How Long Should You Keep Probate Paperwork?

In the intricate process of settling a loved one’s estate, handling probate paperwork can be one of the more daunting tasks. Ensuring you manage and retain these documents correctly not only respects the legal obligations involved but also provides valuable insights for future estate planning. This extensive guide will walk you through the lifespan of probate documents, why their retention matters, and how to effectively manage them.

Understanding Probate Paperwork

Probate paperwork includes a broad range of documents necessary for validating a will, settling debts, paying taxes, and distributing assets as per the deceased’s wishes or local laws if there's no will. Here are the primary documents you'll encounter:

- Will: The legal document detailing how an individual's property should be distributed post-mortem.

- Death Certificate: Essential for verifying the death of the deceased, crucial for beginning the probate process.

- Petition for Probate: Filed with the court to initiate probate.

- Executor's Oath: A sworn affidavit by the executor agreeing to perform their duties.

- Letters Testamentary: Legal proof of the executor's authority to act on behalf of the estate.

- Inventory and Appraisal: A detailed list of all assets and their appraised value.

- Accountings and Settlements: Documents detailing financial transactions, distributions, and creditor settlements.

- Tax Documents: Including final income tax returns, estate tax returns, and possibly inheritance tax documents.

How Long to Keep Probate Paperwork?

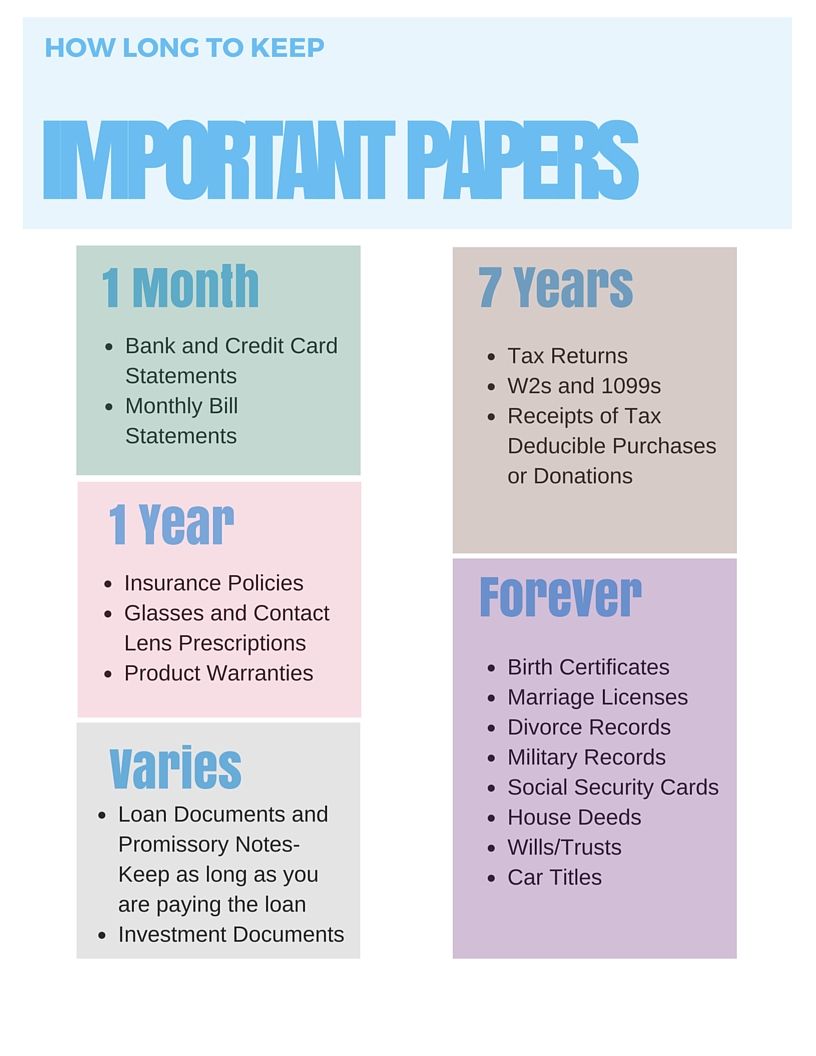

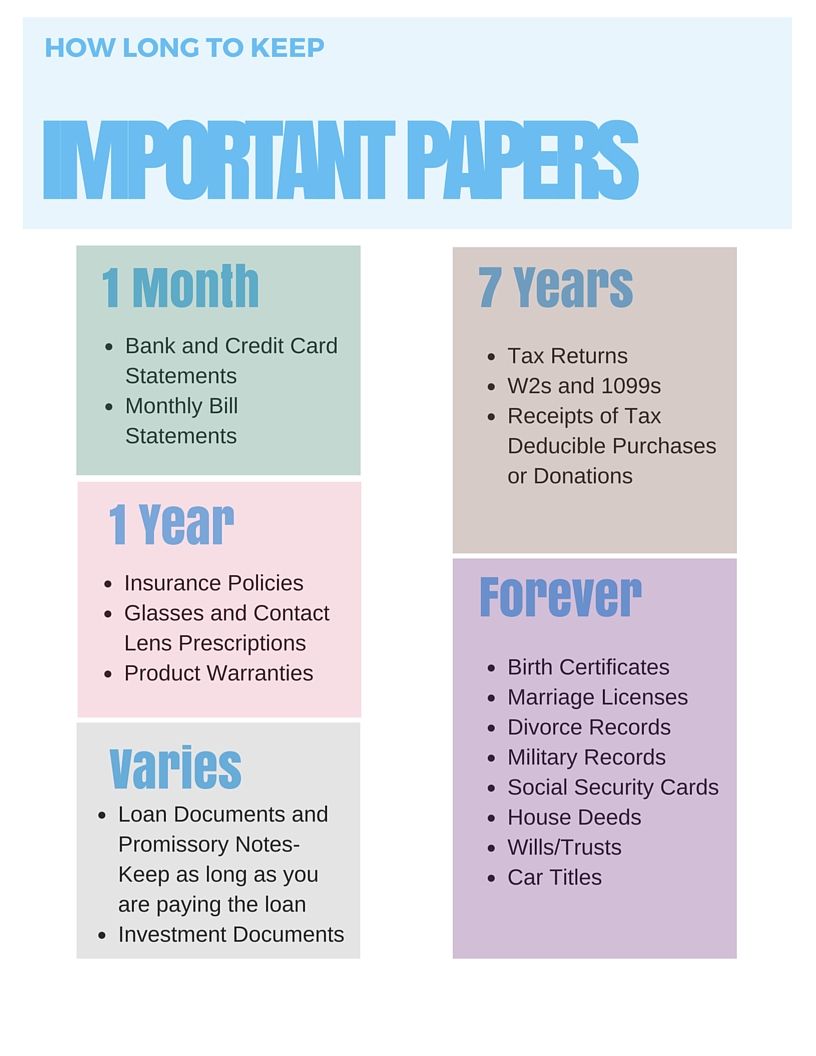

The retention period for probate paperwork is not universally standardized but is influenced by several factors:

Legal Requirements

Different jurisdictions have specific retention mandates:

- In the U.S., states like California require executors to keep accountings for a minimum of five years, while in Texas, there’s no specific statute regarding retention.

- Canada follows similar guidelines with retention ranging from three to seven years.

- In the U.K., retention periods are typically set at seven years for most documents, though estate accounts might need to be kept indefinitely.

Statute of Limitations

Probate-related matters can extend past the time of filing due to legal proceedings or disputes:

- Will Contestations: Periods for challenging a will can last up to several years after probate.

- Financial Obligations: Tax filings, debts, or creditor claims might still be relevant years later.

- Property Transfers: Real estate transactions can remain a point of reference in case of future disputes or asset verification.

⚠️ Note: Consulting a local estate attorney can provide you with the most accurate information regarding retention periods in your jurisdiction.

Tax Implications

Estate tax audits can occur years after probate, highlighting the importance of keeping:

- Federal and state income tax returns, especially if there are estate tax filings.

- Appraisals and valuations of property as evidence for tax purposes.

Record Keeping for Future Generations

Beyond legal requirements, retaining probate documents can:

- Provide insights into family history and financial legacies.

