Calculate Your Income Tax Easily with This Excel Download

Understanding and calculating your income tax can often seem like a daunting task. The complexities involved in navigating through different tax slabs, exemptions, and the process of filing can overwhelm even the most diligent taxpayer. However, with the right tools, managing this essential financial obligation can be simplified. An Excel spreadsheet designed specifically for tax calculation can transform this annual chore into a straightforward, manageable task. Here’s a comprehensive guide to help you calculate your income tax effortlessly using Excel.

Why Use Excel for Tax Calculation?

- Customization: Excel allows you to tailor your tax calculations to your specific financial situation.

- Efficiency: Automated formulas can save time and reduce the likelihood of manual errors.

- Visibility: It provides a clear, visual representation of your taxes, aiding in better financial planning.

- Record Keeping: Excel sheets serve as an excellent tool for keeping your financial records organized and easily accessible.

Setting Up Your Tax Calculation in Excel

Here’s how you can set up your Excel sheet for income tax calculations:

1. Install Excel

Ensure you have Microsoft Excel installed on your computer. If you don’t have Excel, you can use alternatives like Google Sheets, which offer similar functionalities.

2. Collect Necessary Documents

- Payslips for the financial year

- Bank statements or records of other income sources

- Investment proofs for tax deductions

- Last year’s tax return for reference

3. Input Your Income

Create columns in your Excel sheet for various types of income:

| Type of Income | Amount (in INR) |

|---|---|

| Salary | XXXX |

| Interest Income | XXXX |

| Rental Income | XXXX |

| Capital Gains | XXXX |

| Other Income | XXXX |

4. Account for Deductions

List all deductions you are eligible for under Sections like 80C, 80D, etc. Here’s a sample layout:

- 80C: Investments, EPF, PPF, NSC, Life Insurance Premiums

- 80D: Medical Insurance

- 80TTA: Interest on Savings Account

5. Enter Tax Slabs

Set up a table with the current tax slabs applicable for individuals:

| Income Range (INR) | Tax Rate (%) |

|---|---|

| Upto 2,50,000 | 0 |

| 2,50,001 - 5,00,000 | 5 |

| 5,00,001 - 10,00,000 | 20 |

| Above 10,00,000 | 30 |

6. Calculate Your Taxable Income

Subtract total deductions from your gross total income to find your taxable income.

