Craft an Income Statement from Your Excel Balance Sheet

Introduction to Crafting an Income Statement from an Excel Balance Sheet

An income statement, often referred to as the profit and loss statement or statement of operations, is a fundamental financial document that illustrates a company’s financial performance over a specific period. For businesses that rely heavily on Excel for their financial tracking, transitioning from a balance sheet, which details assets, liabilities, and equity, to an income statement can seem daunting. Yet, with the right approach, this process can be straightforward and insightful, providing a clear snapshot of profitability, revenue generation, and expense management.

The Basics of an Income Statement

Before diving into the process of extracting an income statement from a balance sheet, understanding its key components is crucial:

- Revenue: This represents the total income from sales or services before any expenses are deducted.

- Cost of Goods Sold (COGS): These are direct costs attributable to the production or purchase of the products sold during the period.

- Gross Profit: Calculated by subtracting COGS from Revenue.

- Operating Expenses: These include overhead costs like rent, salaries, marketing, and others not directly tied to product production.

- Net Income: What remains after all expenses are deducted from revenue.

💡 Note: Ensure that all revenue and expense figures are captured correctly for the reporting period. Mismatched data can lead to incorrect financial analysis.

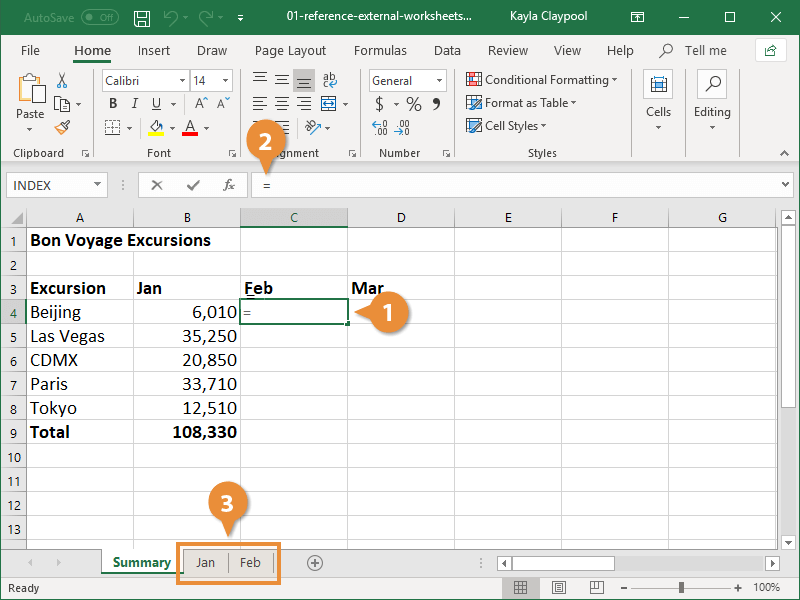

Setting Up Your Excel Spreadsheet

To prepare your Excel file for this transition, consider the following setup:

- Open your existing balance sheet: Start with your current Excel balance sheet document.

- Create a new worksheet: Label this new worksheet as "Income Statement".

- Column Headers: Label columns to include headers like Date, Account, Description, Revenue, COGS, Gross Profit, Operating Expenses, and Net Income.

Extracting and Organizing Financial Data

Revenue

Revenue is typically one of the easiest elements to extract because it's frequently listed as Sales or Service Income in a balance sheet. You can:

- Sum up all the revenue accounts.

- Ensure that returns or allowances are subtracted to get the net revenue figure.

- Use Excel formulas like SUMIF or VLOOKUP to automate this process if your balance sheet has categorized entries.

Cost of Goods Sold (COGS)

Here's where things can get tricky:

- Identify COGS accounts from your balance sheet.

- Link or copy these figures directly into your income statement worksheet.

