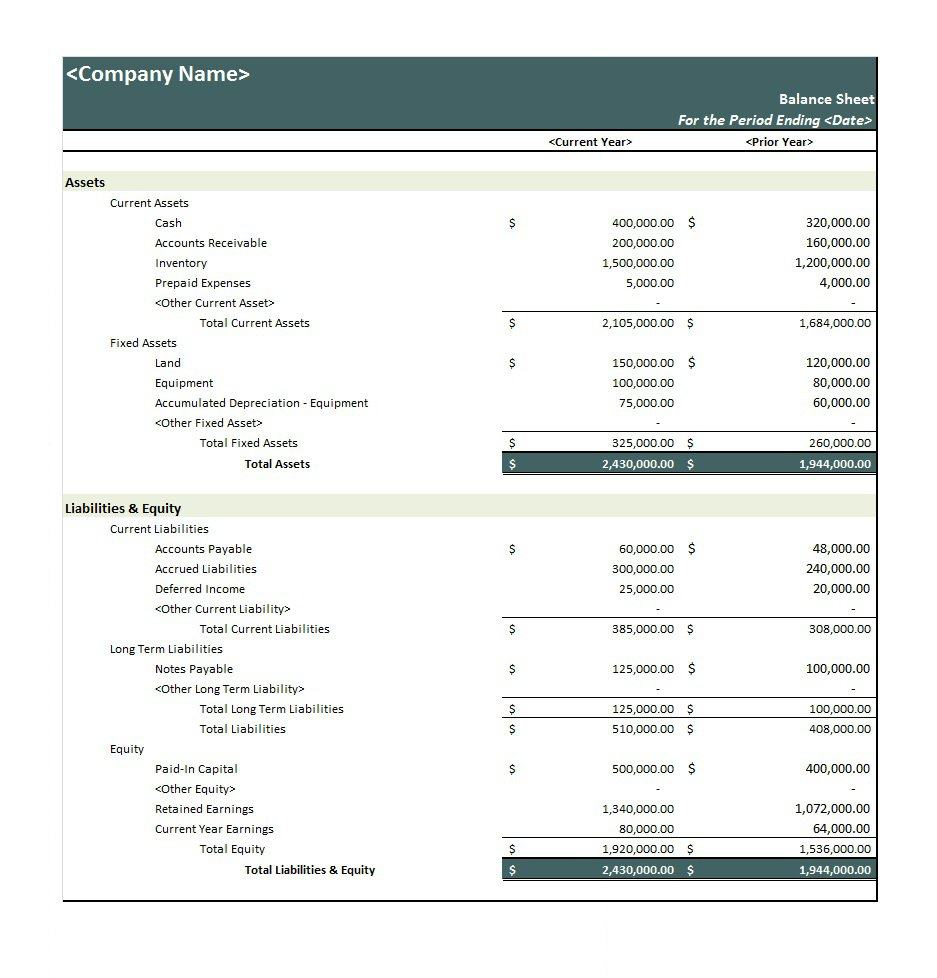

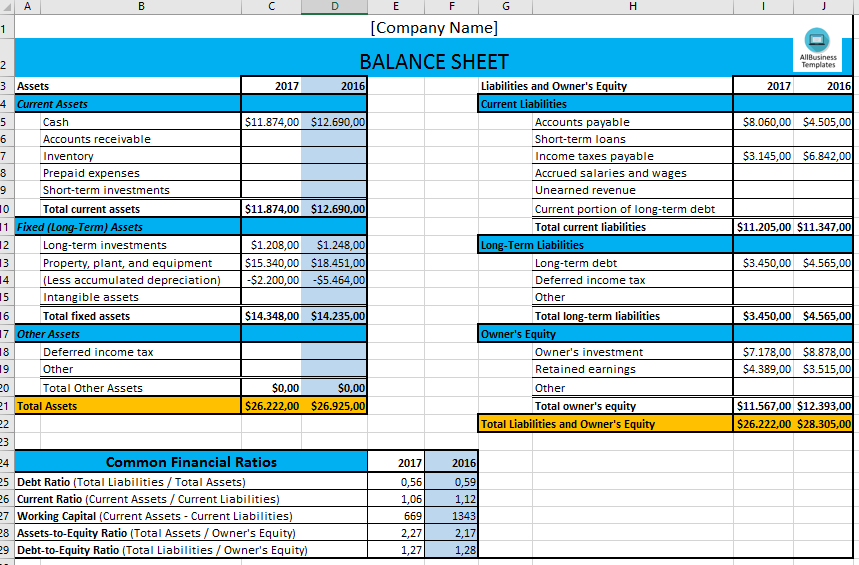

Here's an example of how your headers might look:

| Category | Item | Amount |

|---|---|---|

| Assets | Current Assets | |

| Fixed Assets | ||

| Total Assets | ||

| Liabilities | Current Liabilities | |

| Long-Term Liabilities | ||

| Total Liabilities | ||

| Shareholders' Equity | ||

| Total Equity |

Step 3: Input Your Financial Data

Once your headers and categories are in place, start entering the financial data:

- List each asset, liability, and equity item under their respective headers.

- Use formulas for calculations; for example, to sum up current assets:

=SUM(A6:A10)

Here are some considerations:

- Ensure all figures are entered consistently (e.g., in dollars without cents).

- Be precise with date-related items like accounts receivable or inventory.

- Verify all data for accuracy, as the balance sheet must balance.

💡 Note: Use relative and absolute cell references wisely to make updating your balance sheet easier in the future.

Step 4: Format Your Balance Sheet

The visual presentation of your balance sheet is crucial for clarity:

- Apply formatting options like bold, underlines, or different fonts for headers and totals.

- Align numbers to the right to keep a clean and professional look.

- Color-code categories or add borders for better readability.

- Ensure totals are prominently displayed with larger fonts or borders.

🖌 Note: Consistency in formatting helps maintain a professional appearance and aids in reading the balance sheet accurately.

Step 5: Verify and Balance Your Sheet

The final step in creating a balance sheet is ensuring that it balances:

- The fundamental accounting equation should hold true: Assets = Liabilities + Shareholders’ Equity.

- Use Excel’s SUM formulas to total your assets, liabilities, and equity, then cross-check the equation:

=SUM(Assets) = SUM(Liabilities) + SUM(Shareholders' Equity)

If your balance sheet does not balance, you'll need to:

- Recheck your data entries for any errors or omissions.

- Recalculate your totals to ensure all numbers are correctly summed.

- Review classifications to ensure each item is correctly categorized.

⚖️ Note: Utilize Excel's error checking features or conditional formatting to highlight discrepancies in your balance sheet.

In conclusion, creating a balance sheet in Excel involves setting up your workbook, categorizing and inputting data, formatting for presentation, and verifying the balance. These steps ensure your financial document not only looks professional but also accurately reflects the company's financial position, making it valuable for analysis and decision-making. Whether you are preparing for an audit, presenting to stakeholders, or managing your own finances, having a well-crafted balance sheet is indispensable for financial management.

What are the main components of a balance sheet?

+

The main components of a balance sheet are Assets (what the company owns), Liabilities (what the company owes), and Shareholders’ Equity (the residual interest in the company’s assets after deducting liabilities).

Can I use Excel for other financial statements besides the balance sheet?

+

Yes, Excel can be used to prepare various financial statements, including income statements, cash flow statements, and statements of retained earnings.

How often should I update my balance sheet?

+

Typically, balance sheets are prepared annually or quarterly to reflect changes in the company’s financial position over time. However, updating them more frequently can help with monthly or weekly financial tracking if needed.