7. Compute Tax Payable

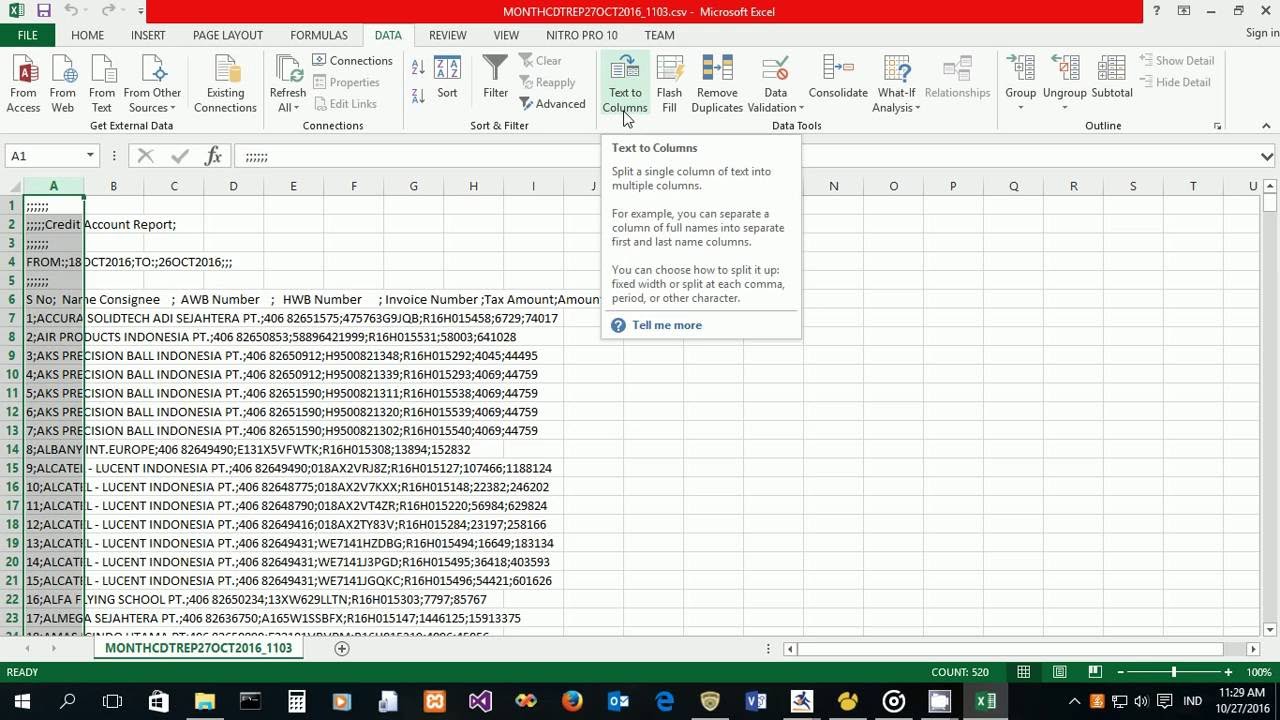

Use Excel functions like VLOOKUP or IF to automatically compute the tax payable based on the slabs:

=IF(A2 <= 250000, 0,

IF(A2 <= 500000, (A2-250000) * 0.05,

IF(A2 <= 1000000, (A2-500000) * 0.20 + 12500,

(A2-1000000) * 0.30 + 112500)))

8. Include Additional Taxes and Adjustments

- Health and Education Cess (4% of tax payable)

- Rebate under Section 87A for incomes up to 5 lakh

- Calculate Surcharge if applicable

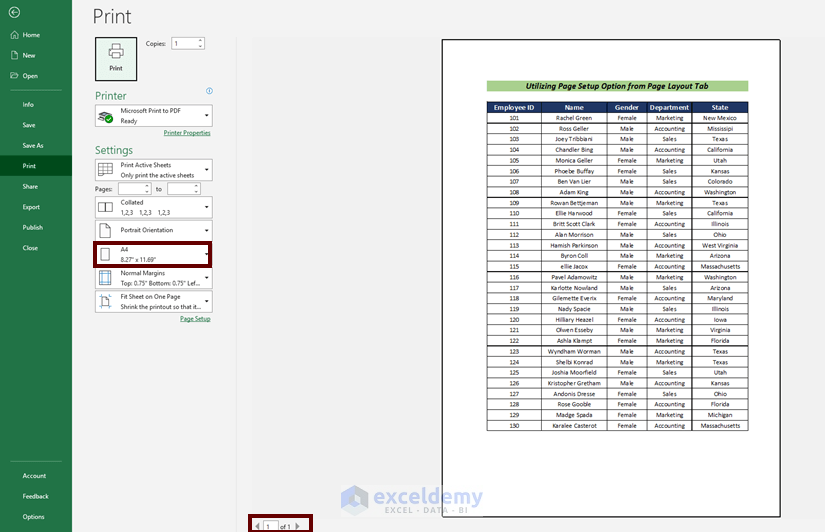

After following these steps, you’ll have a comprehensive tax calculation in Excel:

💡 Note: The formula above is an example. Please adjust according to the current tax slabs and rates provided by the government.

Benefits of Calculating Tax in Excel

- Precision: Excel’s calculations are precise, minimizing errors in tax computation.

- Transparency: You can easily track where your money is going and which deductions you’re applying.

- Simplicity: Once set up, the spreadsheet can be reused year after year, just updating the values.

- Ease of Review: Auditing your tax calculations becomes straightforward, which is helpful during ITR filing.

By using Excel for your tax calculations, you're not just making the process more manageable; you're also gaining insights into your finances that could lead to better financial planning and possibly lower tax liabilities through strategic tax planning.

How often should I update my Excel tax sheet?

+

It’s best to update your tax sheet quarterly or upon any significant financial change to keep your tax estimates current.

Can I use Excel to file my tax returns?

+

No, Excel helps you calculate your tax liability. You still need to file returns through the Income Tax Department’s e-filing portal.

What if my tax calculations don’t match with the official ITR software?

+Check for errors in your inputs, ensure you’ve applied the correct tax laws, or consult with a tax professional if discrepancies persist.

Can Excel help with tax planning?

+Yes, by experimenting with different deductions and investments, Excel can simulate different tax outcomes, helping you plan your finances.

How secure is my financial information in Excel?

+Excel files on your local machine are secure. However, ensure you protect the file with a password, and consider using encryption for added security.