- Serve as a guide for future estate planning.

- Act as a testament to the deceased’s wishes and relationships.

Practical Steps for Managing Probate Paperwork

Here are actionable steps to effectively manage probate documentation:

Organize Documents

Use:

- Physical folders or filing cabinets for hard copies.

- Digital file systems with clear naming conventions for electronic documents.

Create an Inventory

Maintain an updated list or spreadsheet of all documents, including:

- Document names

- Dates

- Purpose

Secure Storage

Implement:

- Lockable filing systems or safety deposit boxes for physical documents.

- Password-protected digital storage solutions with encryption.

Access and Dissemination

Ensure:

- Key family members or co-executors know where documents are stored.

- Legal professionals can access critical files if needed.

Disposal

When it’s time:

- Shred or securely destroy physical documents once retention periods have passed.

- Delete or securely overwrite electronic documents.

📝 Note: Always retain critical or sentimental documents like the Will or important tax records for longer periods than others, often indefinitely.

Challenges and Tips for Long-Term Probate Document Storage

Managing probate paperwork over time comes with its set of challenges:

Space Management

- Opt for digital storage solutions to minimize physical space needs.

- Regularly review and purge unnecessary documents as retention periods expire.

Technology and Security

- Keep up with updates in digital storage solutions for better security.

- Consider using cloud services with strong encryption and backup systems.

Accessibility and Succession Planning

- Ensure documents are easily accessible to successors through clear documentation and access instructions.

- Plan for succession by sharing document locations with trusted individuals.

Emotional Considerations

- Handle the process with empathy, understanding the emotional weight probate documents carry.

The proper management of probate paperwork is a delicate balance between legal obligations, practical considerations, and emotional ties. By retaining these documents judiciously, executors and family members can honor the deceased's wishes, safeguard financial interests, and lay the groundwork for future estate planning. The key lies in understanding retention periods, securing storage solutions, and planning for access and disposal. This not only provides peace of mind but also ensures a smoother transition for those who come after us, keeping the legacy of careful estate management intact.

What if I lose probate documents?

+Losing probate documents can complicate the estate process. Recreating these documents through the court or involving an attorney might be necessary. However, prevention through organized storage is always preferable.

Can I digitize probate documents for easier storage?

+Yes, digitizing probate documents is not only allowed but recommended for ease of storage and access. Ensure backups and secure digital storage solutions are in place.

How do I ensure privacy when storing probate documents?

+Use encryption for digital storage and secure physical storage methods like lockable cabinets or safety deposit boxes. Limit access to authorized individuals only.