5 Ways to Analyze Balance Sheets in Excel

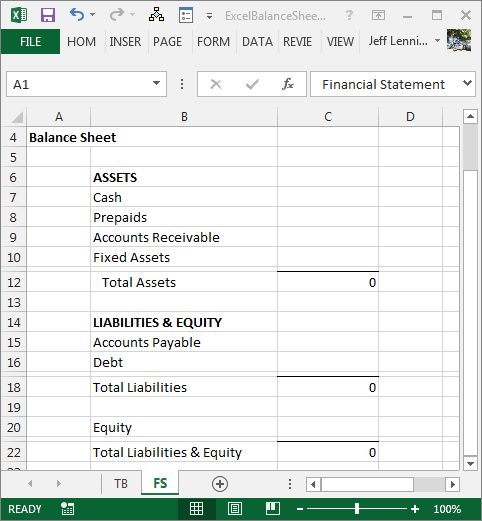

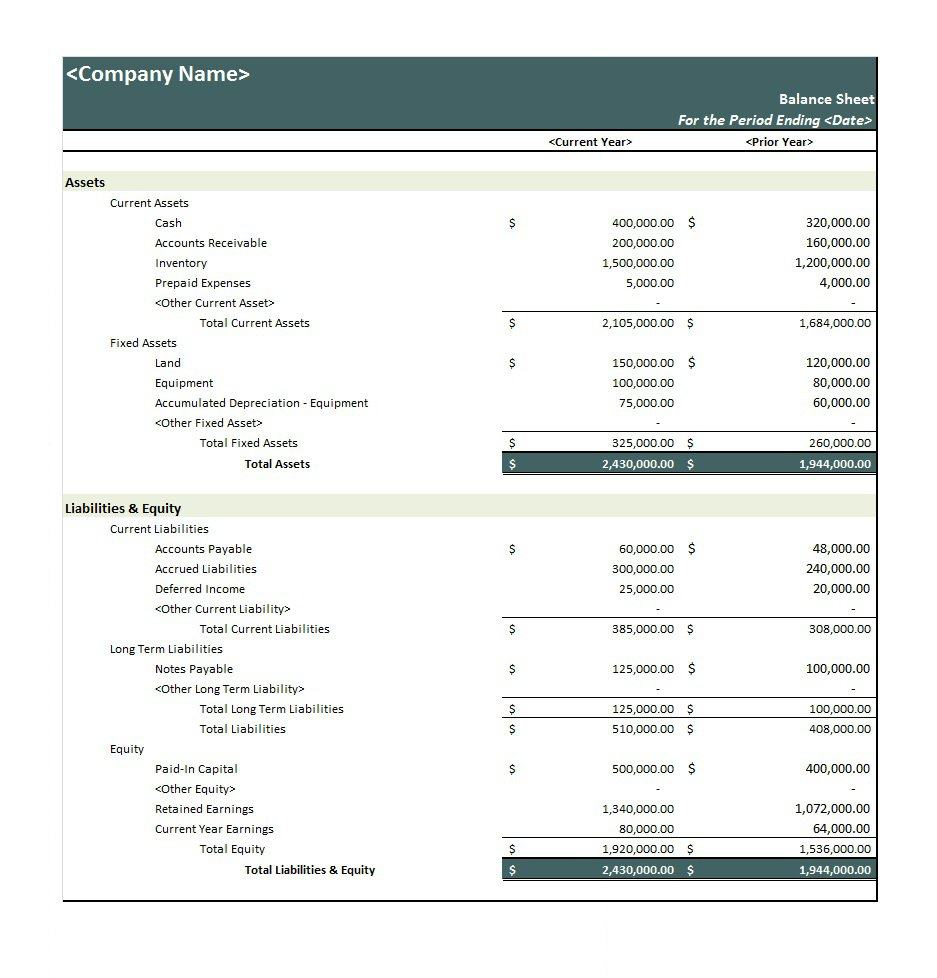

Understanding and analyzing a company's financial health is a critical skill for investors, financial analysts, and business owners. Among the tools at their disposal, the balance sheet stands out as one of the most telling financial statements. It offers a snapshot of a company's assets, liabilities, and equity at a specific point in time. Microsoft Excel, with its powerful computational abilities, provides an excellent platform to analyze these balance sheets effectively. Here, we will explore five strategic ways to dissect balance sheets in Excel, enabling better financial decision-making.