- If COGS isn't explicitly listed, you might need to calculate it by adding up inventory changes, direct labor, materials, and manufacturing overhead.

| Account | Description | Balance Sheet Amount | Income Statement Calculation |

|---|---|---|---|

| Opening Inventory | $50,000 | Input manually | |

| Add: Purchases | $10,000 | Input manually | |

| Less: Ending Inventory | $6,000 | =C3-C4 | |

| COGS | $54,000 | =C2+C3-C4 |

💡 Note: Accurate COGS calculation is vital for profitability analysis. Ensure all related figures are accurate and up-to-date.

Operating Expenses

These will include:

- Salaries and wages

- Rent

- Utilities

- Depreciation and amortization

- Marketing and Advertising expenses

- General and Administrative (G&A) expenses

List all of these accounts and link their values from your balance sheet:

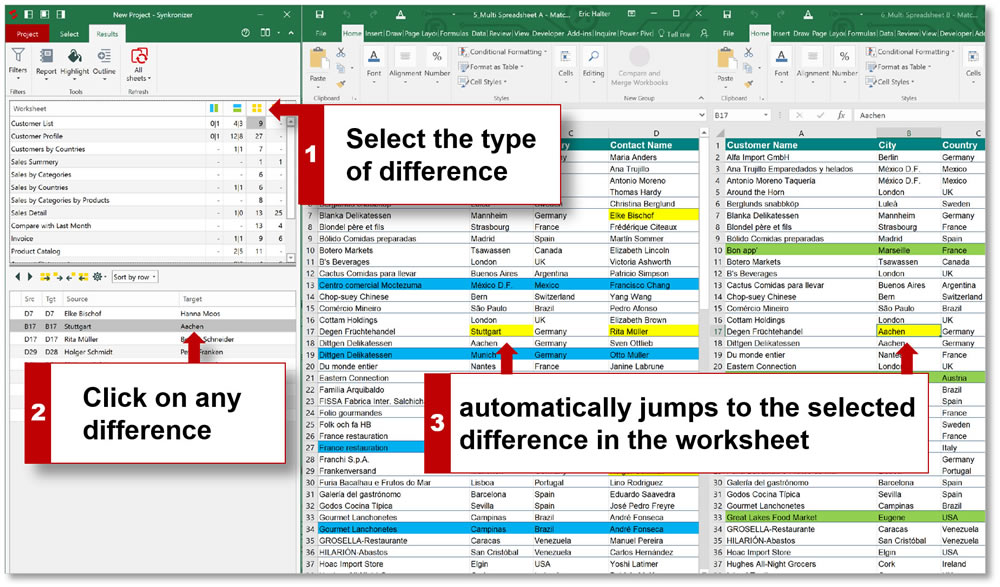

- Use SUMIF or similar functions to aggregate values if your sheet is properly structured.

Net Income

Once you have your revenue, COGS, and expenses:

- Calculate Gross Profit: Revenue - COGS.

- Subtract Operating Expenses from Gross Profit.

- Add or subtract any other income or expenses, like interest income or tax provisions.

- Net Income = Gross Profit - Operating Expenses + Other Income - Other Expenses - Taxes.

Final Touches and Analysis

Now that your income statement is assembled, consider these final steps:

- Format for Clarity: Use formatting tools in Excel to make your document visually appealing and easy to read.

- Verify Data: Ensure that all figures are consistent with your balance sheet data.

- Perform Analysis: Use Excel's analytical tools to create charts, trend lines, and ratios for deeper insight into your financial health.

By following these steps, you've transformed your balance sheet into a comprehensive income statement, providing a clearer picture of your business's financial performance. This process not only highlights profitability but also assists in strategic planning, budgeting, and performance tracking, ensuring you're well-informed to make sound financial decisions.

How often should I generate an income statement?

+

It’s recommended to generate an income statement at least quarterly, if not monthly, for timely financial analysis and decision-making.

What should I do if my income statement shows a loss?

+

Assess your cost structures, pricing strategy, and operational efficiency. Consider reducing expenses, increasing revenue, or both to improve financial health.

Can I create an income statement for personal finance?

+

Absolutely! While typically used for businesses, you can adapt an income statement for personal use to track your income, expenses, and savings.