Mastering Balance Sheet Creation in Excel: Step-by-Step Guide

The balance sheet, a cornerstone of financial reporting, provides a snapshot of a company's financial position at a specific point in time. Essential for both internal analysis and external reporting, crafting an accurate balance sheet requires understanding the interplay between assets, liabilities, and equity. This comprehensive guide will walk you through the steps to create a balance sheet in Microsoft Excel, ensuring clarity and precision in your financial documentation.

Understanding the Components of a Balance Sheet

Before diving into Excel, it's critical to understand what a balance sheet represents:

- Assets: What your company owns or controls, including current and non-current assets like cash, inventory, property, and investments.

- Liabilities: What your company owes, both current and long-term, such as loans, accounts payable, and accrued liabilities.

- Equity: Represented by the difference between assets and liabilities, this includes owner's equity, retained earnings, and stockholder's equity.

Preparation Before Creating the Balance Sheet

Here's what you need before you start:

- A detailed list of all assets, liabilities, and equity accounts.

- Trial balance or financial statements to extract data.

- Microsoft Excel or a similar spreadsheet software.

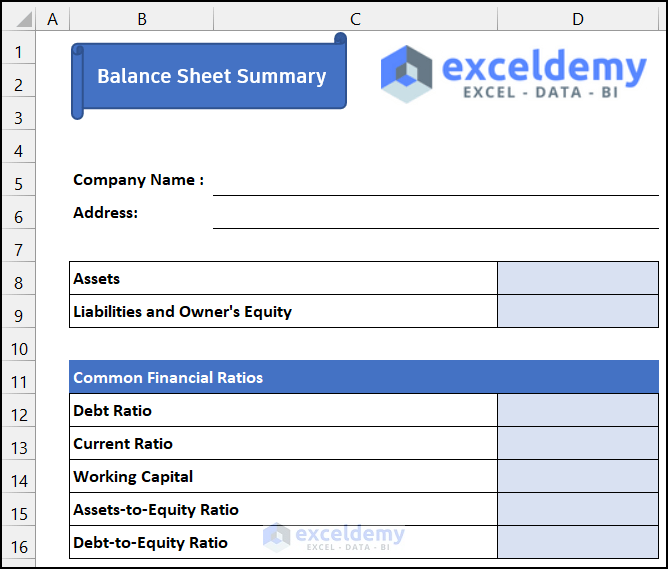

Step-by-Step Guide to Create a Balance Sheet in Excel

1. Setting Up the Excel Workbook

- Open Excel and start a new workbook.

- Save the file with a descriptive name for easy retrieval (e.g., "CompanyName_Balance_Sheet.xlsx").

2. Entering the Header and Title

Merge the top cells to create a wide header:

- Type your company name.

- Add "Balance Sheet" below it.

- Include the date for which the balance sheet represents.

3. Structuring the Assets Section

Create headings for:

- Current Assets

- Non-Current Assets

- Total Assets

Enter your asset values in columns, ensuring alignment and accuracy:

| Account | Amount |

|---|---|

| Cash | $X,XXX.XX |

| Accounts Receivable | $X,XXX.XX |

| Inventory | $X,XXX.XX |

| Property, Plant & Equipment | $X,XXX.XX |

4. Compiling the Liabilities and Equity Section

Below the Assets section, list:

- Current Liabilities

- Non-Current Liabilities

- Total Liabilities

- Equity

- Total Liabilities & Equity

Enter the corresponding values, ensuring the equity section includes:

- Paid-in Capital

- Retained Earnings

- Accumulated Other Comprehensive Income

- Treasury Stock

5. Summarizing and Balancing

Calculate totals for:

- Total Assets

- Total Liabilities & Equity

Using Excel formulas, ensure:

- Total Assets = Total Liabilities + Equity

💡 Note: Double-check your data entries to avoid common errors that can imbalance your sheet.

6. Formatting for Clarity

- Use bold and italic text for headings and subheadings.

- Align numbers to the right for better readability.

- Apply borders to separate sections clearly.

7. Final Review and Analysis

Ensure all formulas are correct, and the balance sheet balances. Use conditional formatting to highlight any discrepancies:

- If the two totals do not match, review your entries for any mistakes or missing data.

- Analyze key ratios like debt-to-equity and current ratio to provide insights into the company’s financial health.

The balance sheet creation process in Excel is meticulous, requiring an eye for detail and precision. By following this guide, you'll be able to craft a balance sheet that not only balances perfectly but also provides meaningful financial insights to stakeholders. The final step before sharing or presenting your balance sheet involves a thorough review to ensure all numbers are accurate, and the formatting enhances the document's professional appearance. Furthermore, by maintaining consistent records and updating your balance sheet regularly, you can keep a pulse on your business's financial health, making informed decisions for growth and stability.

Why is it important for a balance sheet to balance?

+

Balance sheets are named for their need to balance; this principle represents the accounting equation (Assets = Liabilities + Equity), reflecting the company’s financial position accurately.

What are common errors when creating a balance sheet?

+

Common errors include inputting incorrect figures, leaving out accounts, misclassifying items, or failing to update the sheet with all transactions.

How often should a balance sheet be prepared?

+

While businesses typically prepare balance sheets monthly or quarterly, for internal management, weekly or even daily updates might be beneficial to stay current with the company’s financial status.