Trend Analysis

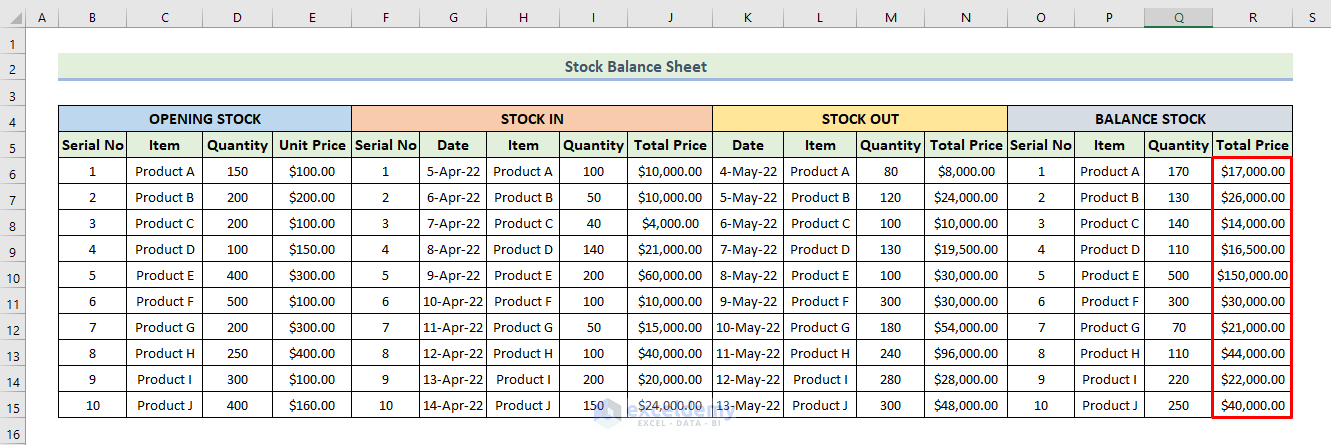

One of the most fundamental analyses you can perform on a balance sheet is trend analysis. This involves plotting key financial ratios or figures over time to detect patterns that could indicate financial stability or potential problems.

- Download balance sheets for multiple periods into Excel.

- Select the financial metrics you want to track, such as total assets, liabilities, equity, debt-to-equity ratio, or current ratio.

- Use the Line Chart or Scatter Plot in Excel to visualize these trends.

- Use LINEST function for linear regression analysis to quantify trends.

📊 Note: When plotting trends, ensure that each balance sheet corresponds to the same accounting period, like fiscal year-end or quarter-end, to ensure consistency in comparison.

Ratio Analysis

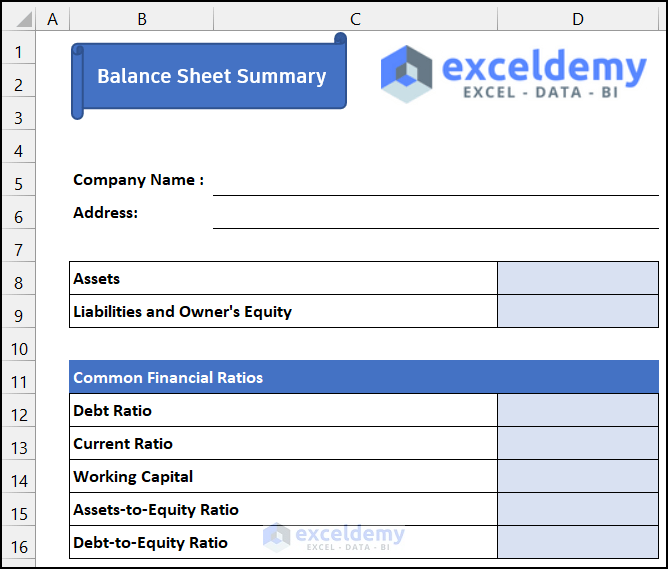

Financial ratios derived from balance sheet data provide insights into liquidity, solvency, efficiency, and profitability:

| Ratio | Formula | What it tells you |

|---|---|---|

| Liquidity (Current Ratio) | Current Assets / Current Liabilities | Ability to pay off short-term liabilities with short-term assets. |

| Debt-to-Equity | Total Liabilities / Total Equity | Company’s leverage or reliance on debt financing. |

| Return on Assets (ROA) | Net Income / Total Assets | How effectively the company uses its assets to generate earnings. |

- Calculate these ratios in Excel by referencing specific cells from your balance sheet data.

- Automate these calculations using formulas or pivot tables for dynamic analysis.

Common Size Analysis

This method involves converting balance sheet items into percentages of a base figure (usually total assets or liabilities) to evaluate the company’s structure over time:

- Highlight a column of the balance sheet and use Excel’s Format Cells to express figures as percentages of the total.

- Use formulas to compute these percentages (e.g.,

=A2/SUM(A2:A10)). - Create a side-by-side comparison chart to observe changes in the company’s financial structure over different periods.

Vertical Analysis

Vertical analysis or common size analysis focuses on the breakdown of financial statement categories as a percentage of a base figure. Here’s how to use Excel for this:

- Format the balance sheet in Excel with all items listed vertically.

- Use formulas to calculate each item as a percentage of total assets or liabilities (e.g.,

=A2/SUM(A2:A10)*100). - Create stacked bar or pie charts to visualize the balance sheet structure.

📈 Note: Keep in mind that vertical analysis can be especially useful for comparing companies within the same industry or sector.

DuPont Analysis

This framework dissects the return on equity (ROE) into three components: profitability, asset utilization, and financial leverage:

- ROE = Net Profit Margin * Asset Turnover * Equity Multiplier

- Calculate each component using balance sheet data:

- Net Profit Margin = Net Income / Sales

- Asset Turnover = Sales / Average Total Assets

- Equity Multiplier = Total Assets / Total Equity

- Use Excel’s cell referencing to dynamically update these values as balance sheets are updated.

- Create a dynamic dashboard to visually track changes in these components over time.

Analyzing balance sheets in Excel not only streamlines financial analysis but also provides deep insights into a company's financial health. By employing trend analysis, ratio analysis, common size analysis, vertical analysis, and the DuPont model, analysts can gain a comprehensive understanding of a company's financial status and performance trends. Whether you are looking for investment opportunities, evaluating company stability, or making strategic business decisions, these tools in Excel offer a robust way to dissect and understand financial data.

Why use Excel for balance sheet analysis?

+

Excel is widely used due to its versatility, computational power, and ability to easily manipulate and analyze large sets of financial data. Its functions and charting tools allow for dynamic and automated analysis, making it an ideal tool for financial professionals.

Can these methods be applied to all types of companies?

+

Yes, these methods can be applied across different industries; however, the interpretation of results might differ. Factors like industry norms, economic cycles, and specific company strategies can influence how these analyses are used and interpreted.

How often should balance sheet analysis be performed?

+

Quarterly or annually, depending on your objectives. For strategic decisions or investment analysis, quarterly updates provide more granular insights, whereas annual reviews suffice for general financial health checks.

What other tools besides Excel can be used for financial analysis?

+

While Excel is a fundamental tool, software like Tableau for advanced data visualization, R or Python for statistical analysis, or specialized financial software like Bloomberg Terminal or FactSet can provide additional capabilities for financial analysis.